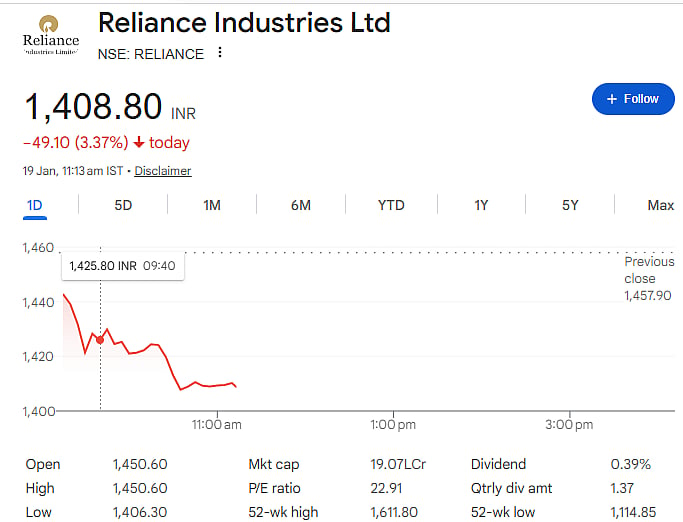

Mumbai: Shares of Reliance Industries, India’s most valuable company, fell sharply on Monday after the company announced its December quarter (Q3 FY26) results. The stock dropped as much as 3.37 percent to an intraday low of Rs 1,406 on the NSE. This marked its biggest single-day fall since January 2025. By mid-morning, the stock was still down over 3 percent, underperforming the broader market.

Profit growth remains muted

Reliance reported a marginal 0.57 percent year-on-year rise in consolidated net profit to Rs 18,645 crore in Q3 FY26, compared with Rs 18,540 crore a year ago. The limited growth in profit disappointed investors, especially given the company’s size and expectations of stronger earnings momentum.

Revenue rises but margins shrink

Revenue from operations increased 10.5 percent to Rs 2,69,496 crore during the October–December quarter, up from Rs 2,43,865 crore in the same period last year. However, operating profit (EBITDA) grew at a slower pace of 5 percent to Rs 46,018 crore. As a result, operating margins declined by 90 basis points to 17.08 percent, indicating higher costs and pressure on profitability.

.jfif)

Retail business shows slower growth

Reliance Retail reported subdued performance during the quarter. Its net profit rose just 2.7 percent to Rs 3,551 crore, while revenue increased 9.2 percent to Rs 86,951 crore. EBITDA grew only 1.3 percent to Rs 6,915 crore, and margins slipped by 60 basis points to 8 percent. During the quarter, the retail arm added 431 new stores, taking the total store count to nearly 20,000.

Jio remains a bright spot

Reliance Jio Platforms delivered a strong performance. Net profit rose 11.2 percent to Rs 7,629 crore, while EBITDA jumped 16.4 percent to Rs 19,303 crore. EBITDA margins improved significantly to 51.8 percent. Jio’s average revenue per user (ARPU) also improved to Rs 213.7 per month, reflecting better customer spending.

Chairman Mukesh Ambani said the company delivered steady performance across businesses and highlighted Jio’s growing digital reach. However, market reaction showed investor concerns around margin pressure and slower profit growth.

Disclaimer: This article is for informational purposes only and is based on publicly available data. It does not constitute investment advice. Readers should consult financial advisors before making investment decisions.