Mumbai: Easy Trip Planners Ltd shares fell sharply on Wednesday, reflecting weak investor confidence and continued pressure on travel-related stocks. The company, which operates the EaseMyTrip online travel platform, saw its share price slip and staying in the red as selling interest being seen stronger at lower levels.

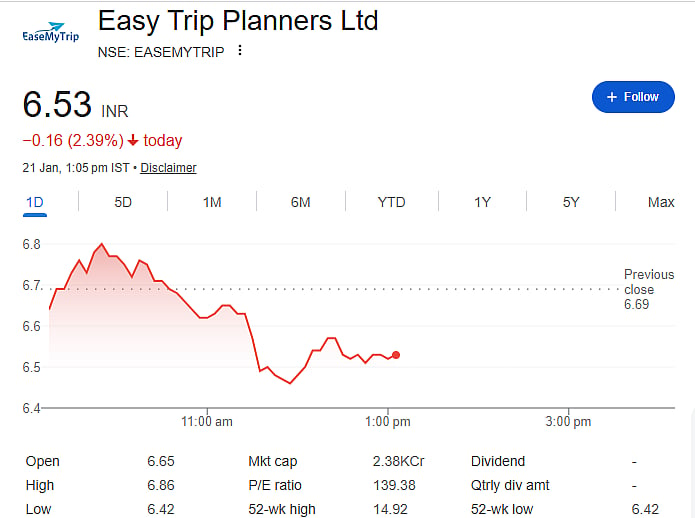

The stock was trading around Rs 6.53 in the afternoon, down about 2.4 percent from the previous close of Rs 6.69. It opened slightly higher at Rs 6.65 but failed to hold early gains. After touching an intraday high of Rs 6.86, the price moved steadily lower, hitting a day’s low of Rs 6.42 before recovering marginally. The intraday chart showed a clear downward trend, indicating persistent selling pressure rather than a brief correction.

Easy Trip Planners currently has a market capitalisation of about Rs 2,380 crore, placing it in the small-cap segment. The stock is trading close to its 52-week low of Rs 6.42 and well below its 52-week high of Rs 14.92. This wide gap highlights the sharp correction the stock has seen over the past year, as optimism around post-pandemic travel demand has faded and earnings growth has remained under pressure.

At current levels, the stock’s price-to-earnings ratio stands at around 139, which is considered high compared to many peers. This suggests that investors may be cautious about paying a premium valuation amid uncertain growth visibility. The company has not announced any dividend, keeping the focus firmly on price movement and business performance.

The fall in the share price appears to be driven more by market sentiment than by any specific company announcement during the day. Broader volatility in mid- and small-cap stocks, along with profit booking at higher levels, has added to the weakness. Traders seem to be adopting a wait-and-watch approach as the stock struggles to find strong buying support.

Overall, the latest price action shows that Easy Trip Planners remains under pressure, with investors closely tracking volumes, price stability and future business updates before taking fresh positions. Any clear improvement in results, costs, or travel demand trends may be needed to rebuild confidence and support a more stable recovery ahead sustainably.

Disclaimer: This news is for information only. It does not constitute investment advice. Stock prices fluctuate due to market risks. Investors should consult certified financial advisors before making any investment decisions.