RBI is like a high school principal, who steps in when class teachers aren’t able to manage the class, and YES Bank is one of those wayward classrooms right now. There are two ways RBI can step in to take charge of a bank’s operations – Put the Bank under its Prompt Corrective Action (PCA) Framework or Supersede the Board of Directors of the said Bank.

What happens with PCA?

PCA framework involves monitoring the Bank, put restrictions on risky lending, and slowly nurture the Bank’s health back.

Why does RBI supersede any Bank? Superseding is not just a ‘to fix’ move. It is done when RBI wants to investigate and inspect, for which an administrator is appointed. The administrator will inspect the book and prepare a report of the asset quality of the bank.

What will be the outcome of the said action?

RBI will take a decision whether to merge the Bank with another bank or infuse more capital from Public Sector Banks into the Bank.

Why has RBI superseded the YES Bank’s Board? “Deterioration in asset quality, inadequate capital and losses in the books” are the reasons that RBI has cited when announcing its decision to supersede YES Bank’s Board. It was a preventive move on the Government’s and RBI’s part, to avoid a domino effect. Failure of a single institution can be construed as a failure of the banking system and can lead to a loss of trust. Private Sector Banks hold over 30% market share in deposits and advances in the country, and a loss of trust can impact this entire Private Banking system. The move to supersede the Board is RBI’s way of restoring the depositors’ confidence in the banking system.

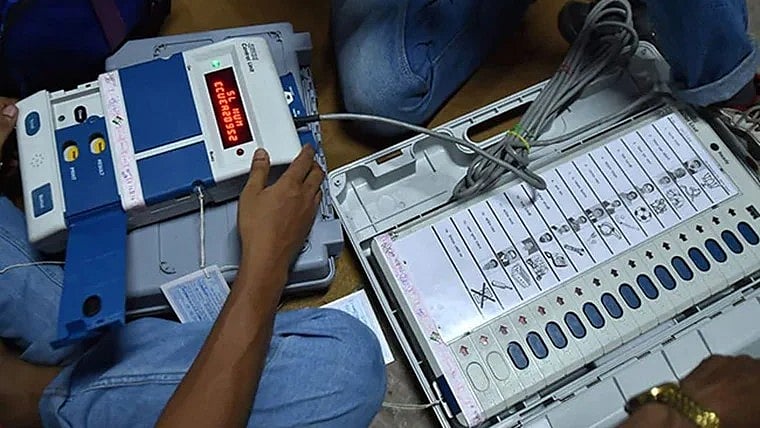

Yes Bank Account holders | PIC Credit: BL Soni

What are the key actions taken by RBI?

Yes Bank’s Board has been suspended for a period of 30 days. A depositor cannot withdraw more than ₹50,000 until April 3, 2020 (30 days).

What happens now?

There is a rumour that SBI and LIC are looking to do a bailout, where they would jointly acquire 49% of stake in YES Bank, in order to stabilise and restore Yes Bank’s operations until new private investors come forward. And it is a rumour, so there could always be a merger in play!

But YES Bank isn’t the first wayward child in RBI’s school. It was Punjab and Maharashtra Bank, where RBI barred the Bank from carrying out its routine business on the grounds of fraud and hidden bad loans. RBI has imposed severe restrictions on withdrawals by depositors initially (up to ₹1,000) but has gradually increased the limit in several phases. So, if you are a depositor in YES Bank, and have more than ₹50,000 in your account, then chances are you would be able to perform withdrawals as soon as RBI decides on its course of action.

What’s the fuss about YES?

The story of YES Bank starts in 2003, when Mr Rana Kapoor and Mr Ashok Kapur opened the for a new generation private bank.

In the 2008 terrorist attack on Trident-Oberoi Hotel, Mr Kapur was killed, and the Company passed into the sole hands of Mr Kapoor. With the more aggressive Mr Kapoor in the driving seat, the Bank has rapidly expanded its lending books with a focus on corporate and MSME lending, including troubled entities. YES Bank became a last resort when troubled companies sought lending.

In April 2018, RBI raised issues of governance and serious lapses in compliance of YES Bank and was critical of Mr Kapoor’s management. It has declined the reappointment of Mr Kapoor as the CEO and has asked him to stepdown after January 2019. This was kind of an unprecedented move, where a promoter-driven bank will lose its original promoter, who will have no control of its operations. After several months of search to replace Mr Kapoor, the board found a rescuer in Mr Ravneet Gill, and he was brought to the helm to contain the ‘out of control’ situation.

On the back of the bad loan book and steadily declining credit ratings by CARE and Moody’s, RBI slapped a fine on YES Bank for being non-compliant and was under SEBI investigation for insider trading.

Stocks plunged when Macquarie downgraded the rating. Following the bad quarterly result, stock plunged and IRR and ICRA gave negative ratings. RBI, once again, slapped a fine for violating money transfer norms and once again, for violating the PPI norms. The woes didn’t end for YES Bank yet. Gross NPAs have increased to 7.4% in Sep 2019, vs. 5% in June 2019 and 1.6% in Sep 2018. The profitability was hit and there was steep increase of bad debt (like there was any other way the loans to troubled entities were going to end!).

YES Bank reported a quarterly loss of ₹600 Crore in Sep 2019. The management team was being revamped , and in midst of this, two Directors resigned. In December 2019, it looked like a fund infusion would happen when Hong Kong based SPGP Holdings stepped in as a knight in shining armour with a $1.2 billion offer, but the transaction fell apart when the firm landed itself in legal trouble. YES Bank at this point needed a large capital infusion to stay afloat, and Mr Gill and his team scoured the ends of the earth to keep the monies coming in. Unfortunately, the fish didn’t bite, and Mr Gill prematurely announced these potential fund-raising transactions, and lost his credibility

At the end of the day, RBI stepped in to stop the situation from spiralling and has superseded the Board. With both individuals and corporations having affected by this moratorium, who can help RBI find a win-win solution to all parties? God? Nah, his ₹545 Crores come under the moratorium restrictions as well! I am sure he is wondering where his next meal is coming from!

Metrics to measure a Bank’s performance:

1. Tier I or Core Capital Ratio = Tier I or Core Capital/Risk-weighted Assets

2. Capital Adequacy Ratio (CAR) = [Tier I + Tier II + Tier III]/Risk weighted Assets

Regulated to prevent banks from taking excess leverage and become insolvent èCredit discipline to protect depositors

Min. Capital Adequacy Ratio is 9.0% for Scheduled commercial banks and 12% for Public sector banks

Min Tier I and Tier 2 Capital must be 8% of the Risk Weighted Assets.

3. Non-Performing Assets are loand or advances on which principal is past due and there have been no interest payments. Under RBI norms, an account is classified as NPA if not serviced for 90 days

NPA Ratio = Non Performing Assets/Gross Advances

4. Tier 1 capital = Bank’s core capital = Shareholder’s equity + Reatined Earnings

5. Tier II Capital = Revaluation reserves + Hybrid capital instruments + Subordinated Term Debt

6. Tier III Capital = Tier II Capital + Short term Subordinated Loans

Yes Bank:

7. Gross NPAs – 7.4% at 9/30/19

8. 31,000 Crore Book rated BBB and below =è At least 25% of this could turn bad

Alekhya Boora is the co-founder of Ripsey, a deep-tech food startup, and an ex-investment banker with UBS and PwC.