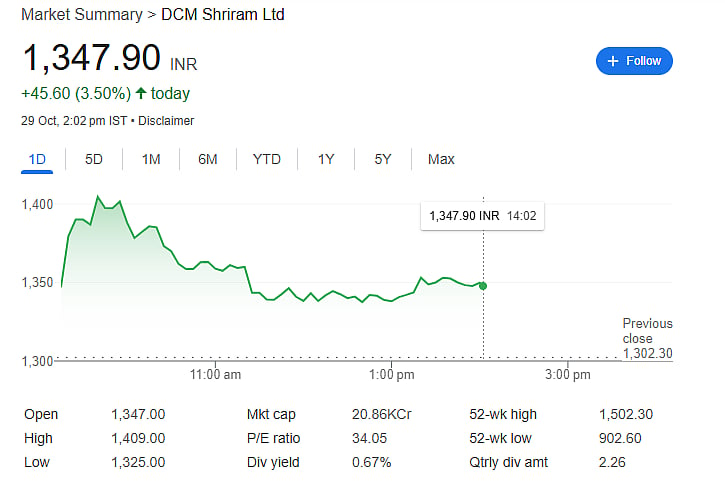

Mumbai: Shares of DCM Shriram Ltd. rallied nearly 6 percent on Wednesday, following the company’s impressive second-quarter (Q2 FY26) earnings announcement. The diversified agri, chemicals, and industrial products conglomerate reported a sharp 151 percent year-on-year (YoY) increase in consolidated net profit to Rs 158 crore, compared to Rs 63 crore in the same period last year.

In afternoon trade, the stock was up 3.50 percent, quoting at Rs 1,347.90 per share on the National Stock Exchange (NSE), reflecting investor optimism about the company’s improved profitability and operational efficiency.

Revenue and Margins Show Robust Growth

DCM Shriram’s revenue from operations climbed 10.6 percent YoY to Rs 3,271 crore, against Rs 2,957 crore in Q2 FY25, driven by healthy performance across its key business segments, particularly in chemicals, fertilizers, and sugar.

The company’s EBITDA (earnings before interest, tax, depreciation, and amortization) rose sharply by 70.8 percent to Rs 308 crore, compared to Rs 180.7 crore in the previous year. Correspondingly, operating margins expanded to 9.4 percent from 6.1 percent, indicating improved cost controls and stronger price realizations across business divisions.

Operational Efficiency and Segmental Gains

The robust earnings performance was underpinned by better realizations in the chlor-alkali and fertiliser segments, alongside operational efficiencies achieved through energy cost savings and capacity utilisation improvements. The sugar business also benefited from favorable pricing trends and enhanced ethanol blending volumes, contributing to margin expansion.

Interim Dividend Declared

In line with its strong quarterly performance, the Board of Directors declared an interim dividend of 180 percent, translating to Rs 3.60 per equity share of face value Rs 2 each for FY2025–26. The record date for determining eligible shareholders has been set as November 3, 2025, and the company confirmed that the dividend will be paid or dispatched within 30 days of the declaration.

Outlook and Investor Sentiment

With consistent performance across its diversified portfolio, DCM Shriram remains well-positioned to benefit from strong agri demand, rising industrial consumption, and supportive policy initiatives. Analysts expect continued earnings momentum in the coming quarters if pricing stability and input cost moderation sustain.

Disclaimer: This article is for informational purposes only and not investment advice. Market conditions and government decisions may change; readers should verify details before making financial or investment choices.