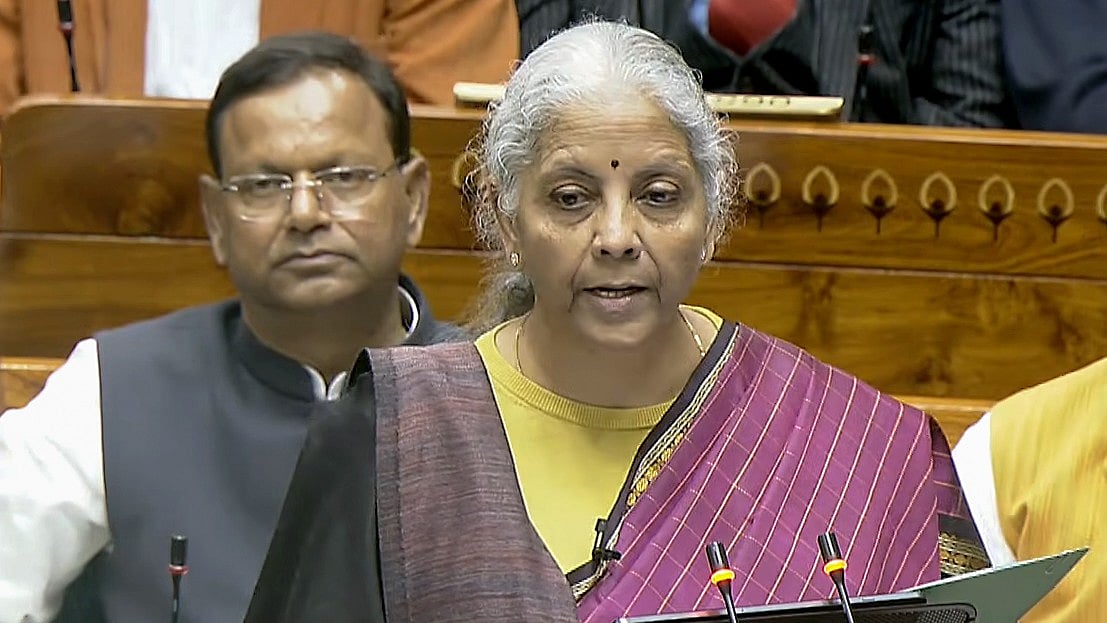

New Delhi: Union Finance Minister Nirmala Sitharaman on Sunday (February 1) presented the Union Budget 2026. Sitharaman unveiled a set of customs duty measures in the Union Budget 2026. Thje Finance Minister delivered a 1 hour and 25 minute-long (85 minutes) Union Budget 2026–27 speech.

Sitharaman announced a series of basic customs duty (BCD) exemptions, reducing the cost of several defence equipment, healthcare products, including medicines, and electronic items.

Sitharaman also announced that the current duty-free import facility for specified inputs—now available for leather and synthetic footwear exports—will be extended to include exports of shoe uppers as well.

Here is the list of items that became cheaper:

- Electronic products, including Microwave oven

- 17 drugs used in life-threatening diseases, including cancer

- Leather products

- Sports equipment

- Foreign education

- Mobile phones

- EV batteries

- Foreign Travel Becomes Cheaper.

- Big relief for travellers as TCS on overseas tour packages is reduced from 5–20% to just 2% making international travel more affordable.

- Solar panels

- Video Games Manufacturing parts

- Airplane parts

- Tendu leaves

- Textile products

- Tax collection at source (TCS) on overseas spending reduced on the sale of overseas tour programme packages to 2 per cent.

List of things that became costlier:

- Alcohol

- Cigarettes

- Pan Masala

- Minerals

- futures & options (F&O) trading

- Watches

- Coal

- Scrap

- Income tax misreporting

- Non-disclosure of movable assets

Sitharaman projected a further reduction in the fiscal deficit to 4.3 per cent of GDP for 2026-27. Presenting the Budget 2026-27, she said that the government had fulfilled its commitment to reduce the fiscal deficit to 4.4 per cent in the Budget for 2025-26 and would now reduce it further to 4.3 per cent.

Finance Minister announced capital expenditure of Rs 12.2 lakh crore in the Budget for 2026-27, to boost big-ticket infrastructure projects for boosting growth and jobs in the economy.