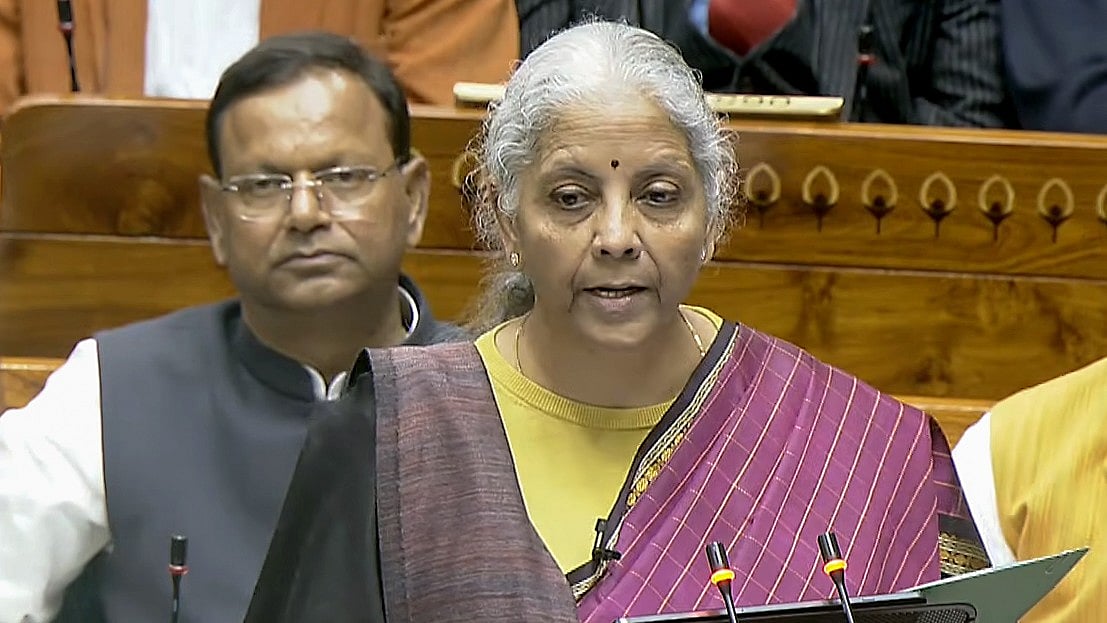

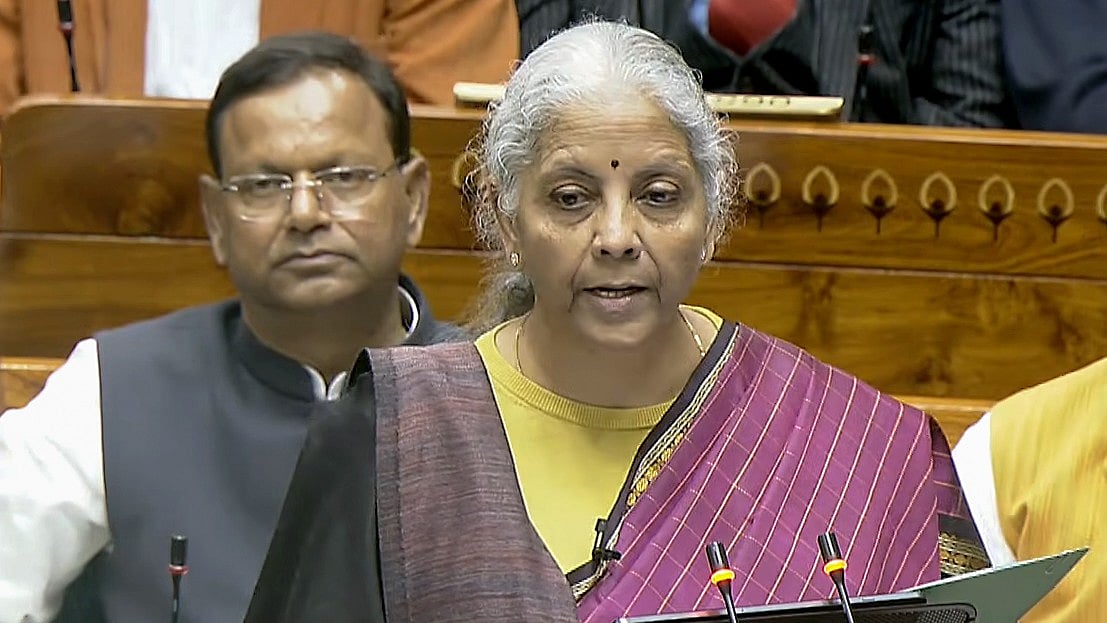

Finance Minister Nirmala Sitharaman on Sunday delivered a 1 hour and 25 minute-long (85 minutes) Union Budget 2026–27 speech, marking the first time the Budget was presented from Kartavya Bhavan.

Beginning at 11 am in Parliament, Sitharaman defined the government’s fiscal priorities, reform agenda and long-term growth strategy amid global economic uncertainty.

Take a look at the longest and the shortest budget speech delivered by Finance Minister's in Independent India

Longest Speech

The duration stands in contrast to her longest-ever Budget speech in 2020, which ran for 2 hours and 42 minutes, making it the longest Budget speech in India's parliamentary history. She paused mid-way due to fatigue but continued via submitted text. It surpassed her own 2019 speech (2 hours 17 minutes).

Shortest Speech

Hirubhai M. Patel's Interim Budget 1977-78 around 800 words. Delivered as an interim speech in the Morarji Desai government; remains the shortest ever.

Focus on Fiscal Discipline, Strategic Sectors

The 2026–27 budget presented by Nirmala Sitharaman despite being short speech, Sitharaman outlined a clear fiscal and reform roadmap, with an emphasis on fiscal consolidation, infrastructure-led growth, and strategic manufacturing.

She pegged the fiscal deficit at 4.3% of GDP for FY27, reaffirming the government’s commitment to debt consolidation, while projecting GDP growth of 6.8–7.2% amid global uncertainty.

Capex Push, Self-Reliance at the Core

The Budget continued the government’s strong infrastructure push, with capital expenditure raised to Rs 12.2 lakh crore, alongside new initiatives in high-speed rail corridors, inland waterways, and private infrastructure financing.

Key sectoral announcements included India Semiconductor Mission 2.0, Rs 10,000 crore Bio Pharma Shakti, MSME support funds and incentives for rare earths, container manufacturing and chemical parks reinforcing the Atmanirbhar Bharat agenda.

No Major Tax Reliefs, Focus on Stability

Sitharaman avoided major populist tax announcements, keeping income tax slabs unchanged, while announcing compliance simplification through the new Income Tax Act, 2025, set to take effect from April 2026.