Mumbai: The Securities and Exchange Board of India (SEBI) is preparing a major overhaul of its Stock Broker Regulations of 1992 to strengthen risk management, compliance, data protection, and investor grievance redressal systems.

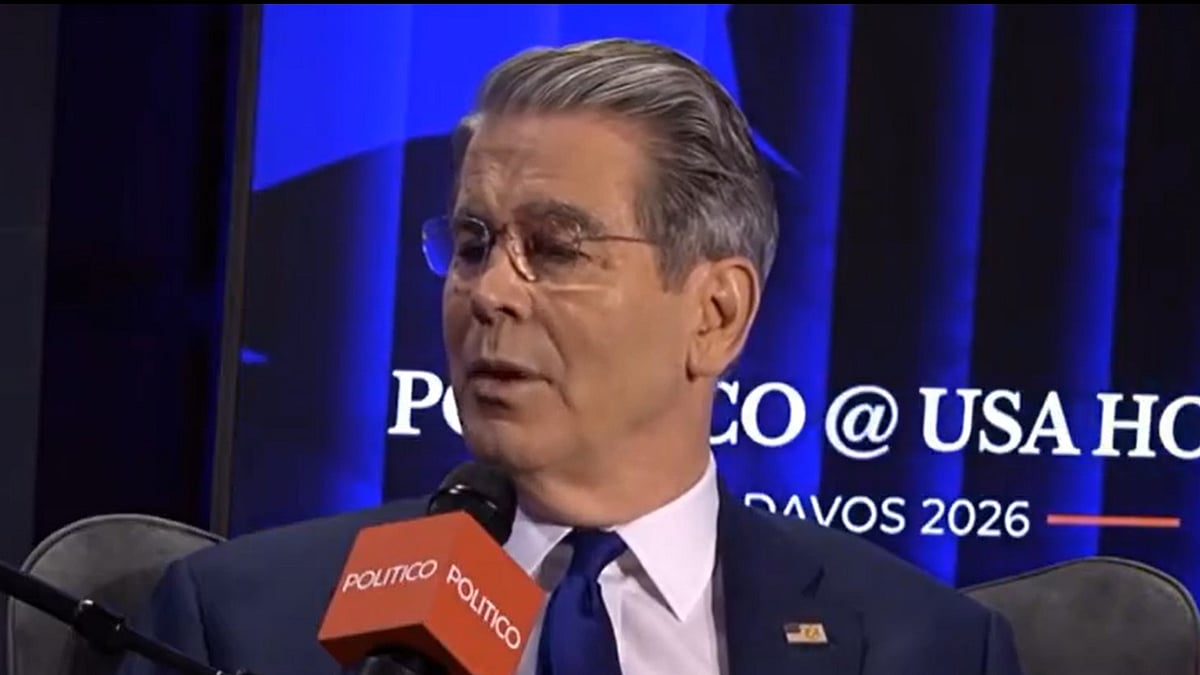

Speaking at the Morningstar India Conference (MIC 2025), SEBI Chairman Tuhin Kanta Pandey emphasized that the regulator’s goal is to ensure market integrity and investor confidence through modernized rules.

Pandey stated, 'It’s no longer just about compliance — the next big step is effective risk identification. Protecting client data is critical, and all intermediaries must strictly adhere to regulatory norms.' He added that timely grievance resolution is now a top priority for enhancing market transparency and safeguarding investor interests.

SEBI Investigates MCX Trading Glitch

Addressing the recent technical disruption at the Multi Commodity Exchange (MCX) on October 28, 2025, Pandey said that a root-cause analysis is currently underway. He expressed concern over the recurring nature of such glitches, noting, 'The last breakdown occurred in July, and it has happened again, which isn’t right. These issues have occurred multiple times. However, we can only comment after a proper review.'

Pandey clarified that the investigation is being conducted in-depth to prevent future disruptions that could affect market credibility. He explained that the review process involves multiple stages and the initial report must be submitted within 24 to 48 hours, after which SEBI will act according to standard operating procedures (SOPs).

Focus on Market Transparency and Investor Protection

SEBI’s upcoming reforms will focus on enhancing accountability across brokers and intermediaries. The regulator aims to build a more resilient, transparent, and investor-friendly market ecosystem. These changes come at a time when technological reliability and cyber risk management are becoming crucial to maintaining market trust.