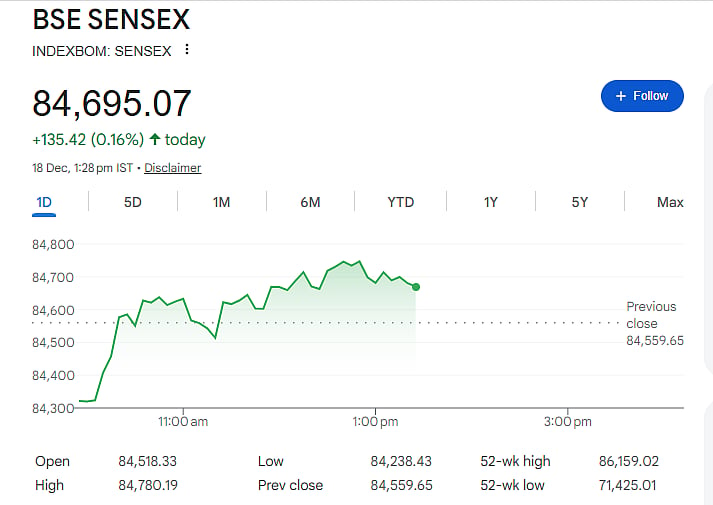

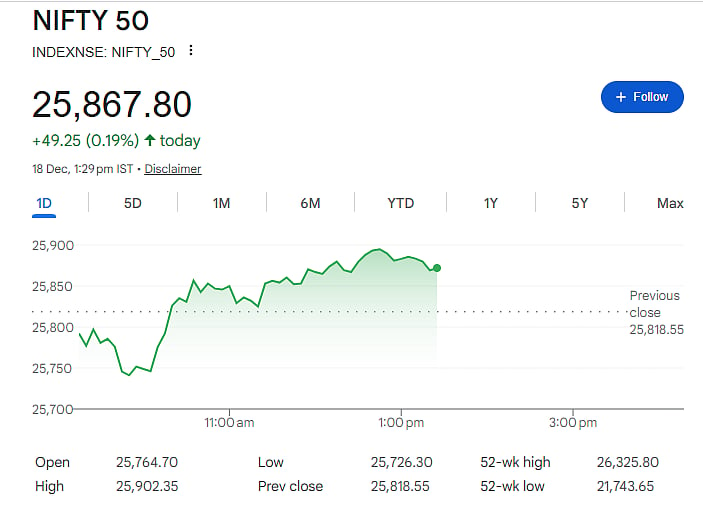

Mumbai: On Friday, the Indian stock market showed a strong recovery after a weak start in the morning. Both the BSE Sensex and NSE Nifty rebounded sharply from their intraday lows. The recovery was driven by value buying at lower levels, the return of foreign investors, and improved investor sentiment.

By 1:28 PM, the Sensex had jumped over 400 points from its day’s low, reaching 84,669.72 and was trading up 135.42 points or 0.15 percent. Meanwhile, the Nifty climbed above 25,850, reaching 25,867.80. Earlier in the day, the Sensex had fallen to 84,238.43, and the Nifty hit a low of 25,726.30.

Stock Performance

Among Nifty50 stocks, Infosys, Max Healthcare, and Hindalco were top gainers, rising nearly 1 percent, while Sun Pharma and Tata Motors Passenger Vehicles fell around 2 percent. Market breadth remained weak, with 1,375 stocks rising, 2,048 falling, and 142 unchanged.

Six Key Reasons for the Recovery

Value Buying at Lows: After three consecutive days of declines from Monday to Wednesday, many stocks reached attractive valuations. Investors seized this opportunity to buy.

Return of FIIs: After 14 straight sessions of selling, Foreign Institutional Investors (FII) returned on December 17, making a net purchase of ₹1,171 crore. Domestic Institutional Investors (DII) added support with ₹768 crore. Analysts say this institutional buying strengthened the market.

Shift from AI Trades: Weakness in AI-heavy stocks in the US improved sentiment for India, which is less dependent on AI trades. S&P 500 and Nasdaq closed at three-week lows. Experts expect this trend to continue into early 2026, benefiting Indian markets.

Rupee Recovery: The rupee remained stable against the dollar, trading in the 90.32–90.38 range. Central bank intervention and foreign fund inflows supported the currency.

Low Volatility: The India VIX, or fear index, stayed nearly stable at 9.87, indicating that investors are not worried about sudden market shocks.

Buying in IT Stocks: TCS announced its global leadership strategy in AI-led tech services, lifting its stock 0.7 percent. The Nifty IT index also rose 0.4 percent.