After the sharp decline of the Titan's shares post the quarterly earnings on Monday, May 6, 2024, the shares of the company continued to trade in the red today, May 7. The shares of the company at 1:07 pm IST were trading at Rs 3,228.95, down by 1.56 per cent.

Rekha Jhunjhunwala, wife of the late investor and billionaire Rakesh Jhunjhunwala, known for his prowess in the stock markets, on Monday's trading session i.e May 6, 2024, witnessed a substantial decline in the notional value of her investments in Titan Company, one of the Tata group firms.

The sudden decline was followed by the announcement of the company's quarterly earning announcement on Friday, May 3, 2024.

With this, the Titan's market capitalisation fell below the Rs 3 lakh mark with Rekha Jhunjhunwala's notional investment value plummeting by over Rs 800 crore.

Moreover, this decline in the Titan's stock price affected Jhunjhunwala's investment portfolio, with the company's shares experiencing a significant dip, reaching a low of Rs 3,257.05 on the Bombay Stock Exchange (BSE) on Monday.

Rekha Jhunjhunwala stake in Titan

As of March 31, 2024, Jhunjhunwala held 5.35 per cent stake in the company. Her holdings, valued at Rs 16,792 crore as per Friday's closing price, which suffered a significant blow due to the stock's downward spiral.

Financial Highlights

Titan company Limited, one of the India's leading consumer lifestyle Company on May 3 announced their quarterly results through an exchange filing.

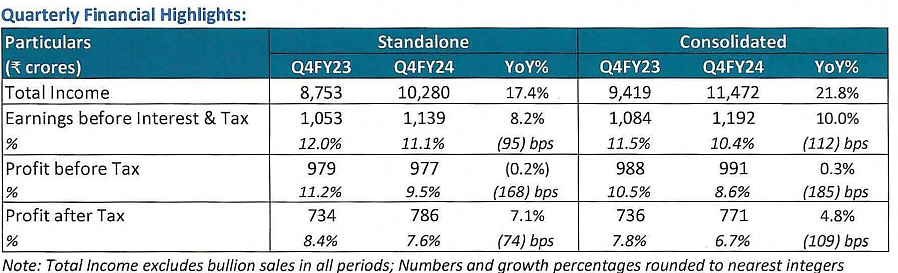

Quarterly Financial results | BSE Exchange Filing

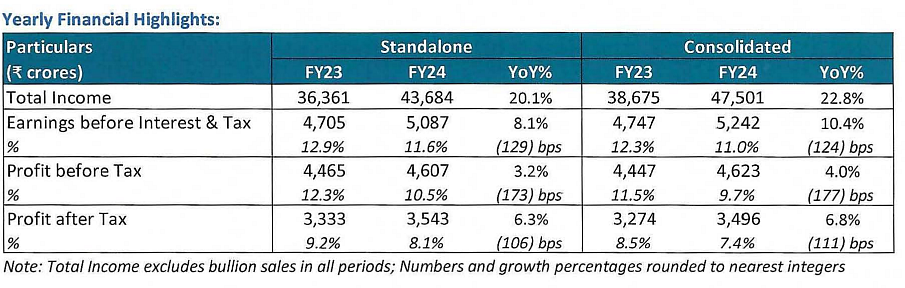

Titan (Consolidated) recorded an income growth of 22 per cent in Q4FY24 compared to Q4FY23. EBIT grew by 10 per cent YoY to approximately 1,192 er, whereas PBT was flat at approximately991 crores that included financial costs of CaratLane acquisition and ESOP related costs. Total Income for FY24 at approximately 47,501 crores grew 23 per cent over FY23. The corresponding PBT grew 4 per cent to approximately 4,623 crores, the company announced through the regulatory filing.

Yearly Financial results | BSE Exchange Filing

The Board has recommended a Dividend of Rs 11.00 per Equity Share of Rs 1 each of the Company which shall be paid/dispatched on or after the seventh day from the conclusion of the 40th Annual General Meeting, subject to approval of the shareholders of the Company, said in the exchange filing.