New Delhi: Under the new Income Tax Bill 2025, taxpayers will now be able to claim a TDS refund even if they file their return after the due date. This is a major relief for many who miss the deadline but are eligible for refunds.

The new provision removes Clause 263(1)(ix), which earlier stopped late filers from getting their TDS refund. This change will apply from April 1, 2026, after the bill becomes law.

Full Tax Deduction on Pension and Gratuity

The bill also gives big tax relief to the family members of deceased employees. It allows for 100% tax deduction on:

- Commuted pension (lump-sum pension amount)

- Gratuity received after the employee’s death

This benefit is mentioned under Clause 93 of the bill and will apply to pensions received from certain funds listed in Schedule VII.

Changes in House Property Tax Rules

As per the Select Committee’s suggestions, new rules for house property income have been added:

- Standard 30 percent deduction will now be calculated after deducting municipal taxes from the annual value of the property.

- For pre-construction home loan interest, if the house is self-occupied, the deduction can be claimed in five installments after getting possession.

- The same rule will also apply to let-out properties.

No TCS on Foreign Education Loans

One more relief in the bill is that money sent abroad under the Liberalised Remittance Scheme (LRS) for education through loans will not attract TCS (Tax Collected at Source).

This is a major relief for students studying overseas.

New Tax Powers for Officers Remain

The bill keeps most of the powers given to tax officers in the earlier version. Tax officials can still:

- Break open locks of doors, safes, cupboards, or boxes during raids

- Access computer systems or codes if needed for investigations

This means digital and physical searches will continue with strong authority.

What Happens Next?

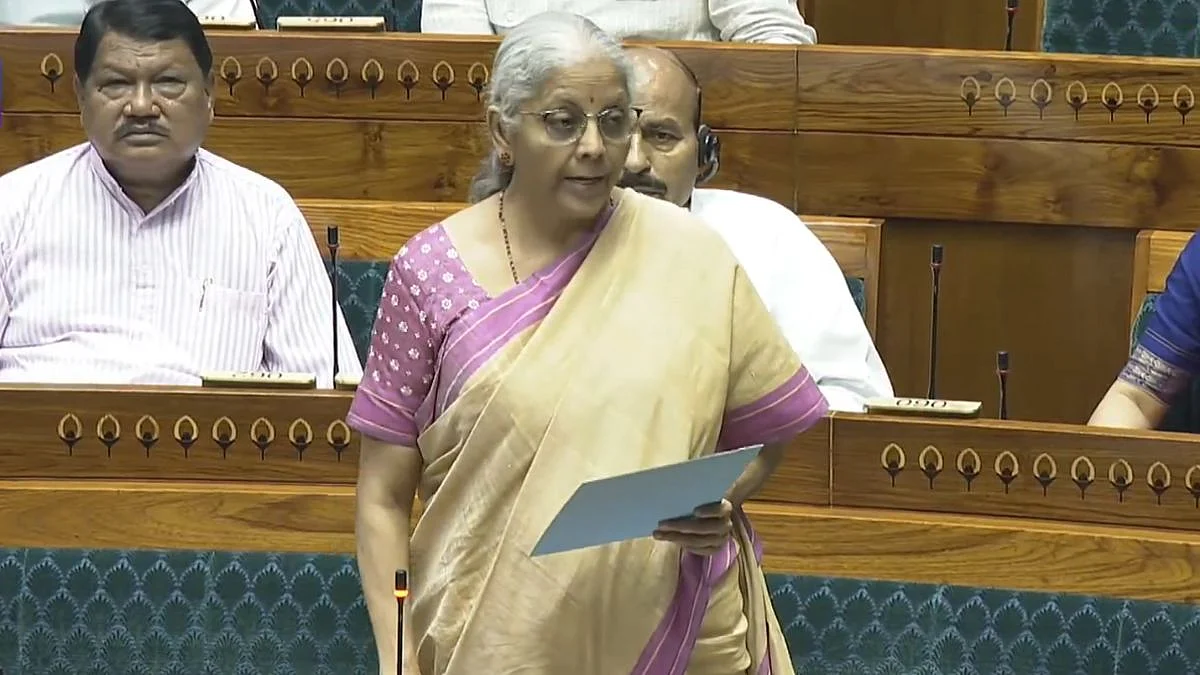

The bill, which was passed by Lok Sabha on Monday, will now go to Rajya Sabha. Once passed and signed into law, it will replace the Income Tax Act, 1961 from April 1, 2026.

The bill is based on the recommendations of the Select Committee headed by MP Baijayant Panda, and most of the suggestions have been accepted by the government.