Indore (Madhya Pradesh): The Tax Practitioner Association largely expressed satisfaction with the Union Budget 2026, giving it an average rating of 7.7/10.

The consensus among the city’s financial experts is that the budget has simplified compliance and providing relief in penalties. However, the increase in Securities Transaction Tax (STT) remains a common point of contention, cited as a dampener for market sentiment.

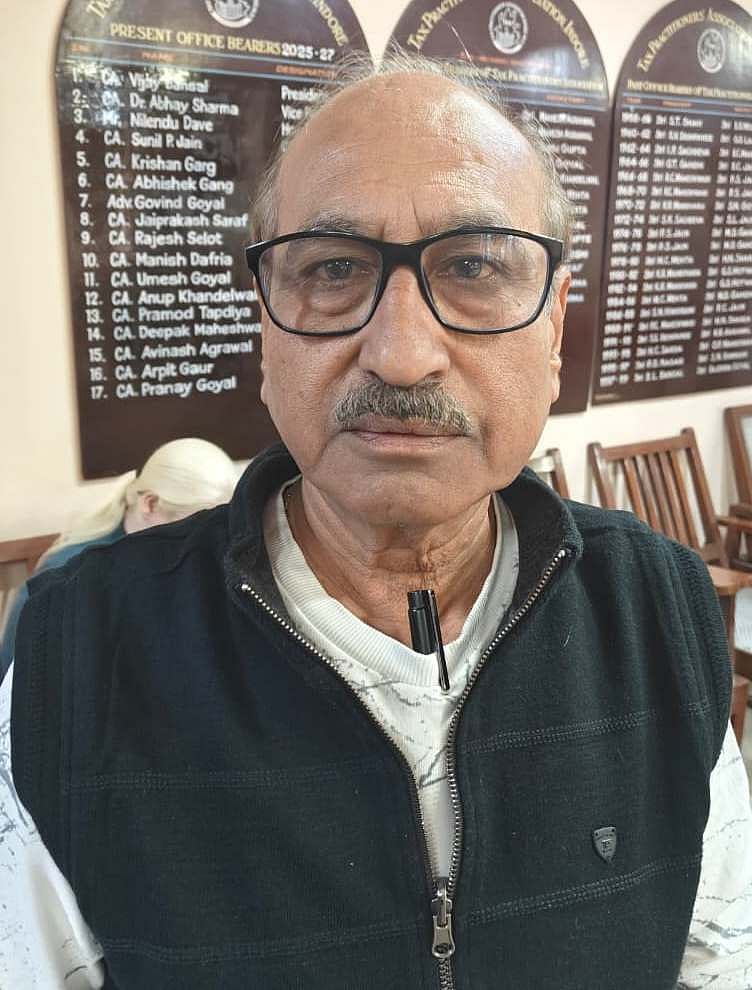

CA Vijay Bansal (7.5/10)

This budget introduces numerous reforms aimed at eliminating the procedural hurdles previously faced by taxpayers. Significant relief has been provided through the waiver or reduction of penalties, prosecution, and interest. The updated TDS and TCS provisions are among the most positive aspects of this budget, specifically regarding tax reductions for money sent to Indian students studying abroad and lower rates on foreign remittances. Conversely, a notable drawback is the increase in the Securities Transaction Tax (STT), the impact of which was immediately felt across the stock market."

CA Santosh Deshmukh (7/10)

This budget prioritises production and growth across key sectors, including Health, IT, and AI. The procedural changes to the Liberalised Remittance Scheme (LRS) are highly beneficial, as they address previous complexities and introduce lower tax rates. Additionally, the tax reduction for foreign tourism provides a significant advantage for travelers. However, a notable drawback is the lack of specific initiatives for the agricultural sector, which is a concern given that India remains a predominantly agrarian economy.

CA Milind Wadhwani (8/10)

The government is prioritising higher consumption to drive growth while keeping its eyes firmly on the Rs 5-trillion economy target. The capital outlay is receiving sustained attention to spur investment. However, the increase in Securities Transaction Tax was avoidable and may dampen market sentiment in the near-term outlook as well.

CA Nilendu Dave (8.5/10)

The Union Budget is a mixed bag with a stronger tilt toward positives. Everyday compliance issues, especially in TDS, have been addressed meaningfully. Reforms in penalty and prosecution will improve ease of doing business. Importantly, the Budget reflects grassroots concerns by incorporating feedback from ordinary taxpayers and small businesses.

Key proposals in Union Budget affecting taxpayers and traders

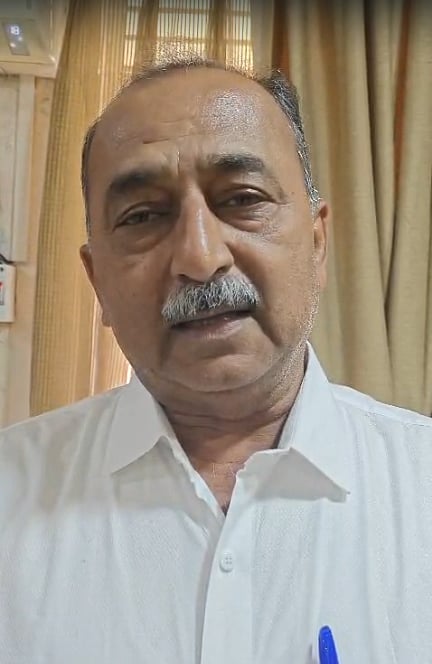

Chartered Accountant Govind Agrawal, former president of the Tax Practitioners Association, Indore, has highlighted major provisions of the Union Budget 2026–27 that directly impact common taxpayers and traders. One of the key announcements is the proposed increase in Securities Transaction Tax (STT) on futures and options trading, which has already led to a sharp decline in the stock market.

The Budget has proposed extending the deadline for filing revised income tax returns from December 31 to March 31 with a prescribed fee. This move is expected to provide relief to honest taxpayers by allowing more time to rectify errors. Another significant change is replacing penalties with fees for failure to conduct tax audits. Unlike penalties, fees will not be appealable, which may increase compliance pressure on taxpayers.

The Budget also proposes issuing assessment and penalty orders simultaneously, although interest on penalties will not apply until the first appeal is decided. Relief has been offered by reducing the mandatory tax demand payment for obtaining a stay from 20 per cent to 10 per cent.

The scope of filing updated income tax returns has been expanded, even in reassessment cases, subject to additional payment. Penalty relief has also been proposed for under-reporting of income if 100 per cent penalty is paid. Additionally, the return filing deadline for non-audit taxpayers has been extended from July 31 to August 31, benefiting small traders and trusts.