Mumbai: Shares of Vodafone Idea (Vi) jumped sharply on Friday, January 9, rising more than 8 percent in early trade. The stock touched a high of Rs 12.46 on the NSE after the company announced a major relief from the Department of Telecommunications (DoT) related to its long-pending AGR dues.

Vodafone Idea has been under financial stress for years due to heavy dues linked to Adjusted Gross Revenue (AGR). The latest decision by the government brings much-needed breathing space to the struggling telecom company.

What the AGR Relief Means for Vodafone Idea?

Vodafone Idea said that its AGR dues-including principal, interest, and penalties for the period from FY 2006-07 to FY 2018-19-will now be frozen as of December 31, 2025. This means the total amount will not increase further after that date.

More importantly, the payment of these dues has been spread out over 16 years, making it much easier for the company to manage its cash flow. From March 2026 to March 2031, Vodafone Idea will pay a maximum of Rs 124 crore every year. After that, from March 2032 to March 2035, the annual payment will be reduced to Rs 100 crore.

The remaining dues will be paid in equal yearly instalments between March 2036 and March 2041. The DoT will also set up a committee to reassess the AGR amount. Whatever amount the committee finalises will be repaid during the last six years of the payment period.

Indus Towers Shares Rise Alongside

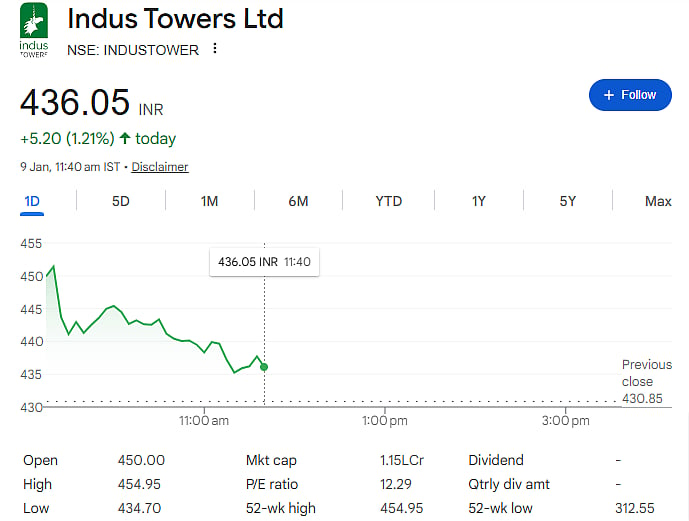

The positive news for Vodafone Idea also lifted shares of Indus Towers. The stock rose over 5 percent to hit a 52-week high of Rs 454.95. Indus Towers is one of the largest telecom tower companies in India and counts Vodafone Idea as a key customer.

Vodafone Idea rents thousands of towers from Indus Towers to run its mobile network. When Vodafone Idea’s financial position improves, it reduces the risk of delayed payments and supports network expansion. This directly benefits Indus Towers’ business and future revenue visibility.

Disclaimer: This article is for informational purposes only and should not be considered investment advice. Readers are advised to consult certified financial advisors before making any investment decisions.