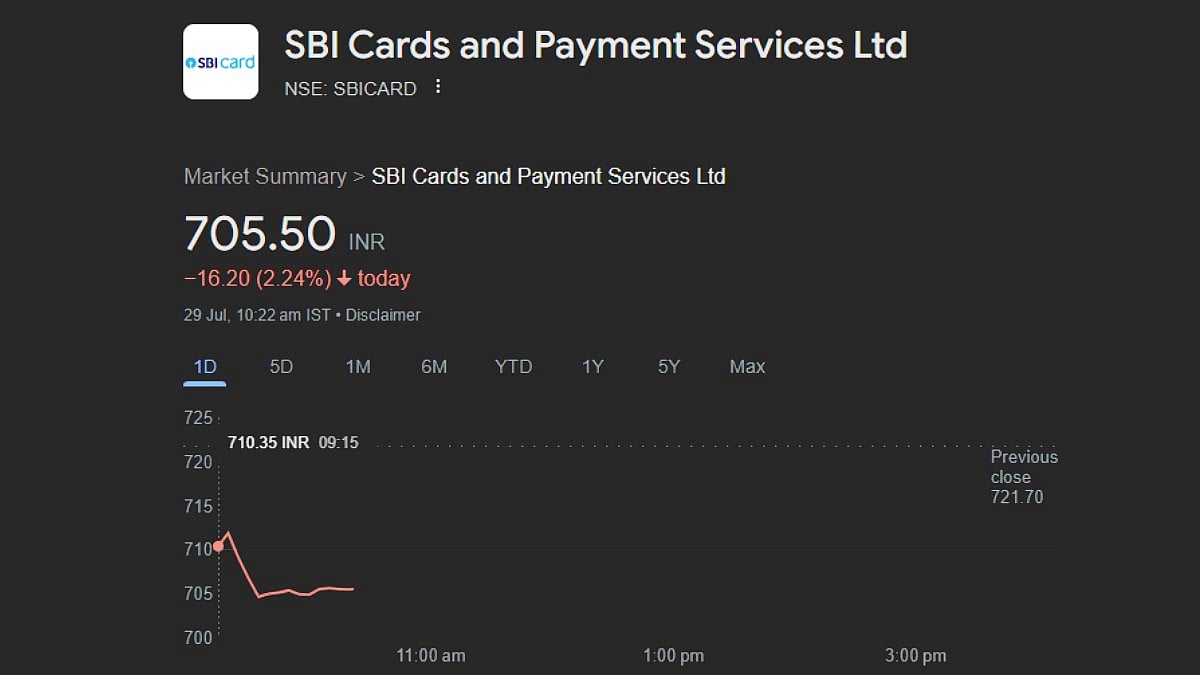

The State Bank of India, or SBI Cards and Payments, is another listed company that is owned by the central government. The company shares opened for the intraday trade on Monday, July 29, taking a hit of over 2 per cent in the early hours of the trading day.

Company Profits Drop

The company results for Q1 of FY25 or the quarter that concluded on June 30, were not necessarily encouraging. This appears to have affected their prospects at Dalal Street as well.

In an exchange filing, the company revealed its performance for the quarter and the overall net profit after taxes stood at Rs 594.45 crore, compared to the previous quarter, Q4 of FY24, that ended in March, when the state-owned entity made profits of Rs 662.37 crore.

The total income of the card company stood at Rs 4,482.59 crore in Q1 of FY25, which is greater than the previous quarter and Q1 of FY24. These numbers stood at Rs 4,474.57 crore and Rs 4,046.11 crore, respectively. |

This meant a 10.25 per cent decline in profits when compared to the previous quarter.

When the profits of the current quarter are compared to the numbers in the corresponding quarter of the previous fiscal year, the numbers are not that flattering either. In Q1 of FY24, the company made Rs 593.31 crore, which only indicates a marginal increase in profit after tax.

.png)

Shares Impacted By Q1 Results

The total income of the card company stood at Rs 4,482.59 crore in Q1 of FY25, which is greater than the previous quarter and Q1 of FY24. These numbers stood at Rs 4,474.57 crore and Rs 4,046.11 crore, respectively.

The company shares dropped significantly in value. |

The company's total expenses also rose compared to their previous quarters. The card company's expenses stood at Rs 3,683.42 crore. The expenses for the previous quarter stood at Rs 3,586.41 crore.

The company shares started the day in a slump and have continued on that trajectory in the intraday trade so far. At 10:22 IST, the SBI Cards and Payment share price dipped by 2.24 per cent or Rs 16.20, reaching a low of Rs 705.50 per share.