India’s remittances from abroad are expected to fall to $64 billion in 2020 from $ 83 billion the previous year. Globally, remittances are projected to decline sharply by about 20 per cent this year due to the economic crisis induced by the COVID-19 pandemic and shutdown

By now the inevitability of a diving recessionary economy for the world, and India is evident to all of us, loud and clear. Have we even considered the changes that this pandemic is bringing to the migratory economy of the world. “In India, remittances are projected to fall by about 23 per cent in 2020, to USD 64 billion – a striking contrast with the growth of 5.5 percent and receipts of USD 83 billion seen in 2019,” the World Bank said in a report on impact of COVID-19 on migration and remittances. The projected fall, which would be the sharpest decline in recent history, is largely due to a fall in the wages and employment of migrant workers, who tend to be more vulnerable to loss of employment and wages during an economic crisis in a host country, the bank said. Globally remittances are projected to decline sharply by about 20 per cent this year due to the economic crisis induced by the COVID-19 pandemic and shutdown. Remittance flows are expected to fall across the world, most notably in Europe and Central Asia (27.5 per cent), followed by Sub-Saharan Africa (23.1 per cent), South Asia (22.1 per cent), the Middle East and North Africa (19.6 per cent), Latin America and the Caribbean (19.3 per cent), and East Asia and the Pacific (13 per cent).

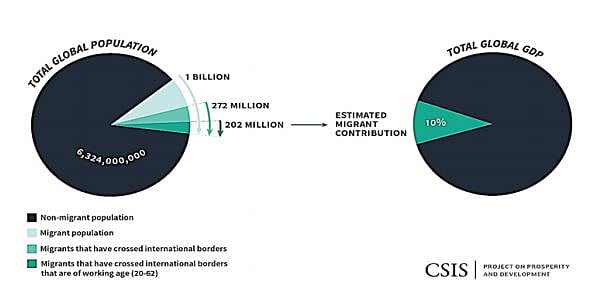

Remittances are a vital source of income for developing countries. Remittances help families afford food, healthcare, and basic needs. The ongoing economic recession caused by COVID-19 is taking a severe toll on the ability to send money home. So it is as imperative and vital for the advanced economies to recover – and recover fast – as it is for our own national economy. India receives the highest remittance from the middle east followed closely by the United States. In fact, the economy of Kerala is largely driven by foreign remittances. Remittance flows are expected to fall across the world, most notably in Europe and Central Asia (27.5 per cent), followed by Sub-Saharan Africa (23.1 per cent), South Asia (22.1 per cent), the Middle East and North Africa (19.6 per cent), Latin America and the Caribbean (19.3 per cent), and East Asia and the Pacific (13 per cent). Human mobility has been a core tenet of the unprecedented economic growth of the last 100 years and is critical to our global economy. Today, there are almost 1 billion migrants worldwide. Of these, 272 million have crossed international borders, and recent estimates suggest that three-fourths of these international migrants are of working age between 20 and 40 years.

Human Mobility

Unemployment is skyrocketing globally. Inequality is growing, and global poverty could increase for the first time since 1990.

While making up just 3.4 percent of the global population, migrants contribute an estimated 10 per cent to global GDP; they have been the engine of global economic growth over the past century.Disruptions to migration flows could have substantial and multidimensional longer-term economic and social impacts. Covid-19 has put an almost complete global halt to human mobility. More people are on lockdown globally (2.6 billion) than were alive during World War II. Those wishing to travel internationally simply cannot do so. In countries like the United States and India, even inter-state travel is restricted. It is unclear how long these restrictions will last. But even in a best-case scenario the next two to three months will still see extremely limited human mobility. And this scenario does not even take into account what many believe will be coming Covid-19 waves in sub-Saharan Africa, Latin America, and elsewhere, meaning that even the two-to-three-month timeframe could be significantly longer in the developing world. The short-term impacts of such restrictions are becoming increasingly clear. Unemployment is skyrocketing globally. Inequality is growing, and global poverty could increase for the first time since 1990. The pandemic is disproportionately affecting the health and livelihoods of the most vulnerable.

India, world’s largest migrant workfroce

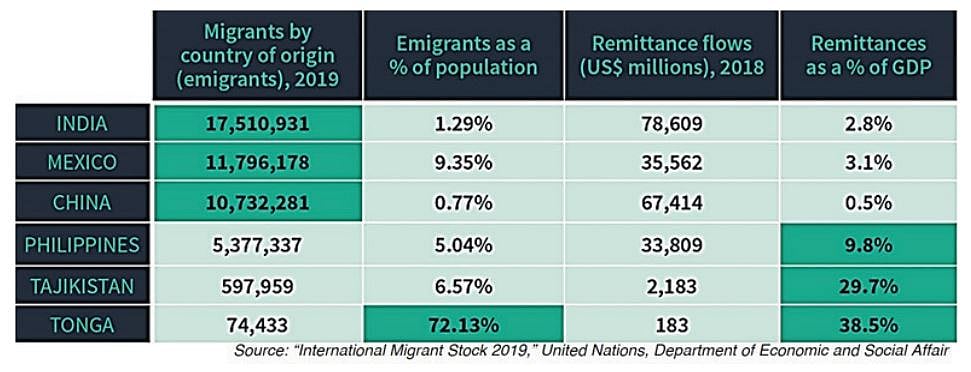

Though much will depend on government responses, the nature of virus mutation, technology, and other drivers, it is important to think about how disruptions to human mobility and decreased remittance flows could pose serious longer-term challenges to migration and to global economic growth. As of 2019, the largest number of migrants originated in India, followed by Mexico, China, Russia, and Syria. Unsurprisingly, India, China, Mexico, the Philippines, and Egypt received the most remittances in 2019. It is reasonable to assume that the size, diversity, and overall structure of these economies will allow them to recover over time. Importantly, our respective GDPs are also not significantly dependent on remittance flows. It is a different story for many developing countries. Remittances make up almost 10 percent of the GDP of the Philippines, a country of over 100 million people. In the small Pacific island nation of Tonga, a significant majority of people born there migrate elsewhere, in turn contributing to almost 40 percent of Tonga’s GDP in the form of remittances. Sometimes, however, lack of remittances through foreign currency works out better for a country as was seen in India during late 90s. When remittances drop dramatically, the rapid depletion of foreign exchange reserves, and the associated weakening of its currency’s purchasing power can push policymakers to reconsider such policies, as was the case right before India’s liberalization in 1991. When most economic migrants in the Middle East fled the Gulf War, India’s biggest source of expatriate remittances dried up and pushed the country into a balance of payment crisis, forcing the Parliament to adopt more liberal, market-oriented economic policies.

Long-term Impacts

Covid-19 is affecting the whole world and causing economic migrants everywhere to lose income. As a result, this historic coping mechanism for the developing world is likely be diminished in the long term, especially once people’s emergency cash reserves are depleted.

Even if large economies like Mexico, China, and India might be able to absorb remittance-flow related hits to GDP, low-income families will suffer and force governments to think about the reallocation of scarce public resources to strengthen social safety nets. At the same time, a decrease in remittance flows could lead some countries to economic reforms, as was the case in India in 1991. During hard times, people in more developed countries send money and goods to people in places that are struggling. Covid-19 is affecting the whole world and causing economic migrants everywhere to lose income. As a result, this historic coping mechanism for the developing world is likely be diminished in the long term, especially once people’s emergency cash reserves are depleted. As economic migrants lose jobs, they are forced to choose between staying in places that offer little if any support to them and home countries dealing with similar pandemic challenges and significantly worse economic stability.

Xenophobia vs Economy?

Mass migrations have historically happened in waves; there will inevitably be a post-Covid-19 wave of economic migration, many of which may not follow traditional or historical patterns.

Many choose to go home, and in doing so, some will face xenophobia during the journey, some will take Covid-19 with them, while a few will risk ostracization by people who fear that returning migrants are harbingers of the virus. As we are already witnessing this in varying degrees. It is reasonable to assume that some low-skilled jobs will return once economies in developed countries start to recover and that some of these jobs will be filled by migrants, though perhaps a smaller subset than before because of increased preference for native-born workers and accelerated trends toward automation in some industries. However, this will happen at scale only when the worst of Covid-19 fears eventually subside which could take years. It will also take a mighty long time for developed countries to realize that their respective economies do not function as well without economic migration, which again could take years. Post this pandemic, politicians and policymakers will take even longer to realisethat native-born, low-skilled labor does not perfectly substitute for low-skilled migrant labour. Economic migrants will pursue opportunities where they exist, even in other developing countries. Mass migrations have historically happened in waves; there will inevitably be a post-Covid-19 wave of economic migration, many of which may not follow traditional or historical patterns. However, a direct result of Covid-19 could be that migration flows between developing countries become significantly greater than flows between the developing and developed worlds. Such a reorientation could then result in overall and sustained decreases in remittance flows since incomes for economic migrants now in developing countries will be less secure and less lucrative than they were in developed countries. What is abundantly clear is that shorter the duration of the pandemic, the more positive the outcomes for migrants—and the global economy—will be. Lack of human mobility means not only fewer remittances but also real economic risks to countriesreliant on migrant labor and brainpower.

During these trying times, policymakers should not forget about the people who will be critical to restarting the engine of the global economy post-Covid-19: migrants, who else?

Please note: The article has been contributed by Shekhar Ghosh.(shekharghosh@fpj.co.in)