Mumbai: Indian stock markets continued their positive run on Friday, rising for the second day in a row. Strong global market cues and heavy buying in metal stocks boosted investor confidence. Sentiment also improved after Prime Minister Narendra Modi spoke with US President Donald Trump on Thursday, discussing plans to strengthen economic ties as both countries work toward a trade deal.

Strong Close for Sensex and Nifty

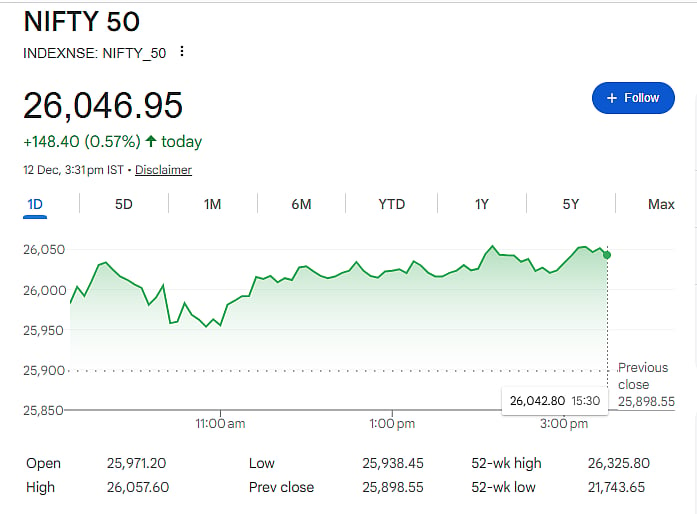

By the end of the trading session, the Sensex climbed 449.53 points (0.53 percent) to 85,267.66, while the Nifty gained 148.40 points (0.57 percent) to reach 26,046.95.

Market experts said the short-term trend remains positive as long as the Nifty stays above 25,900, which is expected to act as a strong support. On the upside, the index could move towards 26,300 if the momentum continues.

Top Gainers and Losers

Several major companies helped lift the Nifty. Stocks such as Tata Steel, Eternal, UltraTech Cement, Larsen & Toubro, Maruti Suzuki, Bharti Airtel, Adani Ports, Axis Bank, and Bajaj Finance saw strong buying interest.

However, some well-known stocks faced profit booking, causing them to fall. Among the top losers were HUL, Sun Pharma, Asian Paints, ITC, Power Grid, and HCL Tech.

MidCap and SmallCap Also Gain

The broader market continued to perform well. The Nifty MidCap index rose 1.18 percent, and the Nifty SmallCap index gained 0.94 percent, showing that buying was not limited to only large companies.

Sector Highlights

The Nifty Metal index was the biggest performer of the day, jumping 2.63 percent due to strong demand for metal companies. Other sectors such as realty, consumer durables, and oil & gas also moved higher. In contrast, FMCG and media stocks slipped into negative territory.

Silver Surges to Historic Levels

In commodity markets, silver created history as prices crossed Rs 2 lakh per kilogram for the first time ever. Silver has risen nearly 130 percent this year, driven by global demand and strong investor interest.

Experts noted that a mix of global strength, strong sector performance, and improving geopolitical signals helped markets finish the week on an optimistic note.