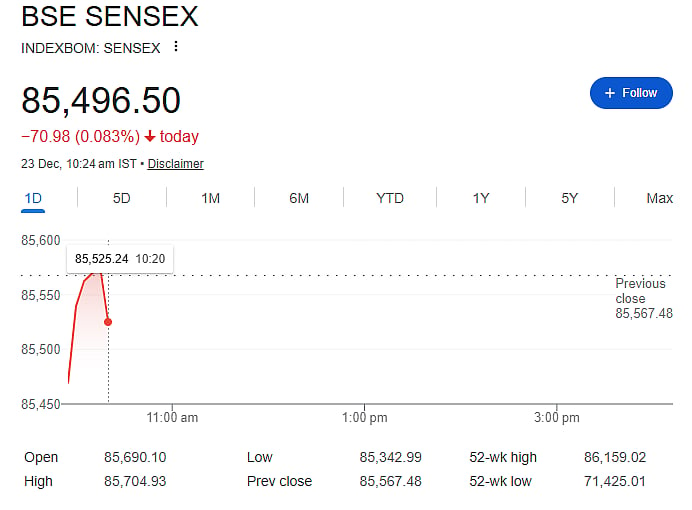

Mumbai: Indian benchmark indices opened lower on Tuesday morning, reflecting cautious investor mood. At around 9:30 am, the Sensex was down by 159 points at 85,407, while the Nifty slipped 32 points to trade near 26,139. Weakness in IT stocks played a major role in pulling the market down.

IT Stocks Lead the Decline

The IT sector was the biggest loser in early trade, falling over 1 per cent. Stocks such as TCS and Tech Mahindra were among the top drags. Analysts said this weakness came after renewed excitement around artificial intelligence (AI) stocks in the US, which shifted investor focus away from Indian IT shares.

Mixed Trend Across Broader Markets

The broader market showed mixed movement. The Nifty Midcap 100 index declined slightly, while the Nifty Smallcap 100 managed small gains. This suggests that while large stocks faced pressure, some buying interest remained in select smaller companies.

Sectoral and Stock Action

Oil and gas and metal stocks performed well, supported by firm crude oil prices and global demand cues. ONGC, Tata Steel and NTPC were among the top gainers on the Nifty. On the other hand, stocks like Max Healthcare, Asian Paints and ICICI Bank traded lower.

Key Levels and Market View

Experts said the Nifty faces resistance near the 26,300–26,350 range, while support is seen between 26,000 and 26,050. Positive economic data could help markets move higher, but strong global AI-related trades may slow foreign investor inflows.

Global and Institutional Cues

Asian markets traded higher, supported by gains in China, Japan and South Korea. US markets also ended mostly positive overnight. However, geopolitical tensions involving the US, Venezuela, and Russia-Ukraine talks kept investors cautious. On Monday, FIIs sold shares worth Rs 516 crore, while DIIs bought shares worth Rs 3,898 crore.