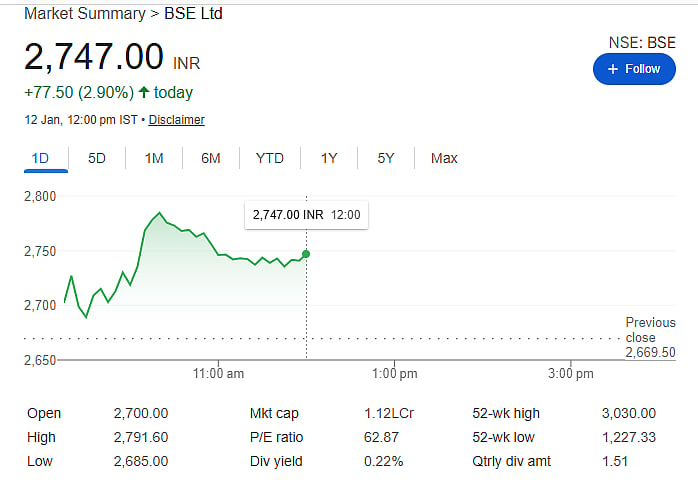

Mumbai: Shares of BSE Ltd rose sharply on Monday, January 12, gaining over 4.5 percent in morning trade. The stock touched a high of Rs 2,791.60 on the NSE as investors reacted positively to fresh news around the long-awaited IPO of the National Stock Exchange (NSE).

The rally came as market participants closely tracked updates from the market regulator on NSE’s listing plans.

SEBI Signals Progress on NSE IPO

According to recent media reports, SEBI Chairman Tuhin Kanta Pandey said that the regulator is at an advanced stage of issuing a No Objection Certificate (NOC) for NSE’s IPO. He added that the approval may come within this month.

His comments were made during an event in Chennai and have raised hopes that NSE’s IPO process may finally move forward after years of delay.

NSE Ready for Listing, Says Management

NSE Managing Director and CEO Ashishkumar Chauhan has earlier said that the exchange is fully prepared for listing once regulatory approvals are received. He pointed out that NSE already has a wide public shareholder base of about 1.72 lakh shareholders and does not have any promoter stake.

This structure, according to him, makes NSE institutionally ready for listing once SEBI gives the green signal.

Other Capital Market Stocks Show Mixed Trend

While BSE shares were trading strongly, other capital market-related stocks showed mixed movement. Shares of Central Depository Services (India) Ltd (CDSL) were slightly higher, trading around 0.7 percent up.

On the other hand, National Securities Depository Ltd (NSDL) shares were down by about 1 percent. Computer Age Management Services (CAMS) also slipped, falling nearly 1.5 percent during the session.

NSE Reports Lower Q2 Profit Due to One-Time Provision

In its Q2 FY26 results, NSE reported a 33 percent year-on-year fall in consolidated profit after tax at Rs 2,098 crore. The drop was mainly due to a one-time provision of Rs 1,297 crore related to settlement applications filed with SEBI.

Excluding this provision, NSE said its adjusted profit stood at Rs 3,396 crore, showing steady underlying performance. The exchange added that the final outcome of the settlement process is still uncertain.

Disclaimer: This article is for informational purposes only and should not be considered investment advice. Stock market investments are subject to market risks. Please consult a qualified financial advisor before making any investment decisions.