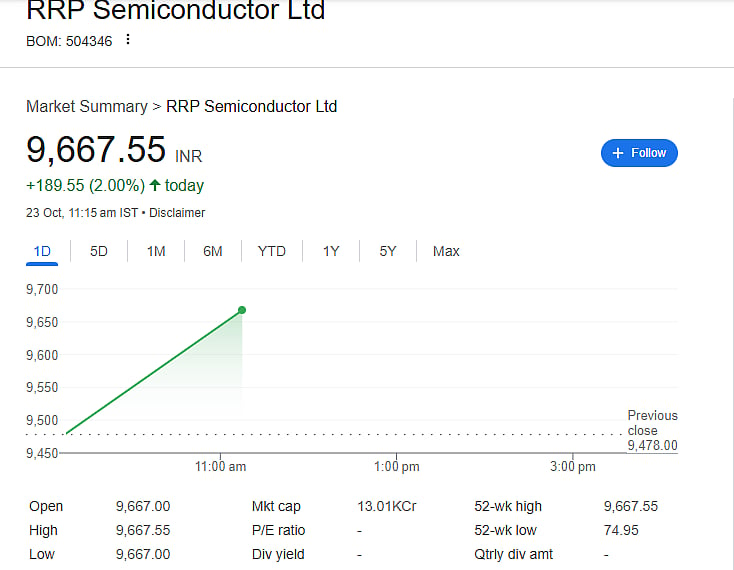

Mumbai: The Indian stock market has seen an unbelievable story. A little-known company, RRP Semiconductor, has given investors an incredible 63,000 percent return in just 18 months. Its stock price, which was around Rs 15 in early 2024, shot up to Rs 9,667 by October 2025. On Monday, it closed at Rs 9,478, and by Tuesday, it touched its 52-week high of Rs 9,667.55.

If an investor had put just Rs 10,000 in this stock 18 months ago, that investment would now be worth about Rs 36 lakh. The company’s market capitalization currently stands at Rs 12,913 crore, with a Return on Equity (ROE) of 50 percent.

Why Did the Stock Rise So Fast?

The stunning rally in RRP Semiconductor’s shares caught everyone’s attention. Social media buzzed with discussions, and small investors began calling it the 'Indian NVIDIA.' Many rushed to buy the stock, hoping for big profits. However, the Bombay Stock Exchange (BSE) raised concerns, saying the rise was not justified by the company’s financial performance.

Stock Under Special Surveillance

The exchange placed the stock under special monitoring measures. Intraday trading was banned, 100 percent margin was made mandatory, and the daily price movement limit was reduced to 2 percent. In simple terms, the stock has been “locked” to control extreme speculation.

Rumours and Clarifications

As RRP’s price kept climbing, rumors spread quickly — from government land grants to celebrity endorsements. One false claim even suggested Sachin Tendulkar had invested in the company. RRP Semiconductor later issued an official statement denying all such claims, clarifying that Tendulkar had no connection and the company had not received any government land.

What Do the Financials Say?

Behind the hype, the company’s actual numbers tell a different story. Its sales rose from Rs 0.38 crore to Rs 31.5 crore in a year, and it made a profit of Rs 6 crore. While impressive for a small firm, these figures don’t justify its massive Rs 12,000+ crore valuation. The promoters hold only 1.27 percent stake, and the stock trades at over 700 times its book value — even higher than global chip giants.

What Does the Company Actually Do?

Based in Maharashtra, RRP Semiconductor works in OSAT (Outsourced Semiconductor Assembly and Testing), providing advanced chip packaging services. It claims to be the first company in the state to export packaged semiconductors, recently shipping Rs 6.51 crore worth of chips to Europe under the India Semiconductor Mission.

Investors Should Stay Alert

According to BSE, RRP Semiconductor is a perfect example of why investors must be careful. Despite strict trading limits, the stock continues to hit upper circuits, showing how market excitement can easily overpower business fundamentals.

Semiconductors may indeed power India’s industrial future, but RRP’s story is a reminder: not every shining stock is gold. When a Rs 15 stock jumps to Rs 9,000 without strong business growth, it’s time to pause, analyse, and think twice before investing.

Disclaimer: This article is for informational purposes only and not investment advice. Stock prices are volatile; investors should research carefully and consult certified financial experts before making investment decisions.