Mumbai: Adani Airports Holdings Limited (AAHL), fully owned by Adani Enterprises and the largest private airport operator in India, has effectively secured USD 1 billion using a project finance framework for their Mumbai International Airport Ltd (MIAL).

As per reports by Adani, the agreement includes the issuance of USD 750 million in notes that will mature in July 2029. These notes will be utilized for refinancing. The funding structure additionally permits raising an extra USD 250 million, bringing the total funding available to USD 1 billion.

The framework is anticipated to offer improved financial flexibility for MIAL's capital expenditure strategies, encompassing development, modernization, and capacity growth. The transaction represents India's inaugural investment-grade rated private bond issuance within the airport infrastructure arena.

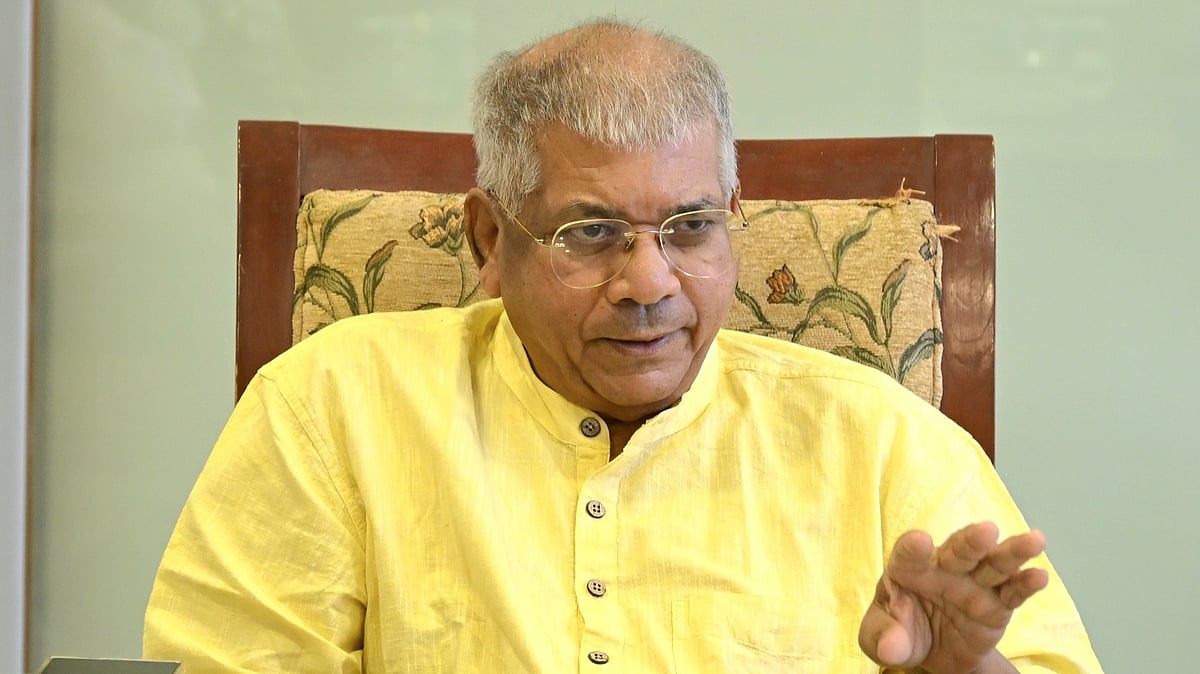

"This successful issuance validates the strength of the Adani Airports' operating platform, the robust fundamentals of Mumbai International Airport, and our commitment to sustainable infrastructure development. Arun Bansal the CEO of Adani Airports Holdings Ltd, stated, "With participation from Apollo-managed funds and leading institutional investors, we are proud to deepen our access to global pools of capital. Our ability to secure one of the largest private investment-grade project finance issuances demonstrates our commitment to financial discipline, capital efficiency and long-term value creation."

The deal was spearheaded by funds managed by Apollo, with involvement from a group of significant institutional investors and insurance companies. Included in this group were funds managed by BlackRock and Standard Chartered, underscoring worldwide interest in India's infrastructure industry and trust in Adani Airports' operational framework.

Earlier, Adani Airports Holdings Ltd (AAHL) had secured USD 750 million through external commercial borrowings from international banks for refinancing debt, infrastructure upgrades, and expanding capacity across six airports. Serving 94 million passengers in FY 2024-25, AAHL aims to triple its capacity to 300 million passengers by 2040. The firm focuses on enhancing customer experience and sustainability while managing eight airports, leading India's aviation sector.