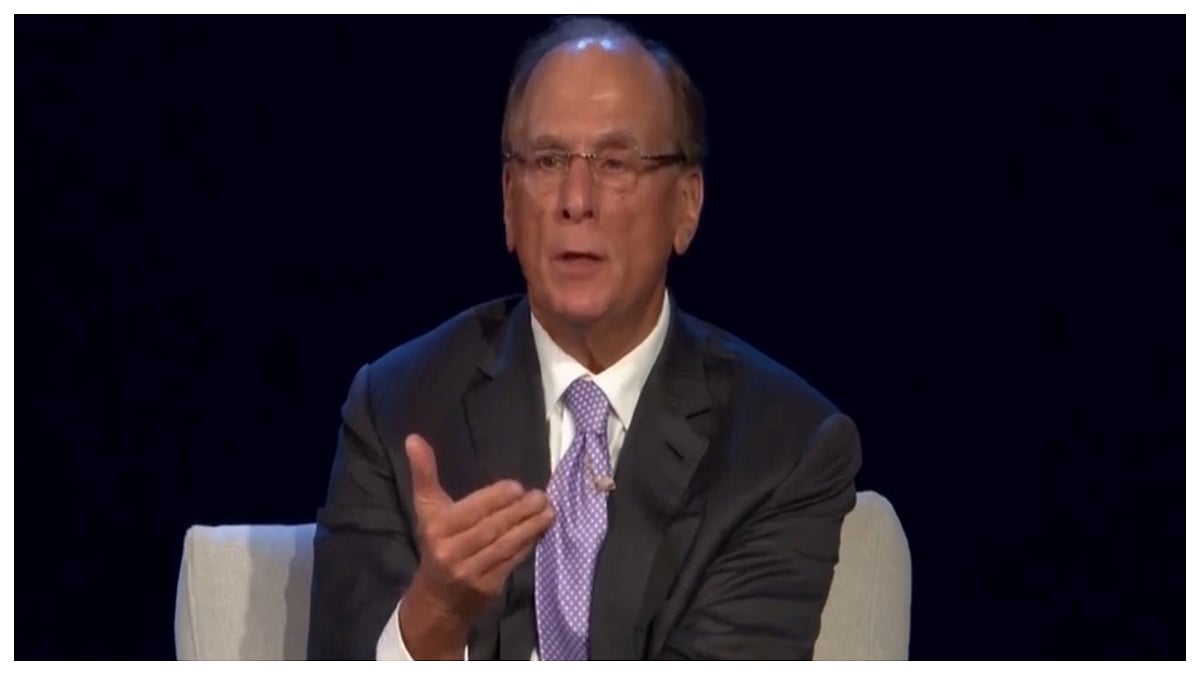

When a telecom giant with 450 million users teams up with the world’s largest asset manager, the question isn’t “what will they launch?”—it’s “how far can they change how India invests?” In the latest episode of the Simple Hai! Show, veteran finance journalist Vivek Law spoke with Rishi Kohli, Chief Investment Officer of Jio BlackRock, to unpack that bet: scale, data, risk, and the long road from selling mutual funds to actually building financial inclusion.

The episode opened with Law setting the context. The entry of Jio BlackRock into India’s mutual fund industry had created a stir. Law described it as an elephant walking into the market, combining the digital power of Jio with the global investment engine of BlackRock.

Kohli acknowledged that there was curiosity and pressure surrounding what the joint venture between the two behemoths would do differently. For the moment, he said, the excitement of building and the clarity of planning were absorbing that pressure. The real testing phase, with more experimentation, was expected to begin in the next six to nine months as the firm moved beyond its foundation stage.

Scale, Reach and First-Time Investors

Law then turned the conversation to scale. Kohli revealed that Jio BlackRock had already crossed 10 lakh retail investors across its schemes within months of launch. What stood out was that 18 percent of these investors were first-timers, many from rural pin codes who had never participated in market-linked investments earlier.

During the launch of the Flexi Cap fund, investments had come in from 93 to 94 percent of India’s pin codes. Kohli explained that this reach was possible because the mutual fund operated as an app within an app, integrated into the MyJio and JioFinance platforms. The aim, he stressed, was financial inclusion, not just asset gathering.

Why Jio and BlackRock Came Together

Law asked why this partnership had made sense. Kohli explained that both partners had identified a clear gap in India. While global markets had long adopted systematic and data-driven investment processes, India still relied heavily on discretionary decision-making.

Jio contributed to the nationwide digital distribution built through the telecom revolution. BlackRock, managing over 14 trillion dollars globally, brought technology-led, data-intensive investing. Together, the goal was to marry product and distribution in a way that reached investors who had never invested before.

Building Products the Way Investors Learned

The discussion then moved to product strategy. Kohli explained that Jio BlackRock had launched 12 funds in roughly eight months, following the natural learning curve of a first-time investor. They began with Liquid and Money Market funds, offering safer alternatives to fixed deposits while also testing operational systems. This was followed by Index funds such as Nifty Next 50, Mid Cap, Small Cap, and an eight-to-13-year government securities index, giving investors low-cost market exposure.

Only after this did active equity come into play, starting with the Flexi Cap fund. Most recently, in late January, the firm launched a Sector Rotation Fund, designed to capture sector-level opportunities rather than focusing only on individual stocks.

Three Sources of Alpha, Not One

Law pressed Kohli on how the firm thought about returns. Kohli outlined three distinct sources of alpha that every portfolio should have to reduce correlation and improve stability.

The first was stock-specific alpha, the traditional Indian approach. The second was sector-level alpha, where choosing the right sector mattered more than picking individual stocks. The third factor or style alpha, such as momentum, value, growth, or low volatility, was still evolving in India. Jio BlackRock, he said, aimed to combine all three through a systematic framework.

Data, Signals, and the Role of AI

The conversation then deepened into a process. Kohli explained that Jio BlackRock did not rely on gut-driven fund management. In the Flexi Cap fund, about 15 to 20 percent of decisions were driven by alternative data such as online transactions, job postings, and message board activity. Globally, BlackRock used up to 50 percent alternative data, and Kohli believed India could reach similar levels in the next ten to fifteen years. The system tracked around 400 signals for India, with 30 to 40 active signals at any given time, covering valuation, quality, and sentiment.

Analyst estimates and target prices from hundreds of brokers were updated automatically, faster than any human process. Rebalancing was also systematic. The Flexi Cap rebalanced weekly, leading to roughly 150 percent annual turnover, while the Sector Rotation fund rebalanced monthly.

Risk, Cost and the Aladdin Engine

Law highlighted that returns often received all the attention, while risk was ignored. Kohli agreed, saying risk and impact cost were under-researched in India. Jio BlackRock uses an India-specific risk model adapted from BlackRock’s global systems. By drawing on trading data from BlackRock’s 50 to 100 billion dollars of passive exposure in India, the firm can estimate how much a trade would move market prices.

These inputs flow into the Aladdin system, BlackRock's integrated investment technology platform, which optimises portfolios by balancing alpha scores, risk scores, and liquidity costs. Human fund managers still intervene during unusual events such as wars or major policy shocks by tightening risk limits.

Market View: Mid-Caps and FPI Behaviour

On the market outlook, Kohli reminded listeners that he had warned of a tough phase starting in August 2024. He now believed the time and price correction was largely complete.

Looking ahead to FY26, his models showed a slight preference for mid-caps, driven by better earnings visibility compared to small-caps. On foreign portfolio investors, Kohli explained that FPIs had been selling because earnings growth had slowed, and global capital was chasing opportunities like the AI trade or markets such as China and Korea. Importantly, FPI flows usually lagged markets and returned only after momentum became visible.