Mumbai: Shares of NCC fell nearly 10 percent on February 19, touching a fresh 52-week low after the company and its subsidiary were barred from bidding for National Highways Authority of India (NHAI) projects for two years.

The stock dropped around 9.85 percent on the NSE to about Rs 135 per share after the announcement. Investors reacted strongly to the news, leading to heavy selling pressure.

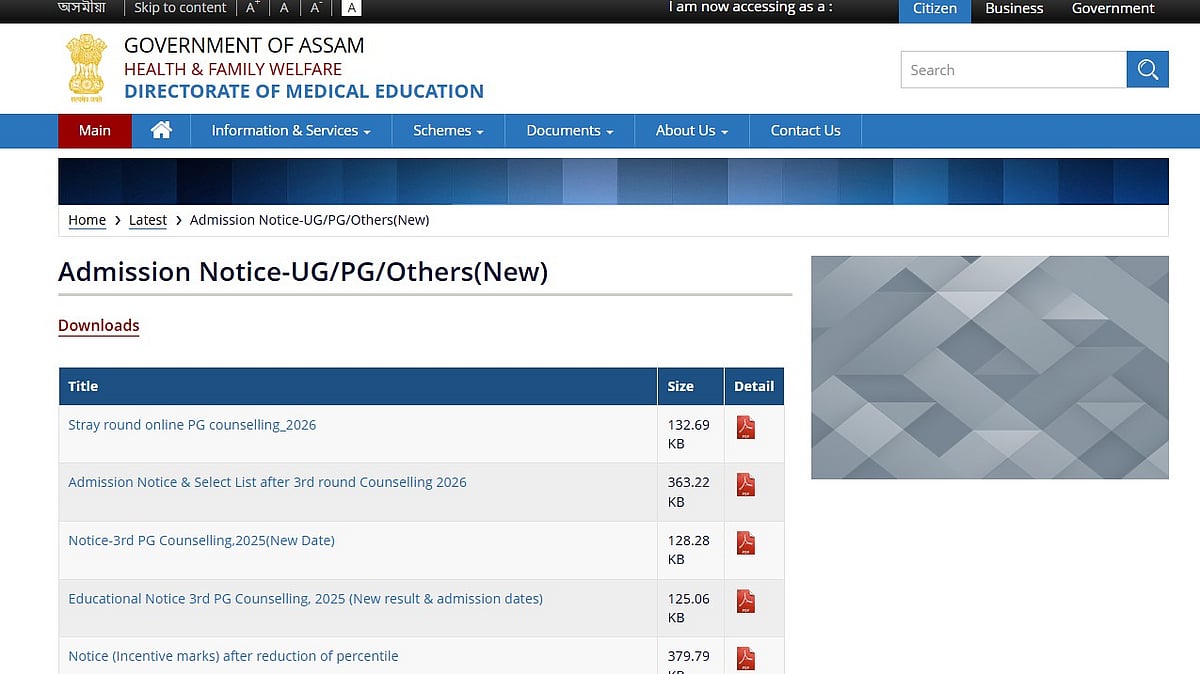

What Is the NHAI Order?

In an exchange filing, NCC said that its step-down subsidiary, OB Infrastructure Limited (OBIL), along with NCC, received a two-year debarment order from NHAI. The ban is effective from February 17, 2026.

Under this order, both companies cannot participate in any NHAI tender or bid. This includes roles such as contractor, EPC contractor, O&M contractor, or consortium member.

The issue is related to a highway project in Uttar Pradesh that was executed by OBIL under a 2006 BOT (Annuity) concession agreement.

Company’s Stand and Legal Dispute

OBIL said that project delays were mainly due to NHAI not handing over land on time and other contractual problems. The company had started arbitration proceedings and received a favourable award in November 2024.

However, NHAI challenged the arbitration award in the Delhi High Court. Other disputes linked to the same project are still under arbitration.

OBIL also stated that the debarment order was issued while arbitration is ongoing and after the concession period ended. The company said it was not given a proper opportunity to present its case. NCC has confirmed that it will challenge the order legally.

Business Impact and Financial Position

NCC clarified that the ban will not affect its ongoing projects or existing orders. However, the company said the impact on future tenders cannot be estimated at this stage.

As of December 2025, NCC’s total order book stood at Rs 79,571 crore. Transportation projects made up about 22 percent of this. The order book grew 38 percent year-on-year in Q3 FY26.

However, standalone revenue fell 14 percent to Rs 4,082 crore. Profit after tax rose 2 percent to Rs 82 crore. EBITDA was Rs 328 crore, and net debt stood at Rs 2,830 crore.

Stock Trend and Market View

The stock had already fallen around 34 percent between November and January. Over a longer period, it has corrected nearly 62 percent.

Analysts say a short-term bounce is possible, but the overall trend remains weak. Experts suggest caution before taking fresh positions.

Disclaimer: This article is for informational purposes only and does not constitute investment advice. Investors should consult financial advisors before making decisions. Stock market investments are subject to risks and market volatility.