Pimpri-Chinchwad: Most people open their first bank account at the age of 18, usually after receiving their PAN card. Over time, many stop using these accounts due to opening additional accounts, such as salary accounts required by employers or other personal banking needs. As a result, the original account often remains unused and unattended. Instead of going to the bank and closing the account, you just keep it as it is.

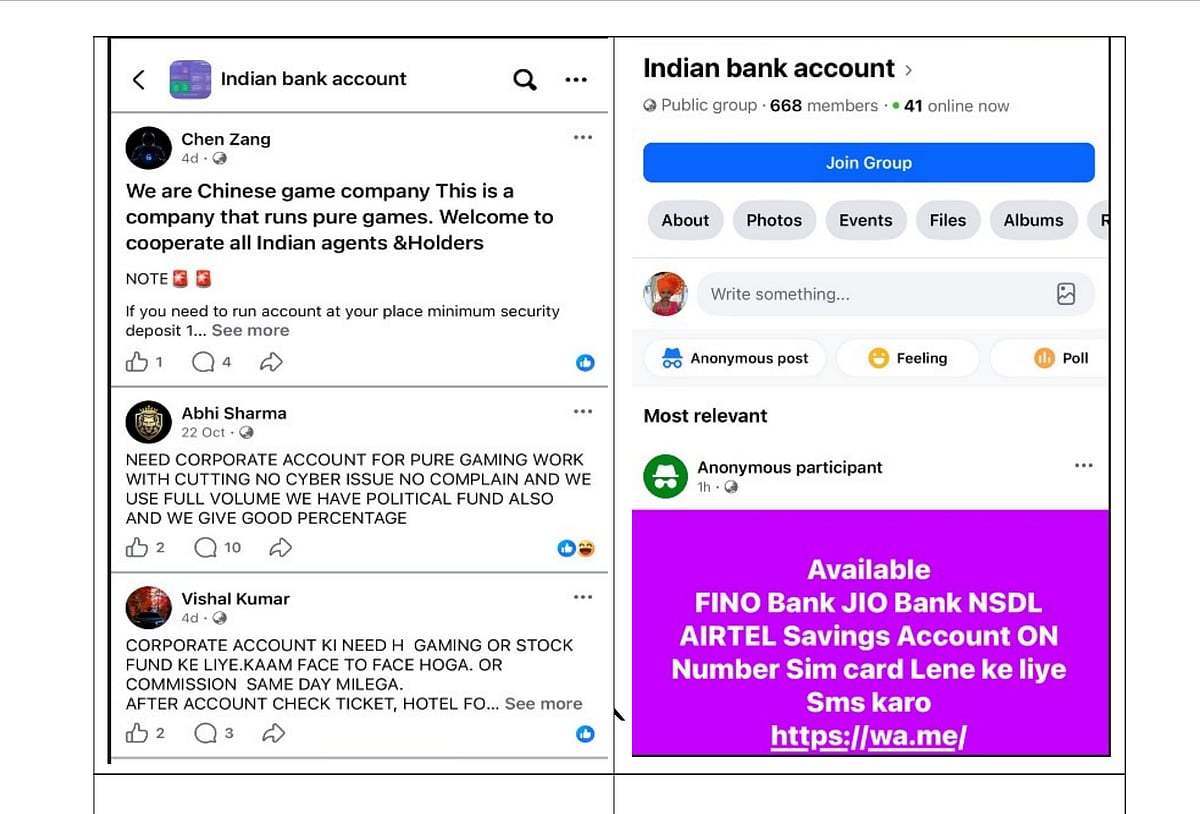

Recently, a disturbing trend has emerged on social media, where individuals are actively seeking such dormant bank accounts. They lure people by offering commissions or incentives, including false promises of improving their CIBIL score. Handing over or allowing misuse of your bank account can have serious consequences. Such accounts are often used for cyber fraud, money laundering, or cheating unsuspecting victims -- ultimately inviting cyber police action against the original account holder.

Whenever the police receive a cyber fraud complaint, the first step is to trace the bank account into which the defrauded money was transferred. Cybercriminals have become increasingly sophisticated and now commonly use mule accounts for this purpose. A mule account is a bank account used, knowingly or unknowingly, by criminals to move or conceal illegally obtained money.

The unsuspecting and unaware original owners of such accounts often get trapped in these cases and are forced to face significant inconvenience. They often spend time and resources to clear themselves of the legal action initiated against them.

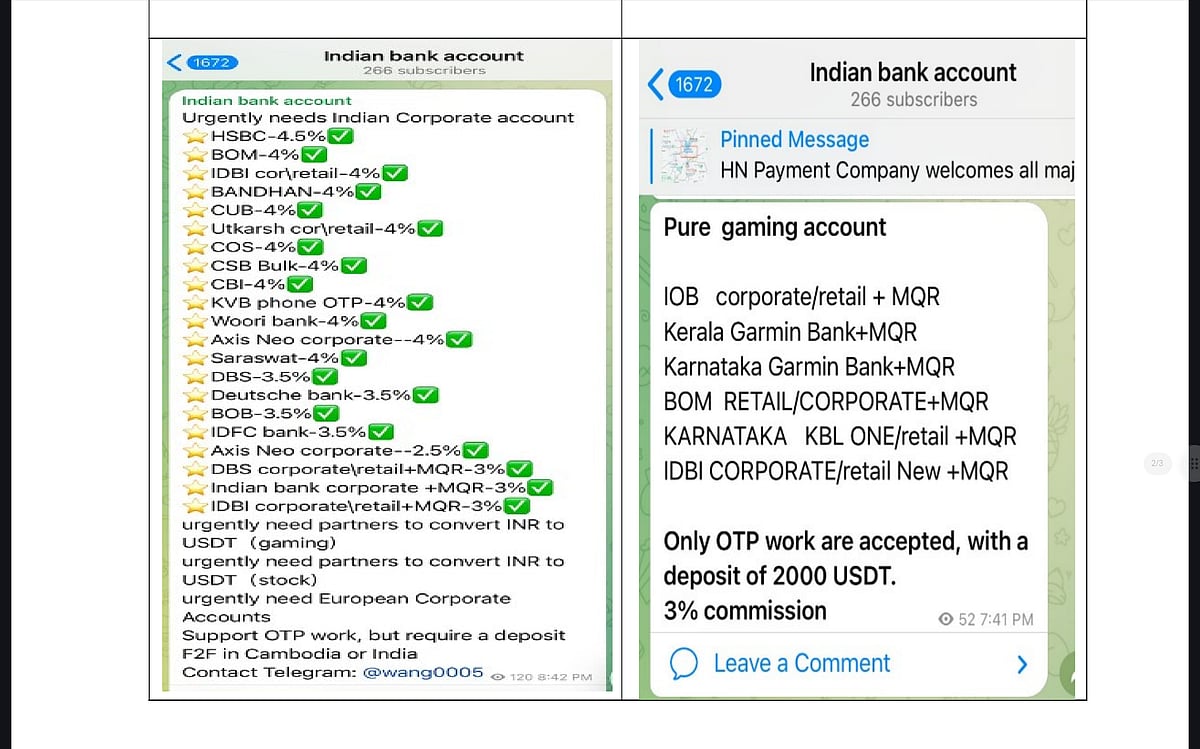

Recently, cyber police officials said that what earlier took place in private WhatsApp and Telegram chats has now become openly visible, with literal rate cards circulating for the demand and use of such bank accounts. Those offering these deals promise commissions of 3–4%, which amounts to a significant sum.

How Are Mule Accounts Brought?

Deputy Commissioner of Police (Crime) Dr Shivaji Pawar said, “Cybercriminals contact people from abroad through social media apps, including Telegram, WhatsApp, Facebook, and others. They ask for dormant or inactive bank accounts, and we have seen many unsuspecting people hand them over. These accounts are then used to receive money duped from victims, which is subsequently transferred elsewhere to convert it into cryptocurrency or otherwise make it untraceable. However, this process takes time.”

Explaining how cybercriminals gain people’s trust to obtain their bank accounts, DCP Dr Pawar said, “Cyber thieves lure individuals by claiming they will help improve their CIBIL score or by saying the accounts are needed to collect money received from gaming apps or the share market, which then has to be converted into foreign currency. People are also promised a commission of 2–5% on the money routed through the account each month or over a certain period.”

Example of mule account scam | Sourced

Example of mule account scam | Sourced

Police officials also said that individuals are asked to send their bank documents, including cheque books, ATM cards, bank-linked SIM cards, and online banking details, to a given address. Once these are handed over, cybercriminals begin carrying out unauthorised transactions. Transactions running into crores of rupees are conducted through such accounts, and whenever a complaint is lodged, the original account holders are the first to come under the police’s radar.

How To Avoid This

- Do not share your bank details or documents with unknown individuals you meet on social media.

- Do not agree to meet people who approach you online asking for your bank accounts.

- Do not fall for lure tactics, and never hand over your bank account—even if the request comes through a close friend or relative.

- Report such advertisements or messages as soon as you come across them.

- If a friend or someone close to you mentions such offers, inform them about the scam and its consequences.

- Report such cases immediately at www.cybercrime.gov.in or call the toll-free helpline 1930.

.jpg)