Not just online, cyber fraudsters can come to your house and cheat you in broad daylight. A recent case of cheating has come to the fore wherein a caller requested a home visit to help increase the credit card limit but availed of a home loan of ₹2 lakh from the customer’s phone.

Kaushik Ghelani, 50, a resident of Borivali, received a call from one Indrajit Yadav, claiming to be calling from Kotak Mahindra Bank. Offering to increase his credit card limit, Yadav asked for identity details. When Ghelani refused, he promised to come home and said he lived in Kranti Nagar, Kandivali East.

Fraudster took the victims phone

On the pretext of taking biometric details, Yadav took Ghelani’s thumb impression and a few other details. He then asked him to download the bank’s app on his mobile. Pretending to help with the process, he took the phone in his own hands and left after a while.

Ghelani received a message of approval for consumer loan

Two hours after Yadav left, Ghelani received a message from the bank that a consumer loan of ₹2 lakh has been approved with an EMI of Rs18,432 per month. A few hours later, a phone call from the bank confirmed that the loan was passed, following which Ghelani lodged a complaint at the Borivali police station, where a case has been registered under various sections of the Indian Penal Code and the IT Act.

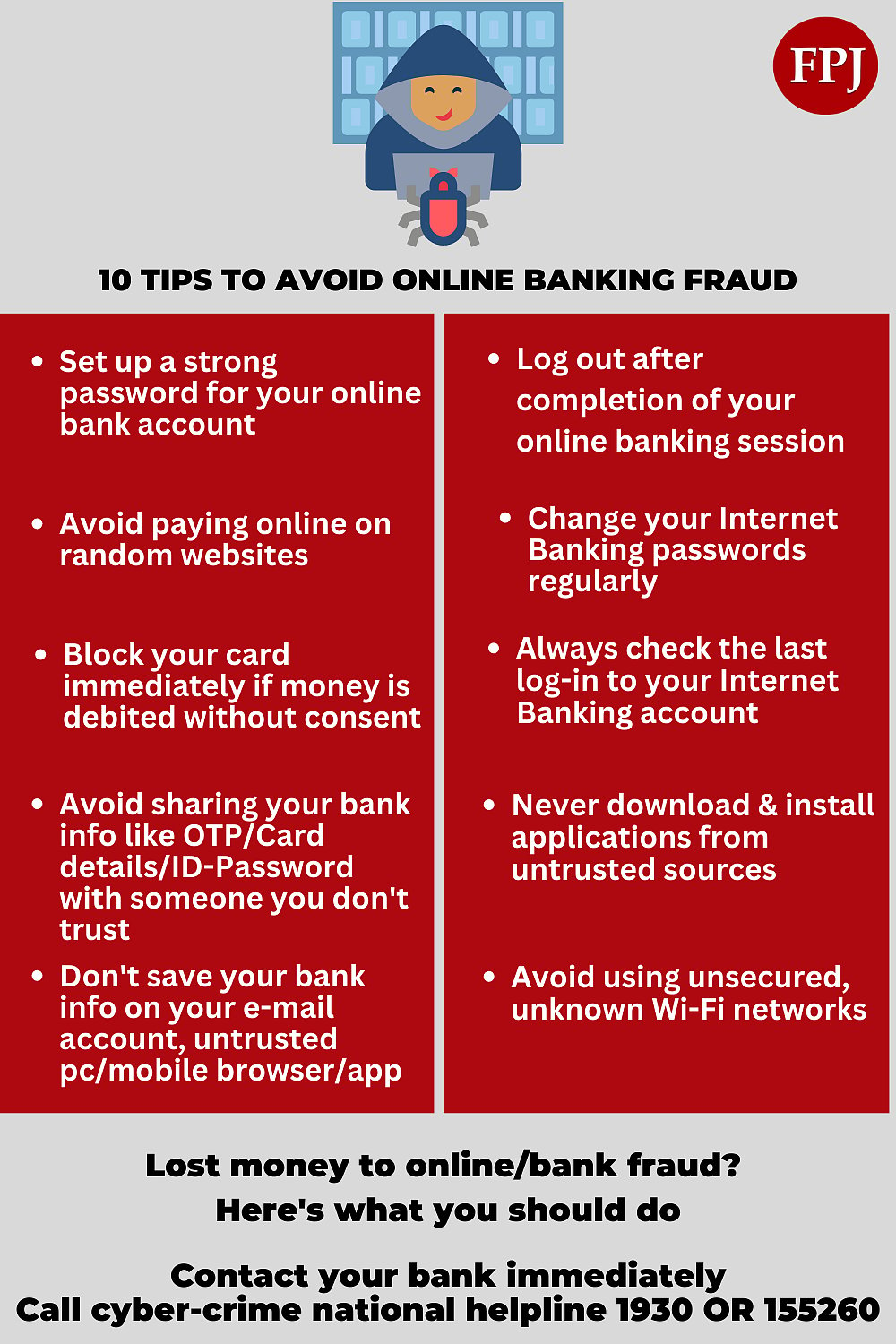

Mubai Cyber Safe: According to Cyber Crime Cell under Crime Branch of mumbai police , the most common form of online frauds are related to banks, online commerce platforms where fraudsters, posing as bank /platform officials, convince the victim to share OTP, KYC updates and sometimes send the links to be clicked to access bank accounts.“People should know that no bank or institution is authorised to demand for bank details or PIN numbers. Unfortunately, educated people are falling prey to online frauds and losing lakhs of rupees,” explained DCP Cyber Crime , Balsingh Rajput.