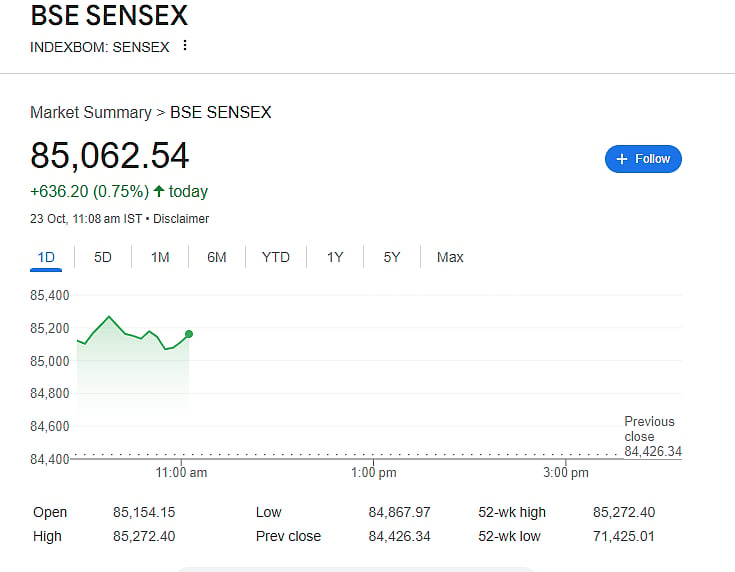

Mumbai: The Indian stock market started Thursday on a high note, with both major indices showing strong upward momentum. The BSE Sensex jumped 727.81 points (0.86 percent) to reach 85,154.15, while the Nifty 50 climbed 188.60 points (0.73 percent) to cross the 26,000 mark. The buying was broad-based despite weakness in other Asian markets and a fall in the US stock market overnight.

Broader markets were mixed — the Nifty Midcap 100 gained 0.2 percent, while the Nifty Smallcap 100 fell 0.1 percent. The Bank Nifty index also advanced 0.5 percent to trade above the 58,200 level.

India-US Trade Deal Boosts Sentiment

Reports of a possible India-US trade deal lifted investor confidence. According to news reports, the deal could reduce US tariffs on Indian exports from nearly 50 percent to 15–16 percent, opening up new trade opportunities. The agreement may also involve India gradually cutting imports of Russian oil. The optimism around the deal helped improve the market mood, especially for export and manufacturing-focused sectors.

Strong Q2 Results Drive Confidence

Better-than-expected second-quarter (Q2) earnings from large companies like Reliance Industries and top banks added to the market’s strength. Analysts believe corporate earnings may have bottomed out, with recovery expected in the second half of FY26. Forecasts for FY27 remain positive, with expectations of a 15 percent growth in earnings, driven by stronger banks and energy companies.

Big Stocks Lead the Rally

Heavyweight stocks such as Infosys, HCL Technologies, Tata Steel, Axis Bank, TCS, Tech Mahindra, and Hindustan Unilever all gained over 1 percent, pushing benchmarks higher. The IT, banking, FMCG, and metal sectors performed the best, while realty and oil & gas stocks saw minor losses.

FII Buying and Short-Covering Add Fuel

Foreign Institutional Investors (FIIs) continued their buying streak for the fifth straight session, purchasing shares worth Rs 96.72 crore, while Domestic Institutional Investors (DIIs) sold equities worth Rs 607.01 crore. Additionally, short-covering activity — where traders buy back previously sold positions — helped push large-cap stocks higher.

On the technical side, analysts note that strong momentum indicators are keeping Nifty near its upper Bollinger band, signaling continued strength in the short term.

Disclaimer: This story is for informational purposes only and not financial advice. Stock markets are volatile; investors should consult certified financial experts before making investment or trading decisions.