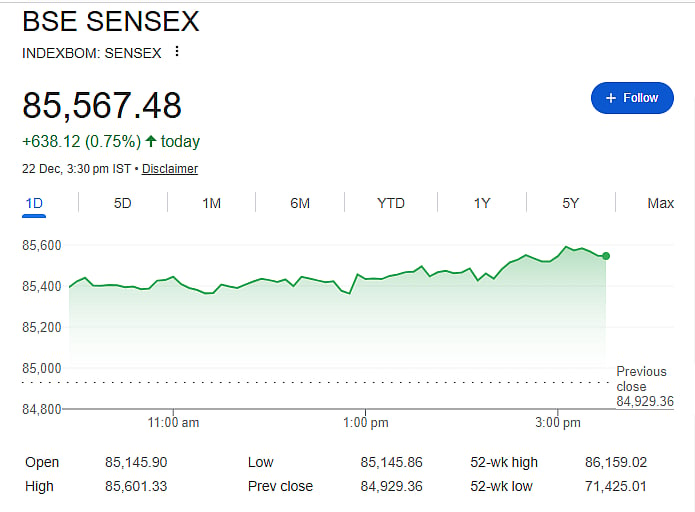

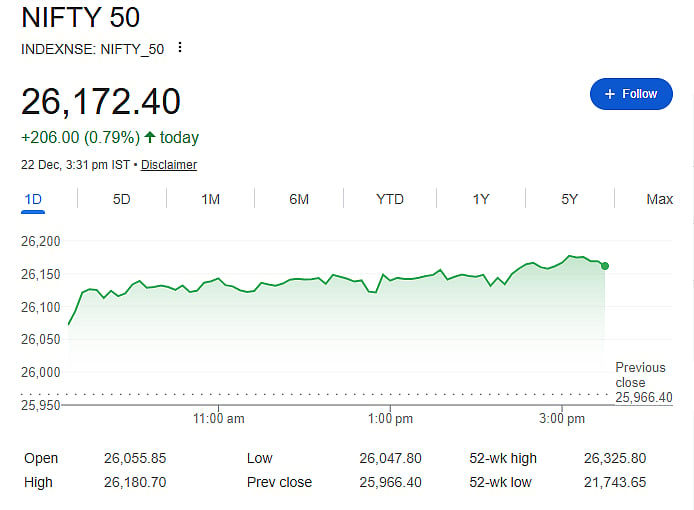

Mumbai: Indian stock markets witnessed a sharp rally, creating wealth of nearly Rs 3.5 lakh crore in a single session. The Sensex jumped 638 points to close at 85,567, while the Nifty rose 206 points to end at 26,172. The Nifty stayed above the 26,150 level throughout the day, showing strong buying support.

Broad-Based Buying Lifts All Sectors

Almost all major sectoral indices traded in the green. Banking stocks remained firm, with the Nifty Bank rising 235 points to 59,304. Midcap stocks supported the rally as well, with the Midcap index gaining 505 points. Defence stocks stood out, rising over 3 per cent, led by sharp gains in ideaForge and DCX Systems.

IT and Commodity Stocks Shine

The IT sector rallied for the fourth straight session. Stocks like Infosys, Wipro and Persistent Systems climbed more than 3 per cent each. Positive quarterly results from global IT major Accenture boosted confidence in the sector. Commodity-linked stocks were also active, with Hindustan Zinc rising 3 per cent as silver prices touched record highs. MCX shares jumped 5 per cent to an all-time high.

Stock-Specific Action Adds Strength

Several stocks moved sharply on company-specific news. GE Vernova T&D India rose 6 per cent after winning a major HVDC project. Shriram Finance gained nearly 4 per cent following a positive brokerage report, while Jupiter Wagons jumped about 5 per cent after news of increased promoter stake.

FII and DII Buying Drives Momentum

The biggest support came from strong buying by both foreign and domestic investors. Foreign Institutional Investors bought shares worth Rs 1,831 crore, while Domestic Institutional Investors purchased stocks worth Rs 5,723 crore. When both groups buy together, markets usually gain strength.

Strong Rupee and Global Support

The rupee strengthened by about 22 paise to 89.45 per dollar, helped by RBI intervention. A stronger rupee boosts foreign investor confidence. Globally, softer US inflation data raised hopes of more US Federal Reserve rate cuts in 2026, lifting global and Indian markets.

Rate Cut Hopes Support Sentiment

RBI policy meeting minutes hinted at possible future rate cuts. Lower interest rates support growth and corporate earnings, which is positive for equities. Technically, markets formed a strong bullish pattern, indicating a positive short-term trend, though experts advise buying on dips.