Domestic equity bourses scaled new high during this week as IT and FMCG stocks outperforms. However, early week gains were wiped on last trading session amid weak global cues and Sensex shed nearly 0.2 percent during week. Market looked beyond the signs of robust revival in economic conditions.

Investors turned cautious over the rich valuations, whereas sentiments were dented as Fed hints tapering and rising global COVID-19 cases further alarming investors. In the midst of this volatile market, Metal, Auto and Banking stocks underperformed while defensive stocks from FMCG pack witnessed strong buying followed by the IT stocks. Stock specifically, sharp gains in heavyweight stocks like HUL and TCS partially offset the losses of private banking stocks and Reliance. Going ahead, investors will monitor update related to economic data, govt’s aid to support economy and global covid-19 cases.

Technically, the benchmark index was primarily dragged down after the news broke that the US Fed is likely to start tapering its monthly asset purchases starting early 2022 or even in 2021 while Bank Nifty ended at 35033.85 levels sliding down by 520.65 or 1.46 percent from the previous close.

On the sectoral front, the Pharma sector shredded 2.41 percent, the Banking Sector witnessed a loss of 3.14 percent while the Metal sector took the most hit of 7.99 percent on a weekly basis.

Meanwhile, the IT sector added 2.06 percent to its gains while the FMCG sector being the prime leader saw a weekly gain of 4.76 percent. The Nifty Index has given a breakdown of the Dark Cloud Cover Candlestick pattern, which indicates further correction. A momentum indicator turned lower from the overbought zone while Stochastic has suggested negative crossover. The index has immediate support at 16,250, and the next support lies at 16,130 levels, while the resistance lies at 16,700 levels.

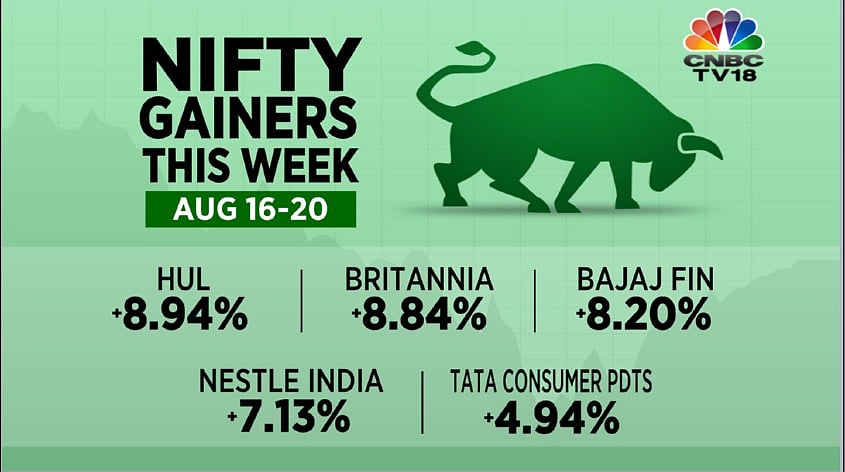

Top Gainers

• In this falling market, Defensive stocks from FMCG basket remained under investor’s buying radar. FMCG stocks like HUL, Britannia, Nestle India and Tata Consumer were the top gainers this week.

Nifty Gainers Aug 16-20 | CNBC TV18

• Strong buying in FMCG counter has capped benchmark’s losses to some extent. Sharp buying interest have lifted Bajaj Finance by nearly 8%.

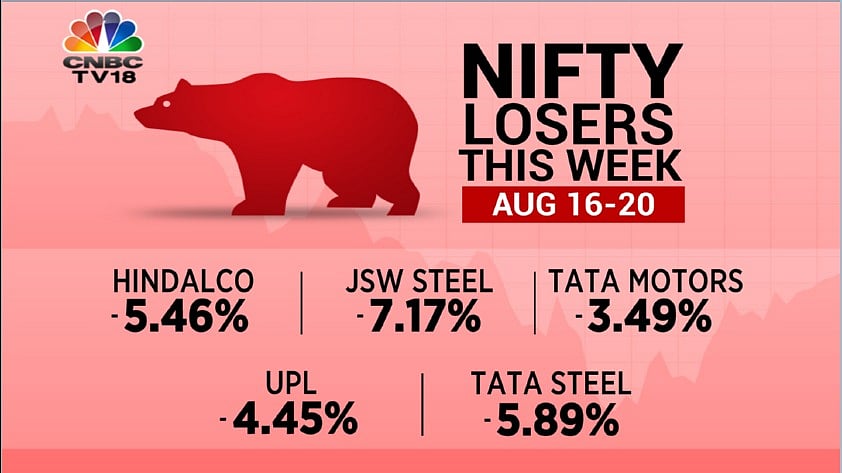

Top Losers

• Major metal stocks from Nifty 50 index like Hindalco, JSW Steel and Tata Steel witnessed steep correction during this week.

Nifty losers Aug 16-20 | CNBC TV18

• Investors tracked the falling LME prices on weakening China demand outlook and fear of tapering by US Fed.

• Tata Motors witness heavy sell off as fear rise over demand recovery and rising raw material costs

(Ankit Pareek is Research Analyst at Choice Broking)