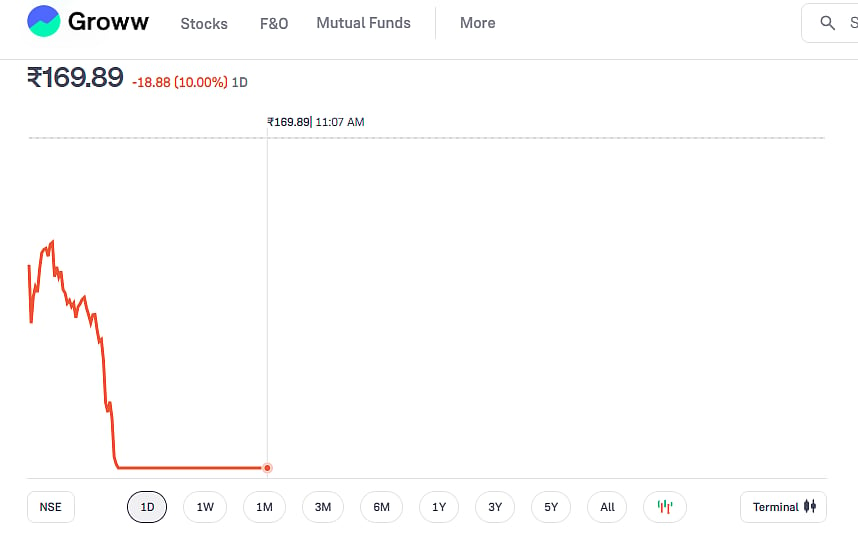

Mumbai: Shares of Billionbrains Garage Ventures, the parent company of Groww, slipped sharply in early trading on Wednesday, November 19, after an extraordinary post-listing surge. The stock dropped more than 10 percent to Rs 169.89 on the NSE, compared to its previous close of Rs 188.77, signaling the first major correction since the listing-driven rally.

Earlier this week, the stock delivered a stunning performance. On Monday, it soared nearly 11 percent to a high of Rs 193.80 on the NSE—representing an impressive 94 percent gain over its IPO issue price of Rs 100. Although the stock later trimmed some gains, it managed to close with solid upward momentum, continuing its exceptional run since debuting on November 12.

On Tuesday, the company announced through a regulatory filing that it will conduct an earnings conference call on Friday, November 21, 2025, at 4:00 p.m. IST to discuss its unaudited financial results. The Board of Directors will also meet the same day to review and approve the standalone and consolidated financials for the quarter and half year ending September 30, 2025.

A key development on Tuesday added further intrigue. As reported by Moneycontrol, more than 30 lakh shares of Billionbrains Garage Ventures moved into the NSE auction window—an unusually large amount, according to analysts. The auction mechanism is triggered when sellers fail to deliver shares they have sold. The exchange then attempts to procure shares from other traders between 2:00 p.m. and 2:45 p.m. to prevent settlement failures.

Analysts believe the heavy auction volume indicates that short sellers severely underestimated the stock’s strength. Many expected the rally to cool quickly and sold shares they did not own, planning to buy them back at lower prices. Instead, the stock surged further, leaving many unable to deliver shares on settlement day and forcing large quantities into the auction segment.

The intense squeeze illustrates robust buying interest, with Groww shares still up nearly 90 percent from their issue price within just four sessions.