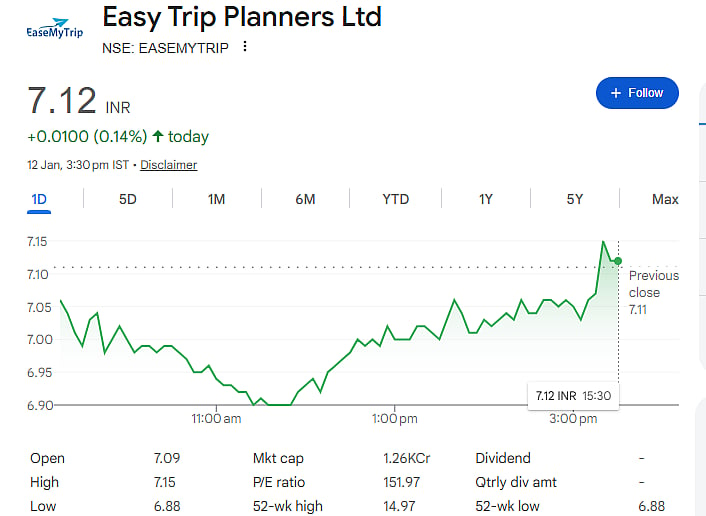

Mumbai: Shares of Easy Trip Planners Ltd (EaseMyTrip) traded close to their 52-week low on Monday, reflecting continued pressure on the stock despite a mild intraday recovery. The stock touched a low of Rs 6.88 during the session, which is also its 52-week low, before bouncing back in afternoon trade.

By 3:30 pm, EaseMyTrip shares were trading at Rs 7.12 on the NSE, up 0.14 percent from the previous close. The stock opened at Rs 7.09 and moved in a narrow range, hitting an intraday high of Rs 7.15, but remained well below its 52-week high of Rs 14.97.

The intraday chart shows that the stock slipped steadily in the morning session, bottoming out around late morning as selling pressure intensified. However, bargain buying at lower levels helped the stock recover gradually through the afternoon, allowing it to close marginally higher.

Market participants remain cautious on the counter, as the stock has lost a significant portion of its value over the past year. From its 52-week high, EaseMyTrip has declined by more than 50 percent, highlighting sustained weakness and muted investor sentiment.

At the current price, the company is trading at a relatively high price-to-earnings (P/E) ratio of nearly 152, which may be limiting aggressive buying interest. The company’s market capitalisation stands at around Rs 1.26 crore, according to exchange data.

While the small uptick offers some relief, analysts believe the stock may continue to face resistance unless there is clarity on growth prospects or an improvement in overall market sentiment. For now, EaseMyTrip’s movement near its 52-week low underscores investor caution and the need for strong triggers to drive a meaningful rebound.

Disclaimer: This article is for informational purposes only and does not constitute investment advice. Stock market investments are subject to risks. Readers should consult certified financial advisors before making investment decisions.