The saga of Franklin Templeton (FT) and it's now-infamous six debt schemes continues to deepen. And SEBI, by adopting a tough stance against the AMC, appears determined to make a strong example out of it.

In the new initiative, the Security and Exchange Board of India has ordered Franklin Templeton India AMC to return the fund management charges levied over the last three years back on those schemes. In addition, SEBI has also imposed a monetary penalty of Rs 5 crore. The proceedings will be used to repay the unitholders of the closed scheme.

Apart from the irregularities and mismanagement, SEBI has also alleged serious lapses in categorizing the schemes. It observed that FT wasted many chances to either reset its interest rates or make exit despite the emerging liquidity crisis.

Setting a Tough Example

While Franklin Templeton has decided to challenge the direction in Securities Appellate Tribunal (SAT), SEBI has set a tough example by taking firm steps against the Franklin Templeton AMC.

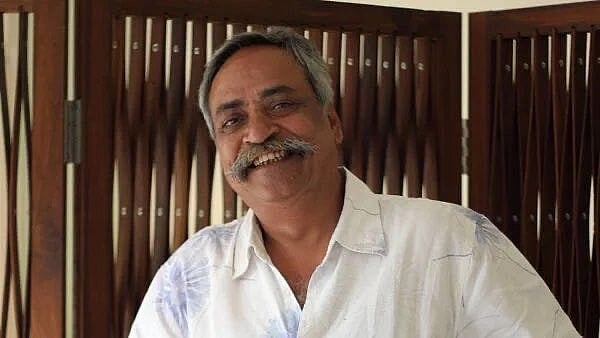

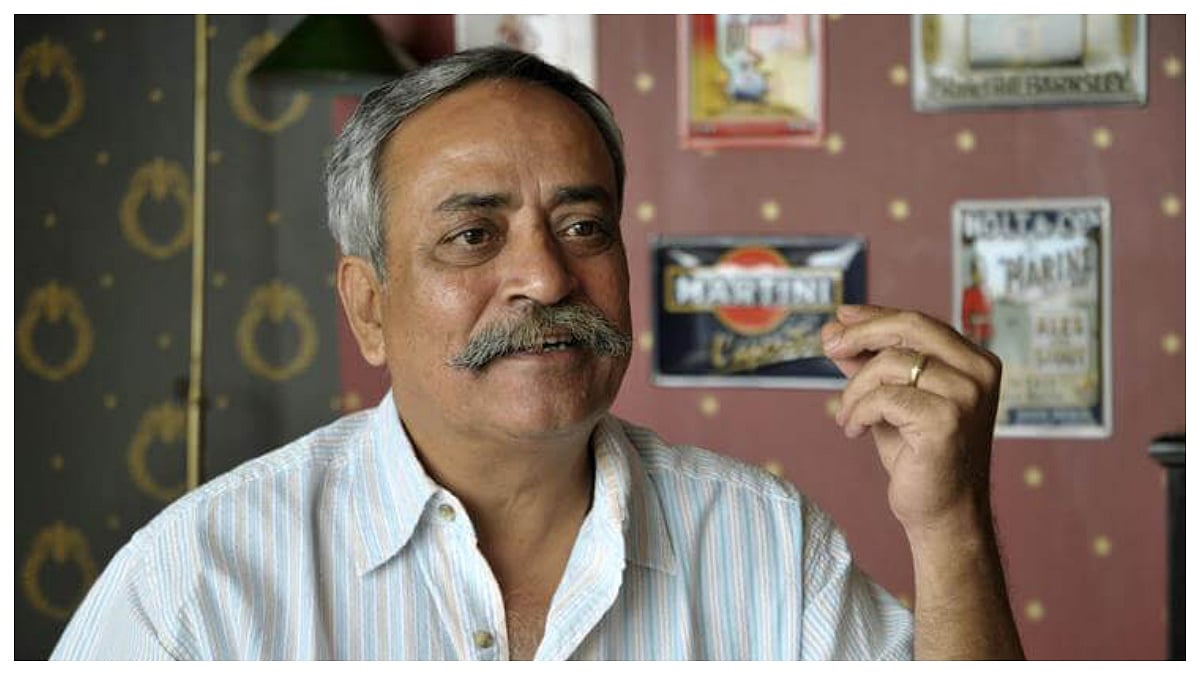

The market regulator has initiated actions against the company and its former Asia-Pacific head Vivek Kudva, and his wife, and other senior executives of AMC for irregular, high-risk investment practices.

Before these actions, SEBI had already announced several measures to increase the responsibilities of fund managers. The proposal to increase the fund manager's skin in the game is already implemented. Mutual fund industries are made to pay a part of the salary to its top employees in the form of units of the schemes they oversee.

These measures are expected to infuse a sense of responsibility among fund managers and bring efficiency to the handling of the scheme.

Room Available for Further Reforms

Despite taking strong measures, SEBI still has a lot of room to push fresh reforms. The regulator needs to ponder upon encouraging the usage of instruments such as credit default swaps and insurance against mutual fund units to protect against default when investing in high-risk instruments.