When actor Sonam Kapoor sold her luxury apartment in Mumbai’s Bandra Kurla Complex for Rs 32.5 crore earlier this year, news started trending on social media. Because according to documents accessed from SquareFeetIndia, an online property platform, the bollywood star had bought this place for Rs 31.48 crore in 2015!

Similarly Businessman Rajesh Chawla (name changed) bought a 2029 sq ft area flat in a tower in Prabhadevi for Rs 12.75 crore in 2013. He sold the same in 2022 for just Rs13.73 crore.

So does real estate investment in Mumbai translate into making money?

According to a study by Liases Foras, a real estate research and rating firm, property prices in Mumbai city have remained stagnant for the last one decade, if not, they have declined by one per cent.

“Its only after 2020 that the market has shown recovery and Mumbai has on an average registered a marginal growth of around 7 to 10 per cent”, Pankaj Kapur, Director, Liases Foras told the FPJ. Now contrast this with property prices at their peak between 2004 and 2008 when they had doubled and tripled!

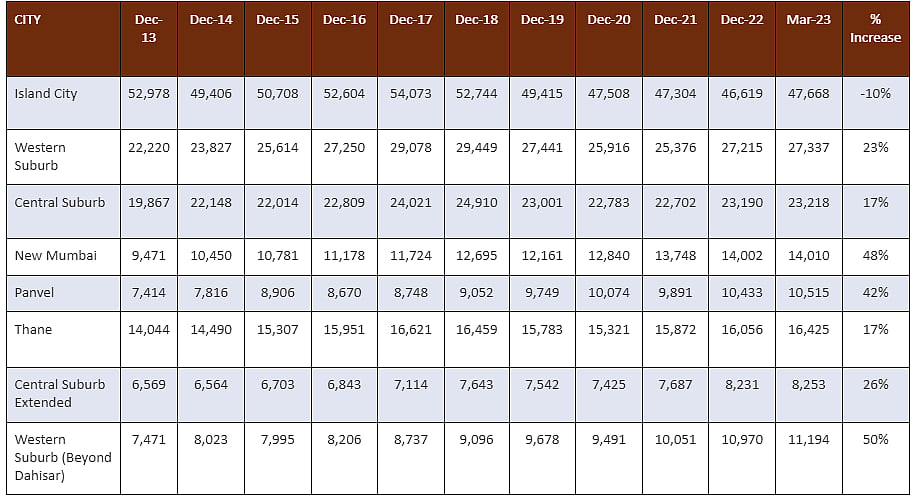

The average price of Mumbai Metropolitan Region in 2013 was 18,845 per sq. ft, which after 10 years stands at 18,708 per sq. ft, a decline of 1%, the study says.

Rushi Mehta, Neelyog Constructions Pvt Ltd admits that the last 10 years have been a period of transition for the real estate industry where they have had to overcome GST, RERA, Demo and even Covid. “As a result the industry has not shown much growth in terms of price per square feet area but has just about managed a holding pattern,” he says.

Whereas, gold prices have doubled over the last one decade and Bank FDIs draw an average seven per cent interest rate, real estate continues to remain a safe zone at 11 per cent for most investors “simply because we are a ‘housing shortage country’ and there will always be a demand for housing units”, says Kapur.

Agrees, Mehta, “you cannot go wrong with real estate. There is paucity of land in Mumbai and there will always be more demand than supply here”.

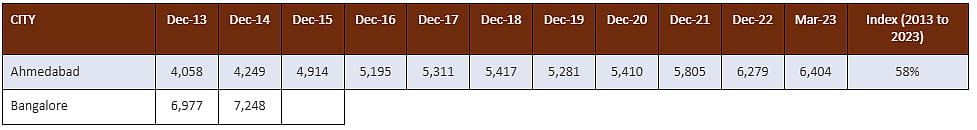

Table: Average apartments carpet area price per sq. ft in the top eight cities in India

During the same 10 year period, the property prices in Hyderabad have almost doubled with 98% appreciation, followed by NCR, where the average price grew 63%, Ahmedabad 58%, Bengaluru 38%, Chennai 35%, Kolkata 37% and Pune 20%, the report says.

According to Kapur, the main reason for this marginal growth in prices in Mumbai is because the supply of housing units has increased substantially after 2020 following several concessions and discounts offered by state authorities. “In the last couple of years there have been more new launches and the stock of unsold inventory too has simultaneously gone up. Its same demand-supply arithmetic at work. Mumbai contributes highest in terms of sales volumes across India as compared to other cities”, Kapur added.

Government initiatives crucial for recovery process

Keval Valambhia, CEO, CREDAI-MCHI agrees that government initiatives like slashing of stamp duty and boost to redevelopment sector have helped in the recovery process.

Kapur explains how upmarket Worli continues to appreciate at Rs 78,147 per sq ft carpet area (a 26.40%rise) because there is a supply squeeze of luxury homes here now. Ditto Walkeshwar at Rs, 1,60,864 per sq ft carpet area (30.71%rise), Bandra and Pali Hill at Rs 60,000 to Rs1,20,000 per sq ft carpet area. “Ready stock in these areas has been consumed. Demand for luxury homes is high and supply restricted which is why their prices have appreciated phenomenally”, says Kapur.

The appreciation in high-end areas like Worli, Walkeshwar, Bandra, and Pali Hill, explains Valambhia, highlight the importance of location and supply-demand dynamics. "The demand for larger and luxury homes has been one of the major factor for appreciation in these areas”, he points out.

Vijay Kandhari, Owner Kandhari Properties, a big ticket consultant who deals in prime real estate in the Bandra-Pali hill belt says that “if you simply look at the stamp duty collections in the last few years, you will realise how this segment of luxury market is growing. The volume of transactions is very high in this Bandra-Pali Hill belt”. He adds it will continue to grow as India heads towards becoming a 5 trillion economy. “Real Estate will be a major contributor towards this growth”, he maintains.

Navi Mumbai and peripheral regions have also registered appreciation in real estate prices and will continue to do so in the coming months primarily because of connectivity and infrastructure boost from projects like the Mumbai Trans Harbour Link (MTHL) and the Navi Mumbai airport, points out Kapur.

According to Mehta, Chembur at Rs 25,305 per sq ft carpet area and Ghatkopar on the central line are also appreciating because of new infra projects that are coming up which have increased the connectivity between western and central corridors. “In the suburbs, pockets of Kandivali at Rs 23,270 per sq ft carpet area (10.10% rise) and Malad at Rs 23,685 per sq ft carpet area (12.85% rise) are growing because some communities like the Gujaratis and Marwaris are well settled and prefer not to move out.”

As infrastructure and connectivity develops, the south side of the city may not have the same gravitational pull as it once did. Eventually all suburbs in the North side of Mumbai will command a similar price bracket with some localities/complexes commanding a premium, maintains Mehta.

The Liases Foras Study shows that the prices in Island City have declined by 10%. In comparison, locations in the western and central suburbs appreciated just 23% and 17 % receptively in the last ten years.

Looking at the current demand of home buyers, Valambhia is optimistic and sees an upward surge in the home buying sentiments. “Industry may get a boost provided the Government looks into rationalizing the premiums for Mumbai real estate where affordability is still a big question”.

Table: Average apartments carpet area price per sq. ft in the top eight cities in India