Mumbai: The Central Goods and Services Tax (CGST) Mumbai Zone, CGST Navi Mumbai Commissionerate, has arrested the financial head of a firm for supplying taxable services amounting to Rs492 crore without issuing any tax invoice, and thereby allegedly evading GST to the tune of approximately Rs88 crore, officials said on Tuesday.

According to the officials, Foodlink F&B Holdings India, Mumbai, supplied taxable services amounting to Rs492 crore without issuing tax invoice and thereby committing offence as specified in the Central Goods and Services Tax Act, 2017.

Arrests Made in Connection with CGST Act Violations

As per the CGST Act, supply of goods and services without issuing tax invoices is a cognizable and non-bailable offence if the tax amount involved is above Rs5 crore.

“The first arrest in the case was made in December 2023, when the finance controller of the said company admitted his role in illegal transfer and deposit of cash, generated from the stated modus operandi in various bank accounts not declared in GST Registration, by breaking it into smaller amounts to avoid tax scrutiny and depositing in the name of fake business to consumer restaurant sale. This is the second arrest in this case,” an official said.

Legal Actions Following Arrest In CGST Act Violation Case

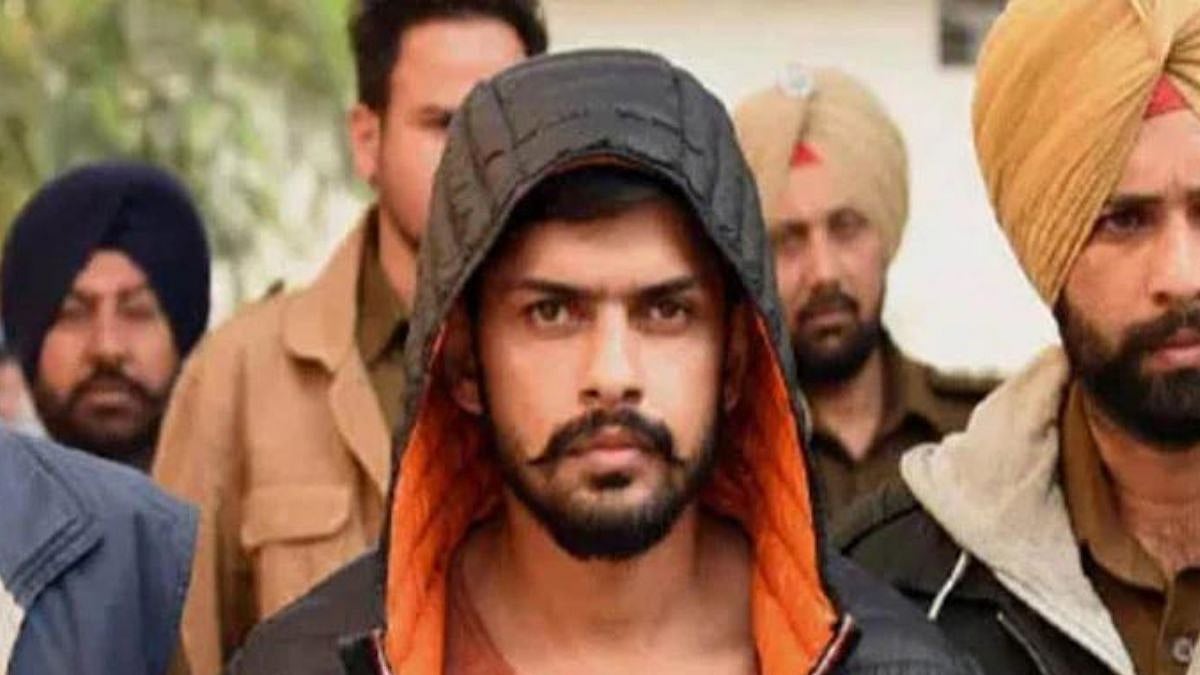

The accused was arrested from Ahmedabad, Gujarat, and produced before the local magistrate court, which granted his transit remand. The accused was produced before the jurisdictional magistrate, who remanded him to judicial custody till March 12, the officials said.

Last month, officers of the investigation wing of CGST Palghar Commissionerate, Mumbai Zone, had busted a fake invoice racket that involved availment and passing of ineligible Input Tax Credit to the tune of Rs11.61 crore and had arrested director of a private company in the said case.