CORNERVIEW

Our new thought leadership initiative, a weekly newsletter every Monday which will analyse the effects of COVID-19 from all across the world and present inferences with global economic perspectives. You never know, you could even sniff out a few business opportunities. In times of crisis, every bit helps.

This ongoing pandemic global crisis and the battle against COVID-19 is unlike any war ever witnessed in the modern history. In a war, while lives are lost, economy thrives. Manufacturing activity goes up, service industry sizzles, ports, transport, infrastructure, even agriculture thrives during a war. This COVID-19 battle however, has turned the world turtle. Instead of young soldiers, the older gents are dying. The entire population is in a lockdown, and almost all economic activity has ground to a halt.

A recent projection by the Economist Intelligence Unit (EIU) claims India’s GDP growth rate will go down from 6% to 2.1% during fiscal year 2020-21. China’s from 5.9% to 1% while most of the western G20 economies have been projected to grow negatively, with Germany’s GDP predicted to decelerate at (-) 6.8% while US at (-) 2.8%.

While the jury is still out on the exact growth rate, India tops the chart compared to many other economies – both developed and emerging – but that is little reason to cheer. The fact remains that the Indian government’s fiscal relief during this crisis to the economically weaker sections of the society notwithstanding, it will take quite a long while for the national economy to splutter back into shape.

Agriculture:

The irony is palpable. The International Grains Council (IGC) has forecast record world grains production in the 2020/21 season while warning projections were tentative until the progress and duration of the coronavirus pandemic became clearer.

At the same time, the Food and Agriculture Organization of the United Nations (FAO) has warned of a food crisis looming large as coronavirus forces farms to stay idle and countries hoard supplies. “We risk a looming food crisis unless measures are taken fast to protect the most vulnerable, keep global food supply chains alive and mitigate the pandemic’s impacts across the food system,” said FAO in a recent post on its website.

IGC in its first full assessment of the 2020/21 season, has projected world grains production would rise to a record 2.22 billion tonnes, up 2% from the prior season. It however, warned that transport restrictions related to the pandemic could hamper the distribution of farm supplies such as seeds and fertilisers and disrupt spring fieldwork.

In India the rabi season harvest is in full swing, and despite the government’s attempts, farmers are still wary during the COVID-19 crisis. Many states are supposed to start their procurement process last week. Uttar Pradesh, Madhya Pradesh, Gujarat and Rajasthan are starting wheat procurement from April 2 as the crop has matured in these states. Punjab and Haryana will begin purchase of the grains from April 15 and 20, respectively.

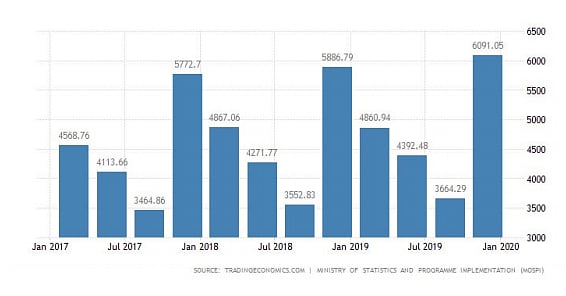

India GDP From Agriculture:

On any regular day, 5-6 million vehicles ply on Indian roads. After the lockdown announcement, only 1.5-2 million vehicles may have found a way to return to their owners. The rest may have been parked anywhere while the drivers have fled home. The absence of drivers is a key reason for the transport operators to believe that lifting of restrictions may not make any instant difference. Indeed, logistics industry will take a long time to recover. Goods at Indian ports are practically full to the brim with ships in the sea waiting to be docked and unloaded. Trucks and tankers, and more importantly, the drivers, are conspicuous by their absence.

Metals:

Research agency Fitch Solutions expects volatility to continue playing to the downside for metal prices in the coming weeks owing mainly to bearish investor sentiment on the back of the widespread Covid-19 pandemic.

The pandemic scare has adversely the global steel industry, including India’s. Steel mills, in all regions, are shutting plants or cutting production – either voluntarily or forced by national governments. Steel manufacturers are closing their facilities and workers are being sent home. American steel mills are requesting to be included in a list of “essential industries” in order to prevent mandatory stoppages. Steel production is being curtailed in Europe. Long queues of trucks are, reportedly, waiting to enter certain countries. Several producers across Asia are restricting their steel manufacturing amid weakening demand.

Tata Steel is closing down its downstream standalone units in Maharashtra and Uttar Pradesh in line with guidance from respective states. The main sites at Jamshedpur, Kaliganagar and Angul, however, are operational, as they are process plants and hence have permission from local authorities. ArcelorMittal Nippon Steel (AM/NS) India ‘s main plant at Hazira with a downstream facility in Pune is also planning a partial shutdown. Jindal Steel & Power’s production is likely to be impacted adversely. One of the main issues that has cropped up from the lockdown is that 80-85 per cent of trucks are not moving which is impacting dispatches.

However, while output reduces in most countries, production is rebounding in China. Moreover, Chinese traders are seeking export opportunities to offload excess stocks. Oversupply remains a feature of the Asian market, despite less severe effects from COVID-19 being witnessed, when compared with those in western nations.

Demand for copper and aluminum from Chinese downstream sectors is recovering as the lockdown eases, but the pace is slow. construction of new aluminum capacity has slowed as companies try to avoid more losses. Battery metals market sentiment remains gloomy due to the virus spread outside China and slow recovery in demand from downstream sectors. Lithium and cobalt demand is lackluster and a recovery is still some time away.

Gold:

Gold sped past $1,650 an ounce barrier last week, after the US Federal Reserve’s massive emergency economic injection to counter the market volatility, global closures and supply chain disruptions brought on by the COVID-19 pandemic. Concerns of a supply crunch is also aiding gold keep above $1,600-$1650 an ounce. In India, it touched Rs.41,000 per 10 grams. But of course there are no buyers of gold in India at present.

Three of the world’s largest gold refineries in Switzerland were closed in the wake of COVID-19. Together these refineries process roughly 30 to 40 per cent (1,500 tonnes) of all gold annually. To add, the Rand refinery in South Africa also announced it would shut down its smelter and significantly scale back operations in compliance with the nationwide lockdown. Annually the South African Rand refinery produces 250 -280 tonnes of refined gold.

Energy:

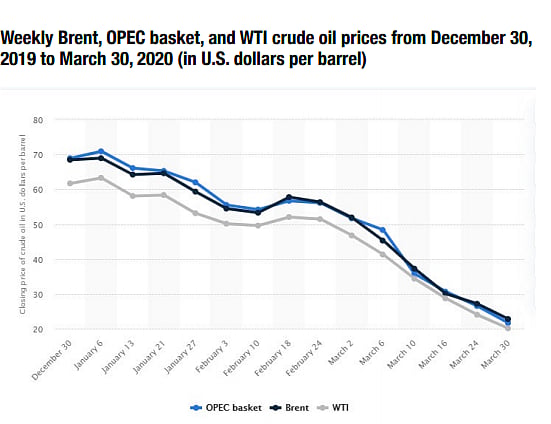

Oil & gas is perhaps the only sector that has been constantly hurtling downwards ever since Russia refused to cut production limits as per OPEC mandates. The crude oil war between Saudi Arabia and Russia, combined with slump in demand due to COVID-19 has seen oil prices fall to $20 a barrel and few are predicting it going down to even $10 a barrel. In India, the parliament passed an excise of Rs 18 per litre for petrol and Rs 12 per litre for diesel. Once demand starts picking up – when it does – India is likely to nullify the effect of falling global crude prices with increase in excise duties.

Storage capacity for crude in most countries is depleting fast. And this perhaps may be the trigger to end oil price war as crude prices record largest fall in the last quarter (Q4) of the previous fiscal (2019-20). Indeed, the storage facilities in most countries are about to reach their full capacity. Hopefully this will end the bloodbath in the global crude oil market.

The good news is that production in all walks of society in China is springing back to life, buying time for the world economy to avert a crisis. Chinese President Xi Jinping was in an inspection tour in eastern China’s Zhejiang Province on the resumption of work and production. It highlights the importance of economic and ecological development as the country has generally contained the coronavirus outbreak within its territory.

Reason to cheer?

China now seems to be leading the world in stepping up production. It has rolled out supportive policies in fiscal, credit, employment and logistics for the SMEs. The Beijing government is harnessing synergies of its policies related to employment, industries, investment, consumption and regional development. Unlike its past record, China has shifted to a more nuanced, precise and targeted approach to bolster the economy.

Positive changes have emerged. The purchasing managers’ index (PMI) for China’s non-manufacturing sector came in at 52.3 in March, up from 29.6 in February, the National Bureau of Statistics said on Tuesday. The restart of the “World’s Factory” will not only help China put its economic and social development back on track, but also relieve pressure on the world economy and safeguard the common interests of the global community.

The question still remains though, "Are we clutching at straws." May be next week will have a clearer picture.

Please note: The article has been contributed by Shekhar Ghosh.