Financial freedom ensures that you don’t have to depend on someone else for your monetary needs in the present or future. You can ensure financial security by choosing to invest your earnings in the right investment options, like, mutual funds, stocks, fixed deposits etc. You can align your investments based on your long-term and short-term goals. This will help you in achieving your goals seamlessly while ensuring financial freedom.

To secure your future you must not only save, but also invest in sound financial tools that offer decent returns. Fixed deposit is an undisputed leader when it comes to the safety and security of the money that is parked, along with a steady rate of capital appreciation. Bajaj Finance is one such financier that offers the dual advantage of the safety of funds and steady capital growth with its fixed deposit plan.

Here’s why you can choose to invest in a Bajaj Finance FD for your financial freedom:

Freedom from risk

You can be financially independent in the true sense only when you are free from market risks. Bajaj Finance Fixed Deposit is an ideal investment tool for risk averse investors as its not market linked. While bank FD interest rates fluctuate with RBI’s policy announcements, Bajaj Finance FD rates are one of the highest in the market, even when the economic situation is volatile. Additionally, the FD instrument offered by Bajaj Finance has the highest stability ratings from CRISIL (FAAA/stable rating) and ICRA (MAAA/stable) rating.

Freedom to earn more with high interest rates

Bajaj Finance FD offers some of the highest FD interest rates. These interest rates go up to 6.50%, with an additional 0.10% benefit for investing online. Additionally, senior citizens can enjoy an additional rate benefit of 0.25% over and above the base rate. If you’re looking to accrue more value long-term, these interest rates are extremely advantageous for your financial needs.

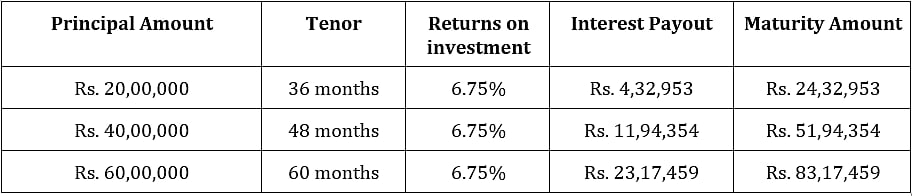

Bajaj Finance FD provides attractive FD interest rates for senior citizens, which is a lucrative option for people in this age group. The table given below is an example to show how you can grow your savings by investing in Bajaj Finance FD for different tenors.

As a senior citizen, if you invest your life savings of, for instance, Rs. 60,00,000 for just 5 years, you stand to gain as much as Rs. 23,17,459 at the end of your tenor. You can also choose to get payouts on a periodic basis, if you’re looking for an investment option that helps you meet your recurring expenses.

Freedom to choose

Independence means the freedom to choose, and this instrument gives you the flexibility to choose investment terms as per your requirements.

Flexible tenors- As per your financial needs and planning, you can choose a tenor between 12 and 60 months. Since financial independence has a lot to do with your liquidity and cash flow, flexibility in choosing tenor helps you always ensure liquidity.

Laddering- Flexible tenors make it easy for you to ladder your investments. You can create multiple fixed deposits in succession to benefit from changing interest rates over the course of a few years. Also, a continuous stream of FDs will work like a stead inflow of money at intervals. This lets you efficiently plan for all major life events.

Interest payout frequency - You can choose to either receive the returns periodically or compounded at the end of the tenor depending on your needs. Interest payment mode can be set according to your preference- monthly, quarterly, yearly or at the time of maturity.

Freedom from lengthy paperwork

Why get stuck in long queues and trapped in a maze of complex paperwork? Break free from the old ways and invest in a Bajaj Finance online FD with a simple online application process. You can invest your hard-earned money easily from the comfort of your home.