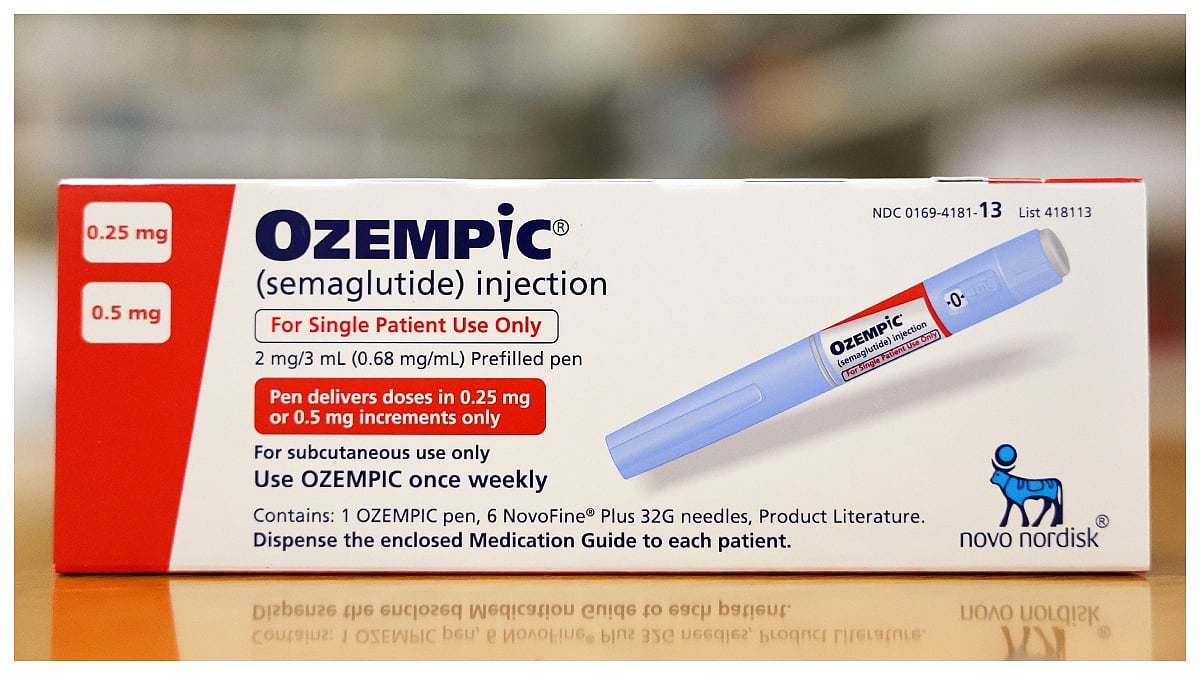

Ozempic, the diabetes drug, induced drastic weight loss and reduced the risk of heart attacks in obese people. It became a cultural phenomenon. It was popular among celebrities and was introduced to the people.

However, Novo Nordisk’s share price has plummeted more than 50 per cent this year, pushing it out of the top ten list of Europe’s most valuable companies. In May, the company stated its chief executive would be replaced, and it has been unable to compete with the American drugmaker Eli Lilly and the prevalence of cheap copycat versions.

“The market’s got no patience for Novo,” said Gareth Powell, the head of health care at Polar Capital, a fund manager. “Sentiment is absolutely dire.”

On Wednesday, Novo Nordisk reported $24 billion in global sales in the first six months of the year, but reiterated it expects growth to slow rest of the year, which it first flagged in a profit warning last week.

Many people revealed the harmful effects of Ozempic and this might have hampered the sales.

According to Business Standard, Ozempic was introduced in the market in late 2017. TikTok videos documenting people’s journeys with Ozempic attracted millions of views. In the first half of the year, Novo Nordisk made $10 billion in sales from Ozempic, of which 70 per cent was in the United States.

After Ozempic went on sale, it was another four and a half years before a serious competitor emerged: Eli Lilly’s Mounjaro, the brand name for tirzepatide, a drug used to treat diabetes.

Novo Nordisk was further hampered by its slowness in introducing a direct-to-consumer sales platform. NovoCare Pharmacy launched in March, 14 months after LillyDirect.

Eli Lilly’s daily pill, orforglipron, has shown promising results in late-stage clinical trials, with similar weight loss to Novo Nordisk’s injections and fewer restrictions on its use. Novo Nordisk’s oral tablet leads to less weight loss than its injections, but the company has other pills in development.

Concerns are mounting that analysts may have overestimated the potential size of the weight-loss market, or at least how easily more people will gain access to these drugs. At the same time, President Trump is pressuring companies to lower drug prices and threatening tariffs on medicines produced abroad, casting a cloud over the business models of pharma firms.