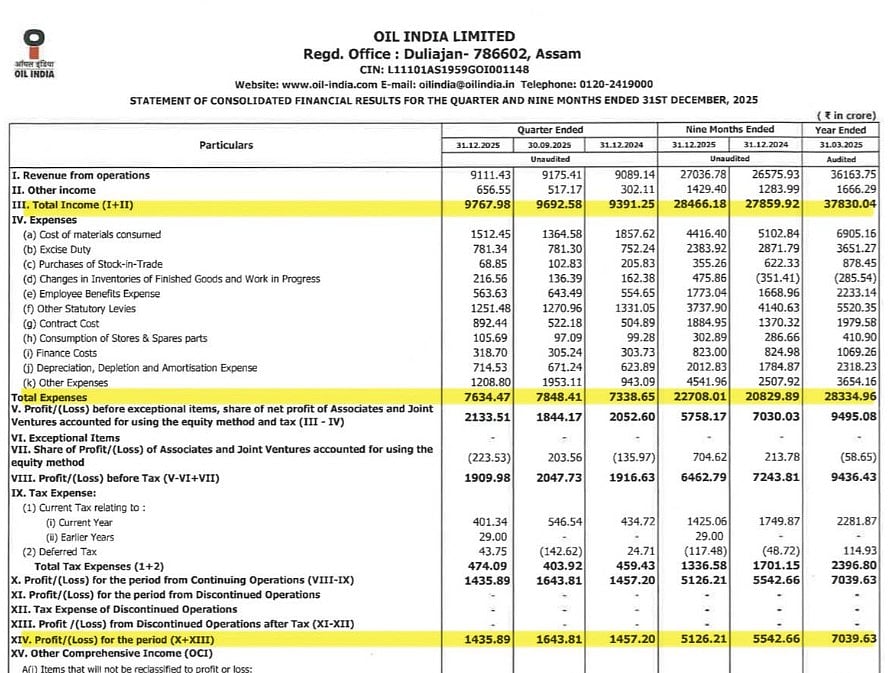

Mumbai: Oil India’s Q3 FY26 revenue from operations stood at Rupees 4,916.10 crore, down from Rupees 5,456.72 crore in Q2 and Rupees 5,239.66 crore in Q3 FY25. Net profit saw a steep decline to Rupees 808.31 crore from Rupees 1,044.02 crore in Q2 and Rupees 1,221.80 crore a year ago. The YoY performance was impacted by reduced statutory levies and a drop in other income. Sequential softening in profit was also visible in earnings per share, which dropped to Rupees 4.97 from Rupees 6.42 in Q2.

Press Release |

Sequential growth moderates amid higher expenses, tax adjustments

Quarter-on-quarter, total income declined by 13.1 percent to Rupees 5,462.80 crore, while expenses moderated by 9.1 percent to Rupees 4,515.08 crore. Contract costs surged to Rupees 892.44 crore, and depreciation rose to Rupees 640.85 crore. Finance costs remained steady at Rupees 266.51 crore. Exceptional items were nil, but the quarter included a deferred tax charge of Rupees 19.62 crore. Margins came under pressure due to higher operating costs and subdued realizations from crude and gas segments.

One-time gains boost comprehensive income, dividend declared

The strong swing in total comprehensive income, from a loss of Rupees 1,586.47 crore to a gain of Rupees 1,898.59 crore, was primarily due to mark-to-market gains on equity investments ( Rupees 1,214.22 crore) and actuarial gains. The Board declared a second interim dividend of Rupees 7 per share, with a record date of February 18, 2026. Combined with the first interim dividend of Rupees 3.50, total payout so far stands at Rupees 10.50 per share for FY26.

Nine-month performance remains weak amid declining top-line

For the nine months ended December 2025, Oil India’s standalone revenue from operations stood at Rupees 15,385.27 crore, down 7.3 percent from Rupees 16,598.28 crore a year earlier. Net profit dropped 41.1 percent YoY to Rupees 2,665.81 crore. EPS for the 9M period was Rupees 16.39. The company’s cumulative performance reflects pressures on realization and upstream margins despite cost control efforts and divestment of non-performing overseas assets.

Disclaimer: This report is based on publicly disclosed financial results by Oil India. It is for informational purposes only and does not constitute investment advice or a recommendation to buy or sell.