Mumbai: The Enforcement Directorate’s (ED) money-laundering investigation into alleged illegal construction and bribery at the Vasai–Virar City Municipal Corporation (VVCMC) has unearthed a complex web of corporate fronts, cash dealings, and layered financial trails allegedly linked to former Vasai-Virar Municipal Commissioner Anil Pawar, his family, and long-time associates. According to the ED’s prosecution complaint (PC), the proceeds of crime (POC) generated through alleged systematic bribe collections for municipal approvals were laundered through a dense network of family-owned firms, benami partnerships, and investment vehicles, ultimately transformed into high-value real estate and warehousing assets.

The agency’s PC, backed by statements recorded under Section 50 of the Prevention of Money-Laundering Act (PMLA), reveals that Pawar’s immediate family including his wife Bharti Pawar, daughters Shrutika and Revti as well as close associates Janardan Pawar, Amol Patil, and Jayesh Patil functioned as the façade of a three-tier laundering system of placement, layering, and integration. This process allegedly involved the direct conversion of illicit cash into share capital, property investments, and corporate inflows camouflaged as legitimate transactions.

The investigation details a complex financial architecture, wherein illicit cash was converted into share capital, property stakes, and corporate inflows camouflaged as legitimate transactions. The ED's forensic analysis indicates that at least eight corporate entities are allegedly linked to Bharti Pawar through direct investments or partnership stakes. Her declared investments across these firms range between Rs 2.5 crore and Rs 3 crore, excluding substantial unaccounted cash components. The ED has flagged several high-value transactions, including a Rs 2.81 crore worth of land purchased in Alibaug and nearly Rs 3.9 crore in cash investments for warehousing assets. Her immovable holdings include the Shrutika Heights project in Nashik, which reportedly generated Rs 4–5 crore in revenue, land at Ambivali sold for Rs 70 lakh, two Pune flats, agricultural lands in Deola and Sinnar, and a Rs 3.5 crore flat purchased in her mother’s name.

Taking into account both declared and undisclosed assets, investigators estimate the total value of properties linked directly or indirectly to Bharti Pawar and her family at Rs 40–50 crore. Officials allegedly suspect that this intricate pattern of wealth accumulation is tied to illicit proceeds of municipal bribery and other irregular financial dealings during Pawar’s tenure as commissioner.

At the centre of the network lies BSR Realty Pvt Ltd, the Pawar family’s principal real estate firm, registered in the names of Bharti Pawar and her mother, Kumudini Pagar. The company executed projects such as Saidham Apartments and Shrutika Heights, though operational control reportedly rested with Anil Pawar’s associate Janardan Arun Pawar. In her statement, Bharti admitted to providing signed cheque books and OTP access to Janardan while exercising “nominal oversight,” a pattern the ED describes as “proxy directorship and beneficial concealment.”

The ED's complaint alleges that the Shrutika Heights project alone generated around Rs 4–5 crore in revenue, a substantial portion of which was absent from BSR Realty’s official books. Investigators believe this unaccounted income stemmed from so-called “municipal facilitation fees,” a euphemism for bribe proceeds collected for building permissions. Contracts for projects in Nashik and Satana were routed through J.A. Pawar Builders & Developers, owned by Janardan Pawar, which maintained parallel cash accounts. A search at Janardan’s residence recovered Rs 1.32 crore in unaccounted cash, allegedly indicating partial cash settlements on Pawar’s behalf.

The ED also identified Shrutika Enterprises, ostensibly a stone-crushing and material supply firm with Bharti pawar holding a 25% stake (Rs 52.50 lakh) as a placement channel for funneling cash receipts from Janardan’s accounts into real estate and other investments.

The agency also identified Triquetra Constrotech LLP as another crucial entity, with shareholding distributed among Bharti (40%), Shrutika (25%), Revti (25%), Janardan (9%), and Milind Pagar (1%). ED investigations revealed that the firm, despite having no actual business operations or project execution, maintained active bank accounts, indicating it allegedly acted as a “pass-through entity” to formalise family wealth.

Similarly, Vithai (Vithal) Weaves Pvt. Ltd., a Jalgaon-based textile firm, also came under scrutiny. Shrutika Pawar, the director, claimed her Rs 55 lakh investment came from grandparents' gifts and jewellery sales, but the ED found no supporting documentation. Despite limited operational involvement, Shrutika received Rs 33 lakh as remuneration, while the firm reported an inflated annual turnover of Rs 40 crore, a discrepancy investigators flagged as “inconsistent with business fundamentals.”

The ED’s investigation has identified Antonov Warehousing Parks Pvt. Ltd. and Dhwaja Warehouses Pvt. Ltd. as key channels for parking unaccounted capital. Subscription records seized by the agency revealed square-foot allocations and payments made in the names of Bharti, Shrutika, and Revti, reflecting a deliberate layering of family wealth through real estate. Payments connected to the Pawar family, totaling Rs 5.2 crore, were traced to these projects, with nearly 75% reportedly routed in cash. The transactions were allegedly coordinated by Anil Pawar through his associate Amol Patil, a practice the ED termed “a textbook case of placement and layering.”

Further scrutiny of the Pawar family’s network revealed systematic use of multiple corporate fronts. Janardan Agri Services Ltd., where Bharti held 90%, was flagged as a “fictitious trading front,” as her declared annual income of Rs 25–30 lakh bore no correlation with actual business activity, inventory, or turnover. A similar scheme emerged in SAPP Ventures and New Front Realty, where Bharti made an investment of Rs 43.21 lakh via cheque. Both companies displayed negligible commercial activity but maintained active financial transactions, underscoring their use as investment placeholders.

Further scrutiny revealed a network of corporate fronts such as Anmol Buildcon, Aadit Asset Holdings Pvt. Ltd., and Aaria Realty, linked to family associates Amol Patil and Jayesh Patil. These entities maintained minimal business activity but facilitated fund routing for family-controlled projects. Notably, consultancy payments to Aadit Asset Holdings were allegedly diverted into warehousing and land acquisitions benefitting the Pawars.

In a recorded statement, Amol Patil admitted receiving Rs 1.37 crore in cash at his Dadar office via Y.S. Reddy, under Anil Pawar’s instructions, to facilitate the Rs 2.81 crore Alibaug land purchase, a transaction in which a significant portion was routed entirely in cash.

Statements from Tushar Pawar, Niranjan Nikam, and Ravindra Nikam corroborated cash movements within the network. Tushar confirmed that he gifted a flat to Shrutika on Anil Pawar’s instructions in Thane, while Niranjan and Ravindra admitted facilitating RTGS transactions and cash deliveries up to Rs 34 lakh. ED recovered handwritten ledgers, blank signed cheques, and digital OTP records linking Bharti’s credentials to Janardan’s execution of transactions, pointing to clear proxy control.

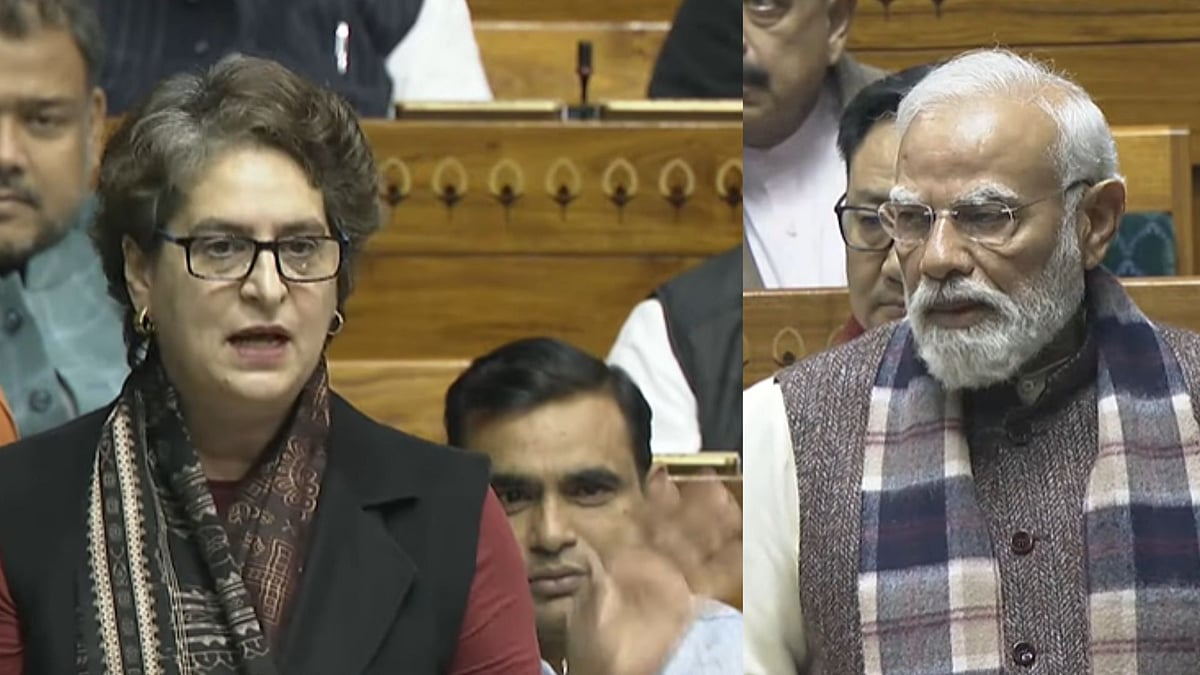

Also Watch:

The ED has provisionally attached assets totaling around Rs 71 crore, with approximately Rs 44 crore directly linked to Anil Pawar. The agency has framed the alleged laundering as consequential to predicate offences of extortion and bribery in the municipal approval process. The investigation continues to trace additional undisclosed assets, bank routing, and cross-jurisdictional payment pathways.

To get details on exclusive and budget-friendly property deals in Mumbai & surrounding regions, do visit: https://budgetproperties.in/