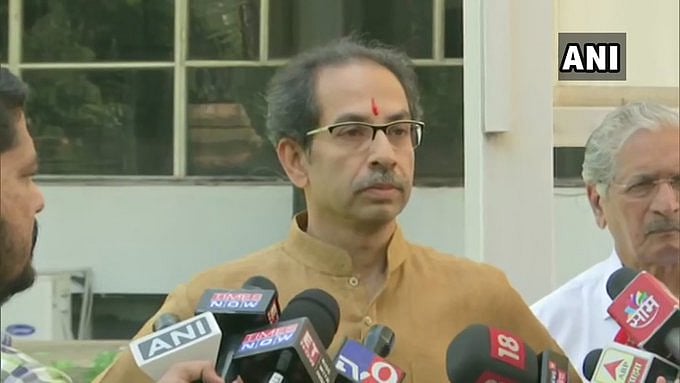

Mumbai: Amidst fiscal constraints on account of the economic slowdown, Maharashtra Chief Minister Uddhav Thackeray has appealed to the Centre for early disbursement of GST and other tax dues worth Rs 15,558.05 crores.

In a letter to Union finance minister Nirmala Sitharaman, he said the timely release of GST compensation and tax devolution amounts would help the government manage finances efficiently. The release of pending dues is urgently needed so that development programmes do not suffer, the letter has urged.

With this letter, Maharashtra has joined eight states, including New Delhi, Punjab, Puducherry, Madhya Pradesh, Kerala, Rajasthan, Chhattisgarh and West Bengal, which are seeking early release of GST compensation. They have claimed that the total dues could be Rs 50,000 crore or more.

As per the Union Budget 2019-20, tax devolution to state is Rs 46,630.66 crore, 11.15% more than the Rs 41,952.65 crore received in 2018-19.

However, Thackeray has brought to Sitharaman's notice that the state had only received Rs 20,254.92 crore until October, Rs 6,946.29 crore (minus 25.53%) less, as compared to the Budget estimate for 2019-20.

''So, instead of receiving an enhanced amount, the state has received less than the budgetary amount. With further slowdown of the economy during the second quarter, it is likely there will be a further reduction in tax devolution,'' he noted.

Thackeray said because of a slowdown there was a shortfall in GST collection, the benchmark being 14%. During the current fiscal, the government has only received Rs 5,635 crore GST compensation for the first four months, while Rs 8,611.76 crore is due until November.

The CM said the interstate GST settlement for many transactions is not happening and it is partly responsible for the accumulation of huge unsettled balance under the IGST.

The Free Press Journal had recently reported that the state may miss its GST target of Rs 1,13,260 crore and Rs 39,378 crore VAT in 2019-20 because of the downturn in the economy. Until November, the GST receipts were Rs 55,142 crore, as against Rs 56,619 crore in the corresponding period last year.