For generations, Indian families have trusted gold as a symbol of security and lasting value. Today, this trust extends into modern financial solutions through the Bajaj Finserv Gold Loan. Enhancing this experience, the Gold Loan Carnival combines quick access to funds with exciting rewards. The offer runs from 25 November 2025 to 28 February 2026 and gives eligible customers an opportunity to win attractive prizes such as travel vouchers, LED televisions, microwaves, and other useful home appliances.

To qualify, customers must avail a gold loan of Rs. 1 lakh or more and keep the loan active for at least 180 days from the date of disbursal. The Gold Loan Carnival is designed to encourage responsible borrowing while offering added value. Each customer is eligible for one reward during the offer period, making the gold loan experience more rewarding without adding any financial pressure.

Why the gold loan process is more rewarding during the Carnival

The Gold Loan carnival adds value beyond access to funds. The gold loan process remains the same, but the benefits increase. Customers get the same transparent valuation, quick disbursal, and multiple repayment options. On top of that, they stand a chance to win attractive rewards. This combination encourages responsible borrowing while recognising timely repayment. The rewards add real value to everyday life, ranging from travel experiences to useful home appliances. This makes the gold loan process more engaging and meaningful.

Rewards available during the Gold Loan Carnival

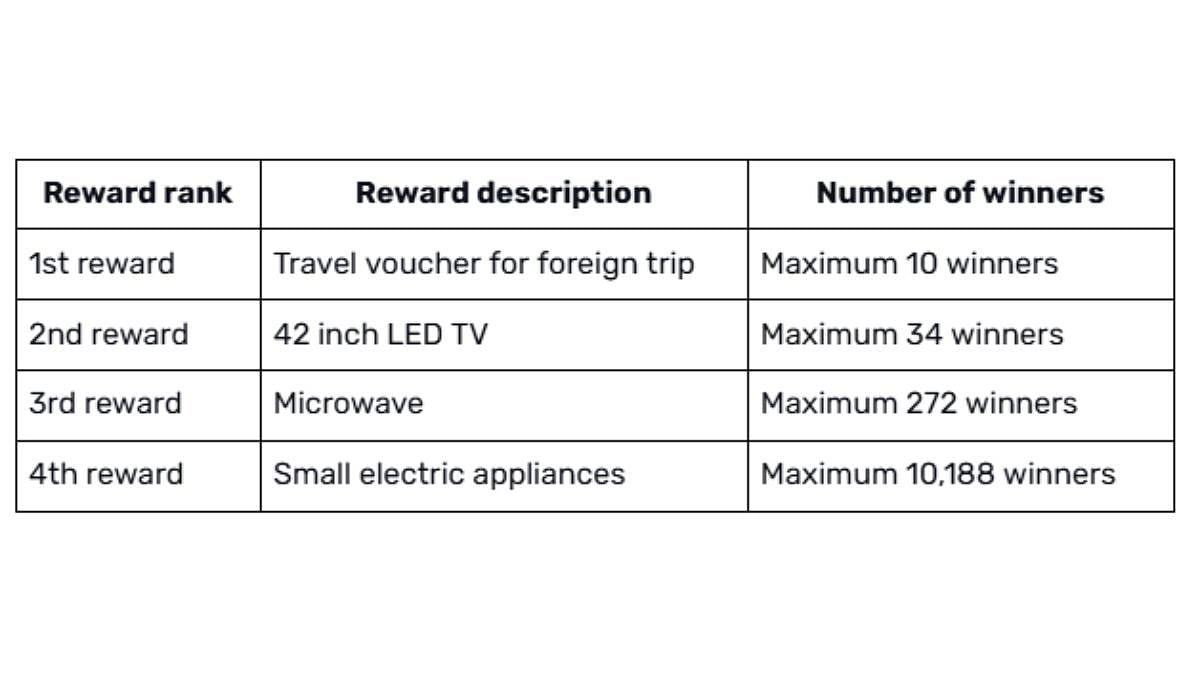

The Gold Loan Carnival offers four categories of rewards to eligible customers. A maximum of 10,504 winners will be selected across all categories. Each customer can receive only one reward during the entire offer period.

These rewards are linked to the successful disbursal and fulfilment of all eligibility conditions. They are designed to add joy to the borrowing experience without creating additional obligations. Customers simply need to borrow responsibly and keep their loan active for the required period.

Who can take part in the Gold Loan Carnival?

Customers must meet the following straightforward and transparent conditions to qualify for the gold loan rewards:

Indian citizens aged between 21 and 80 years

Gold purity between 18 and 22 karats

Minimum gold loan amount of Rs. 1,00,000

Loan not repaid within 180 days from the date of disbursal

One reward per customer during the entire offer period

Bajaj Finance may specify additional criteria at its sole discretion. Meeting these conditions ensures fair participation and clear outcomes for all eligible customers.

How the gold loan process works during the Carnival

The gold loan process is simple, speedy, and secure at every step:

Initiate the application through the Bajaj Finserv website by clicking on 'APPLY'

Share 10-digit mobile phone number and complete identity verification with the received OTP

Enter personal details and select the nearest gold loan branch

Download the in-principal loan eligibility letter and await a call from a Bajaj Finserv representative for guidance on the next steps

Gold evaluation is performed using transparent instruments to assess purity and weight. After which, a loan offer is made based on the gold's value, purity, and current market rates. Once the documents are verified and the terms are agreed upon, disbursal can take place. Reward eligibility tracking begins after successful disbursal.

Customers can also use the gold loan calculator available on the official Bajaj Finserv website to plan their gold loan process. This tool provides a tentative loan amount based on gold weight and purity. However, remember that the final offer depends on the actual valuation done at the branch.

Why choose Bajaj Finance for gold loan

Apart from a smooth, customer-friendly gold loan process, Bajaj Finserv Gold Loan offers features that allow customers to borrow with confidence and repay according to their convenience.

Instant disbursal with just one branch visit

Loan range from Rs. 5,000 to Rs. 2 crore to suit different needs

Competitive interest rates, based on borrower’s profile and the purity and value of the pledged gold

No income proof required or application

Secure storage and free insurance for pledged gold against theft or loss

Part release facility to reclaim some gold before full repayment

Multiple repayment schedules that align with applicant’s cash flow to reduce stress and enable efficient budget management

No prepayment or foreclosure charges for early repayment

Is a gold loan a smart financial choice?

A gold loan can serve many real-life needs without forcing customers to sell their gold. Medical expenses may arise without warning. A gold loan provides quick funds to handle hospital bills or treatments. Education fees or skill courses can also be managed smoothly. Home repairs or renovation work may require immediate liquidity. A gold loan offers support without long waiting periods or complicated eligibility criteria. During the Gold Loan Carnival, these practical uses become even more appealing.

The safety of their pledged gold is a common concern among borrowers. Bajaj Finance addresses this through secure storage and insurance coverage. Professional handling ensures that the gold remains in the same condition as pledged. These measures provide peace of mind while customers use their funds.

Bajaj Finance respects the emotional value of gold alongside its financial utility. With a simple, transparent, customer-focused gold loan process, Bajaj Finance serves as a reliable partner, while the Gold Loan Carnival offers a limited window to gain added value from this trusted source. Customers are encouraged to plan wisely, borrow responsibly, and apply during the Gold Loan Carnival to access immediate funds and enjoy long-term rewards.

T&C Apply

About Bajaj Finance Limited

Bajaj Finance Ltd. (‘BFL’, ‘Bajaj Finance’, or ‘the Company’), a subsidiary of Bajaj Finserv Ltd., is a deposit taking Non-Banking Financial Company (NBFC-D) registered with the Reserve Bank of India (RBI) and is classified as an NBFC-Investment and Credit Company (NBFC-ICC). BFL is engaged in the business of lending and acceptance of deposits. It has a diversified lending portfolio across retail, SMEs, and commercial customers with significant presence in both urban and rural India. It accepts public and corporate deposits and offers a variety of financial services products to its customers. BFL, a thirty-five-year-old enterprise, has now become a leading player in the NBFC sector in India and on a consolidated basis, it has a franchise of 69.14 million customers. BFL has the highest domestic credit rating of AAA/Stable for long-term borrowing, A1+ for short-term borrowing, and CRISIL AAA/Stable & [ICRA]AAA(Stable) for its FD program. It has a long-term issuer credit rating of BB+/Positive and a short-term rating of B by S&P Global ratings.