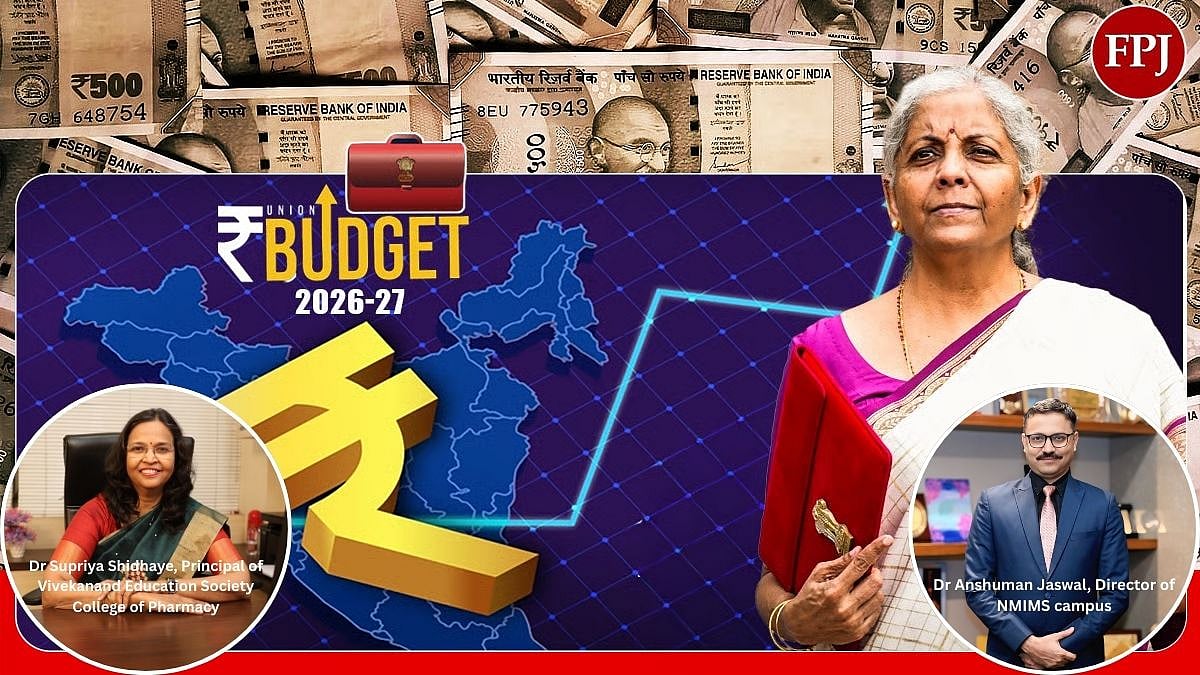

New Delhi: Finance Minister Nirmala Sitharaman on Sunday proposed to reduce the tax collection at source (TCS) rate to 2 per cent for education and medical purposes under Liberalised Remittance Scheme (LRS) as well as on sale of overseas tour program package.

Presenting the Union Budget 2026-27 in the Lok Sabha, the Minister also proposed that TCS rate for sellers of specific goods -- alcoholic liquor, scrap and minerals -- will be rationalised to 2 per cent and that on tendu leaves will be reduced from 5 per cent to 2 per cent. "I propose to reduce TCS rate for pursuing education and for medical purposes under the Liberalised Remittance Scheme (LRS) from 5 per cent to 2 per cent," she said.

The TCS rate on remittance under the LRS of an amount or aggregate of the amounts exceeding Rs 10 lakh has been proposed at 2 per cent for purposes of education or medical treatment from the current 5 per cent. Under the Liberalised Remittance Scheme, all resident individuals, including minors, are allowed to freely remit up to USD 2,50,000 per financial year (April â?" March) for any permissible current or capital account transaction or a combination of both.

However, TCS rate for purposes other than education or medical treatment will continue to attract TCS of 20 per cent. Sitharaman also proposed to reduce TCS rate on the sale of overseas tour program package from the current 5 per cent and 20 per cent to 2 per cent without any stipulation of amount. The current TCS is 5 per cent on sale of 'overseas tour programme package' including expenses for travel or hotel stay or boarding or lodging or any such similar or related expenditure up to Rs 10 lakh, and 20 per cent above 10 lakh. The current TCS on sale of minerals (coal or lignite or iron ore); sale of alcoholic liquor for human consumption; and sale of scrap, is one per cent.

Disclaimer: This story is from the syndicated feed. Nothing has been changed except the headline.