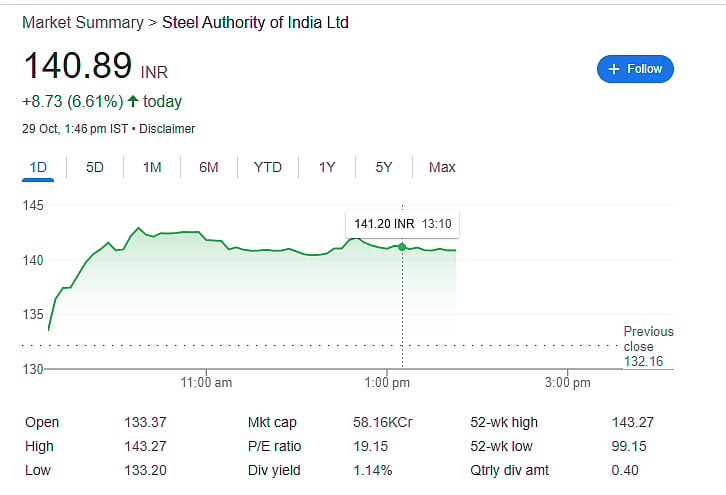

Mumbai: Shares of Steel Authority of India Ltd. (SAIL) rallied over 7 percent on Wednesday, October 29, hitting a fresh 52-week high ahead of the company’s second-quarter (Q2 FY25) earnings announcement. The stock climbed to Rs 142 per share during intraday trade and was last seen trading 6.61 percent higher at Rs 140.89 as of 1:46 p.m.

Over the past six months, SAIL’s shares have gained more than 22 percent, buoyed by improved demand sentiment and expectations of steady operational performance despite pricing pressures.

Sharp Decline in Profit and Margins Anticipated

Analysts expect a significant contraction in profitability during Q2. Operating profit (EBITDA) is forecast to drop 32 percent year-on-year to Rs 1,995 crore, compared to Rs 2,913 crore in the previous year. Similarly, operating margins are estimated to compress to 8.04 percent, down from 11.81 percent in the year-ago quarter.

Net profit is projected to plunge 85 percent to Rs 136 crore, compared to Rs 897 crore a year earlier, largely due to weaker steel prices and elevated costs.

Lower Input Costs Provide Partial Relief

One bright spot is the decline in coking coal prices, which fell by about $10 per tonne sequentially, providing some cushion to margins. However, the benefit of lower raw material costs is unlikely to fully offset the impact of soft realisations and seasonal weakness in domestic steel demand.

Market Sentiment Remains Positive

Despite near-term headwinds, investor sentiment remains optimistic as SAIL continues to benefit from infrastructure spending and government-led capex in the steel sector. The Q2 earnings, expected soon, will likely determine the stock’s next major move.

Disclaimer: This article is for informational purposes only and not investment advice. Market conditions and government decisions may change; readers should verify details before making financial or investment choices.