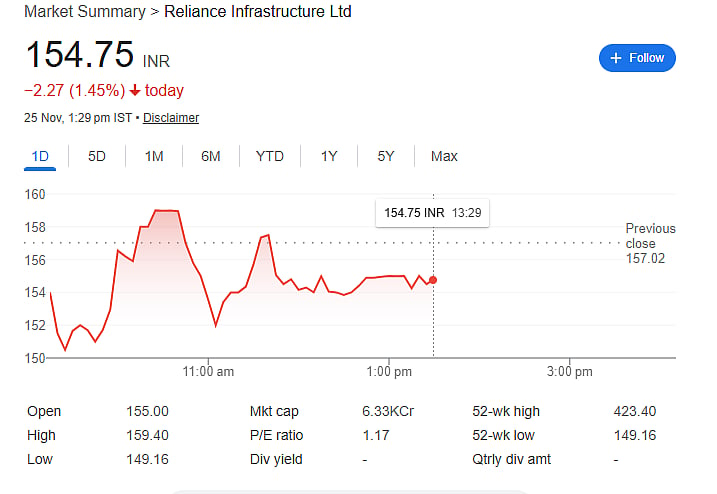

Mumbai: Shares of Reliance Infrastructure, owned by Anil Ambani, have been facing a severe fall in the market. On Tuesday, the company’s stock slipped below Rs 150 during intraday trading on the BSE. The shares dropped 5 percent, touching Rs 149.85. A strong decline was also seen on Monday. With this drop, the stock has now fallen more than 63 percent from its 52-week high. On Tuesday, the company also created a new 52-week low.

Massive Slide From 52-Week High

Reliance Infrastructure’s 52-week high stands at Rs 425, which it touched on June 27, 2025. But by November 25, 2025, the stock crashed to Rs 149.85, marking a fall of over 63 percent.

In the last six months alone, the stock has dropped more than 47 percent. Over the past one month, it has slipped more than 33 percent. Since the beginning of this year, Reliance Infrastructure shares have tumbled over 53 percent, showing continued weakness in investor sentiment.

Block Deal Worth Over Rs 81 Crore

A major block deal took place in Reliance Infrastructure, involving 51,69,059 shares. The total value of this deal was Rs 81.15 crore, and it was completed during the first session of trading. In this transaction, the shares were sold at a price of Rs 157 per share. However, the identities of the buyers and sellers are not known yet.

As per the latest shareholding data for the September quarter, promoters hold 19.05 percent stake in the company. Among public shareholders, mutual funds hold about 0.35 percent.

Company Background

Reliance Infrastructure is part of the Anil Ambani-led Reliance Group and operates mainly in infrastructure, power, and engineering sectors. The sharp fall in the stock price has raised concerns among investors who have already witnessed heavy losses throughout the year.