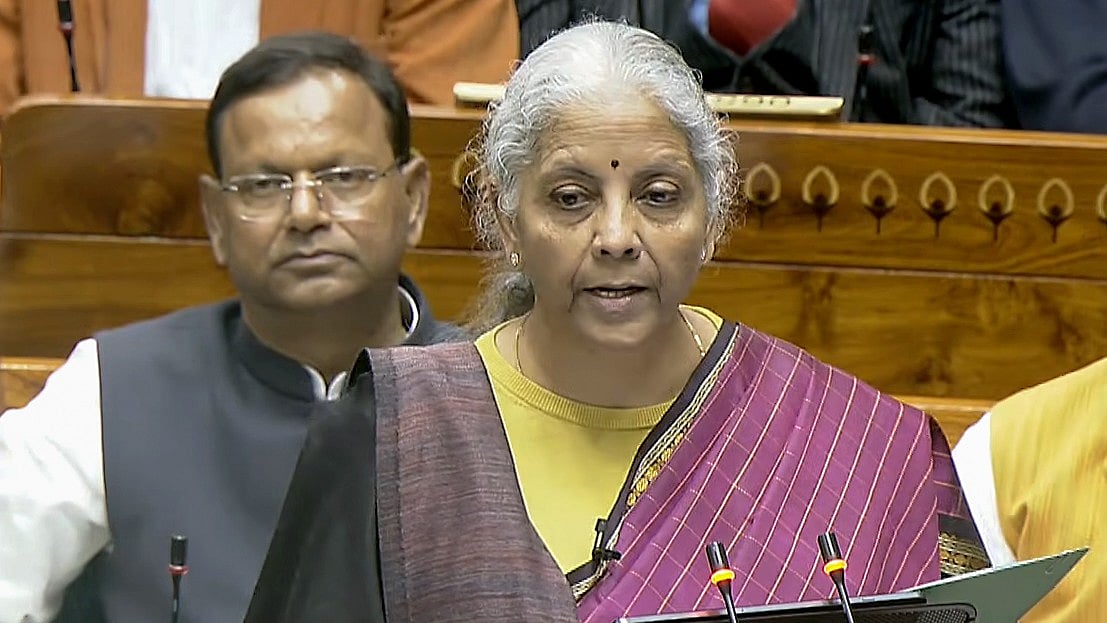

In a major move to reduce "tax terrorism" and boost the ease of doing business, Union Finance Minister Nirmala Sitharaman on Sunday presented the Union Budget 2026-27, proposing a significant shift toward a "trust-based" tax administration.

A central feature of the reforms is the extension of the immunity framework from prosecution and penalty to cases of "misreporting" of income—a benefit previously reserved only for "underreporting"—provided the taxpayer pays 100% of the tax amount as an additional levy.

Presenting the Union Budget 2026-27, the minister signalled a shift toward a "trust-based" tax administration by integrating assessment and penalty processes and offering new lifelines for small taxpayers with overseas assets.

Unified Assessment and Interest Relief

To eliminate the "multiplicity of proceedings" that often plagues taxpayers, the Budget proposes integrating assessment and penalty proceedings into a single, common order.

In a major win for litigants, the minister announced that taxpayers will no longer face interest liability on penalty amounts during the appeal period before the first appellate authority.

Furthermore, the mandatory pre-payment required to file an appeal has been halved from 20% to 10%, and will now be strictly calculated on the "core tax demand," excluding interest and penalties.

Updating Returns After Reassessment

In a first-of-its-kind move to reduce friction, the government will now allow taxpayers to file updated returns even after reassessment proceedings have been initiated. This window comes with a 10% additional tax premium, but it ensures that the assessing officer will proceed solely on the basis of the updated return, effectively neutralizing potential disputes before they escalate.

Decriminalisation and the "Fee" Model

The budget marks a significant shift away from criminal prosecution for technical lapses.

Several defaults—including failure to get accounts audited or non-furnishing of transfer pricing reports—are being converted from "penalties" into simple "fees."

More importantly, the minister announced the decriminalisation of:

Non-production of books of account and documents.

TDS defaults in cases where payments are made in kind.

“Minor offences will now attract fines only,” Sitharaman said, adding that remaining prosecutions will be graded by the gravity of the offence, with maximum imprisonment slashed to two years.

Courts have also been empowered to convert even these jail terms into fines.

Relief for Small Overseas Asset Holders

Addressing a long-standing grievance of the middle class and students, the minister proposed retrospective immunity (effective October 1, 2024) for the non-disclosure of non-immovable foreign assets valued at less than Rs20 lakh.

This move protects small taxpayers from the harsh prosecution provisions of the Black Money Act for minor, often inadvertent, omissions in their tax filings.

The minister also extended the framework for immunity from prosecution, currently available for "underreporting," to cases of "misreporting," provided the taxpayer pays 100% of the tax amount as an additional levy.