Elcid Investments, a relatively lesser-known stock on Dalal Street a few weeks ago by many, made headlines by surpassing MRF Ltd. to become India’s most expensive stock in the recent days.

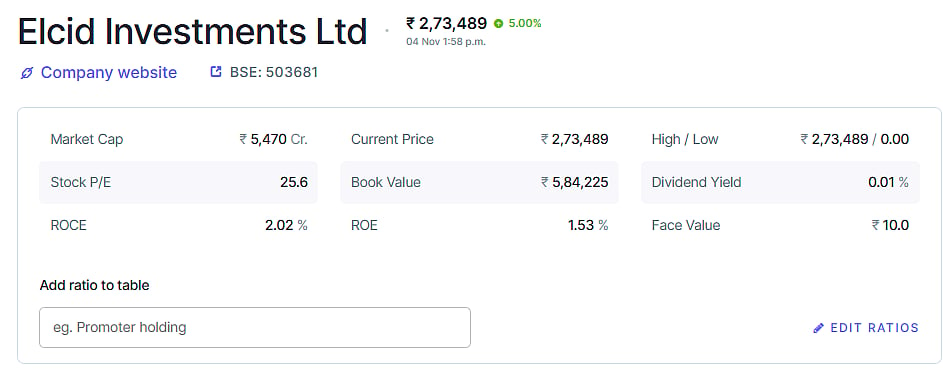

Leaving investors and analysts buzzing, the shares skyrocketed with its current trading price hitting Rs 2,73,488.85 on the Bombay Stock Exchange (BSE).

Share Performance |

Furthermore, the company continued to attract attention, rallying over 20 per cent in four days and locking in at its 5 per cent upper circuit limit on Monday (November 4).

The Spark: SEBI’s Price Discovery Auction

The story behind this whopping surge of the company stocks began with a June 2024 circular by the market regulator Securities and Exchange Board of India (SEBI), which aimed to address the undervaluation of investment holding companies.

In the meantime, many of the companies including Elcid, were trading at a discounts to their book value. To bridge this gap and ensure fair price discovery, the market watchdog SEBI implemented a "special call auction" for such stocks without traditional price bands, which helped unlock hidden value in these firms.

During the price discovery auction on October 29, the shares of the company made headlines and came to the spotlight with its stocks climbing from Rs 3.53 to Rs 2,36,250. This also marked a mind-boggling single-day increase of 66,92,535 per cent.

Current market price

Despite this surge, the company's current market price remains below its book value, which stands at an estimated Rs 5.85 lakh per share, according to financial research platform Screener.

www.screener.in |

The company is a registered Non-Banking Financial Company (NBFC) under the investment company category with the Reserve Bank of India (RBI), and does not operate any standalone business but has a portfolio of holdings in some of India’s most prominent companies.