The RBI on April 6, 2023, surprised everyone by maintaining the repo rate at 6.5%. Despite the RBI maintaining the repo rate, the overall increase over the last 11 months is 2.5%. The interest rate environment could not have been better for fixed deposit (FD) investors, who had to contend with one of the lowest FD interest rates in the last 20 years and are now hoping that the benefits of the prior significant repo rate hikes will be transferred to bank FDs.

With this there are many questions that investors have. If the FD rates will change? Is it good time to invest in fixed deposit?

How is fixed deposit (FD) influenced by repo rate?

The repo rate increase might be quite advantageous for investors looking for fixed deposits with minimal risk and attractive yields.

As investments, FDs are anticipated to increase in value. Changes to the RBI's policy repo rate will influence bank lending and deposit rates. The different banks and NBFCs will decide on the actual rate modifications.

For risk-averse people looking to increase their cash at a respectable and predictable interest rate, fixed deposits are among the safest and most popular investment options. Once invested, individuals are no longer concerned with current market conditions because the FD rates are stable for the duration of the investment.

One of the top financial institutions in India, Bajaj Finance, is offering FD rates up to 8.10% p.a.

Why Bajaj Finance Fixed Deposit is a good Investment.

Apart from the high Fixed Deposit interest rates and flexible tenure options, Bajaj Finance Fixed Deposit offers several other advantages that make it an ideal investment option. Some of these advantages are:

Safety and stability

Bajaj Finance Fixed Deposit is accredited with [ICRA]AAA(Stable) and CRISIL AAA/STABLE, ensuring customers that their investment will stay secure.

Easy to invest

Investing in Bajaj Finance Fixed Deposit is easy and hassle-free. Investors can invest online or offline, and the process is straightforward.

Non-cumulative option

Bajaj Finance Fixed Deposit offers a non-cumulative option, enabling investors to receive regular interest payouts, making it an ideal option for generating passive income.

Loan against FD option

You can avail of a loan amount of up to 75% of the FD amount. One of the key advantages of a loan against Bajaj Finance Fixed Deposit is that investors can avail of the loan without breaking their FD. This means that investors can continue earning interest on their fixed deposit while also availing of the loan amount.

Special tenure:

Bajaj Finance also lets customers secure a higher interest rate by booking their FDs for the given 7 special tenures. These are 15, 18, 22, 30, 33, and 44 months. You can invest online in Bajaj Finance Fixed Deposit. If you are the existing customer of Bajaj, you can book your FD through our customer portal- My Account.

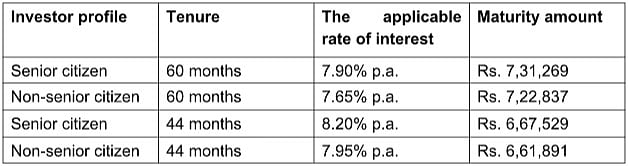

Let us take an example to illustrate the potential returns of investing in Bajaj Finance Fixed Deposit. The table below shows the potential returns on the investment: Here is how much a senior citizen and a citizen aged below 60 can make for different tenures with an investment of Rs. 5 lakh.

As shown in the table, an investment of Rs. 5 lakh in a Bajaj Finance Fixed Deposit for 60 months and 44 months can earn an investor sizeable returns. Moreover, investors can use the maturity amount to realise their financial goals, such as making a down payment for a house or car.

If investing a large chunk of money in one go is not a viable option for you, the Systematic Deposit Plan offered by Bajaj Finance is a good investment option. You can start saving with an amount as low as Rs. 5,000. You can set aside a small chunk of your savings each month and invest in an SDP to achieve your long-term financial goals step by step.

This article is generated and published by FPJ focus team. You can get in touch with them on fpjfocus@fpj.co.in.