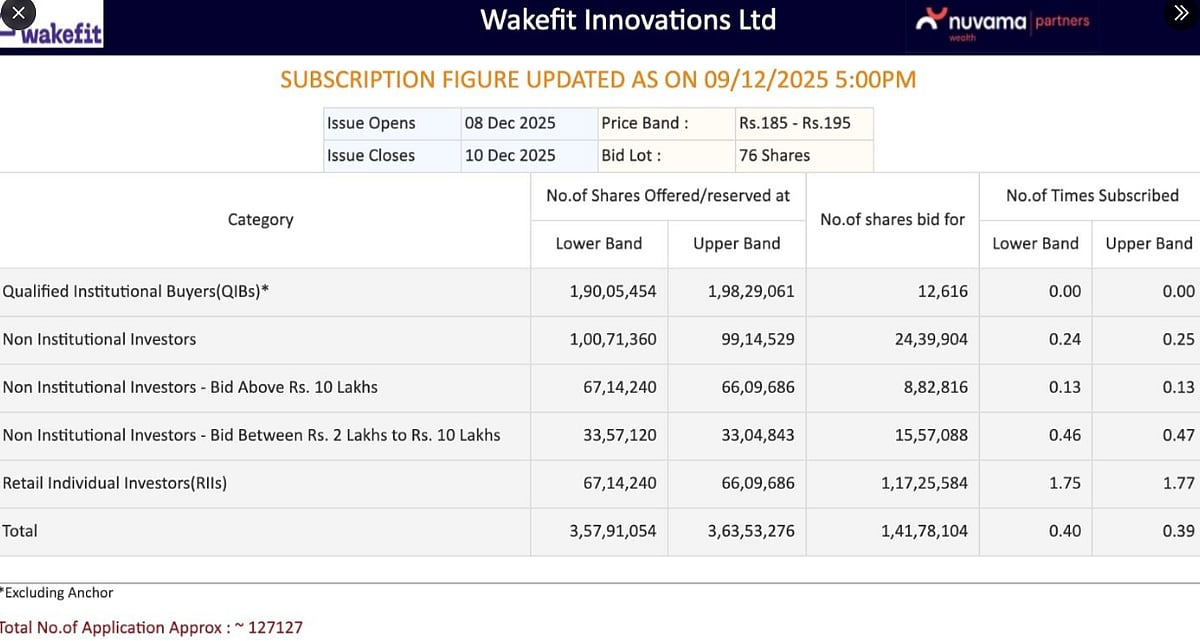

New Delhi: The initial share sale of Wakefit Innovations Ltd subscribed 39 per cent on the second day on Tuesday.The Rs 1,289-crore initial public offering (IPO) got bids for 1,41,81,448 shares against 3,63,53,276 shares on offer, according to the NSE data.Category-wise, shares meant for retail individual investors (RIIs) subscribed 1.77 times, while the quota for Non-Institutional Investors received 25 per cent subscription.

File Image |

However, qualified institutional buyers bid for just 12,616 shares out of 1,98,29,061 shares on offer.Three investors -- Steadview Capital, WhiteOak Capital, InfoEdge and Temasek-backed Capital 2B -- invested Rs 186 crore in Wakefit Innovations Ltd through secondary market transactions.The home and furnishings company on Friday collected Rs 580 crore from anchor investors.

The public issue comprises a fresh issue of equity shares worth up to Rs 377.18 crore and an offer-for-sale (OFS) of 4,67,54,405 shares, valued at around Rs 912 crore, taking the total issue size to Rs 1,289 crore.As part of the OFS, promoters Ankit Garg and Chaitanya Ramalingegowda, along with other selling shareholders -- Nitika Goel, Peak XV Partners Investments VI, Redwood Trust, Verlinvest SA, SAI Global India Fund I LLP, and Paramark KB Fund I -- will offload shares.

Following the stake sale, the promoters' holding will come down to around 37 per cent from the current 43.70 per cent.Wakefit proposes to utilise the proceeds from the fresh issue worth Rs 31 crore for setting up 117 new COCO-Regular Stores; Rs 15.4 crore towards purchase of new equipment and machinery; Rs 161.4 crore for expenditure for lease and sub-lease rent and license fee payments for existing stores.

Additionally, Rs 108.4 crore will be used towards marketing and advertisement expenses for enhancing the awareness and visibility of the brand, and the remaining amount will be used for general corporate purposes.Incorporated in 2016, Wakefit is one of the fastest homegrown players in the home and furnishings market in India among organised peers to achieve a total income of more than Rs 1,000 crore as of March 31, 2024.Wakefit reported a revenue from operations of Rs 724 crore and a profit of Rs 35.5 crore for the six months ending September 2025.

Disclaimer: This story is from the syndicated feed. Nothing has changed except the headline.