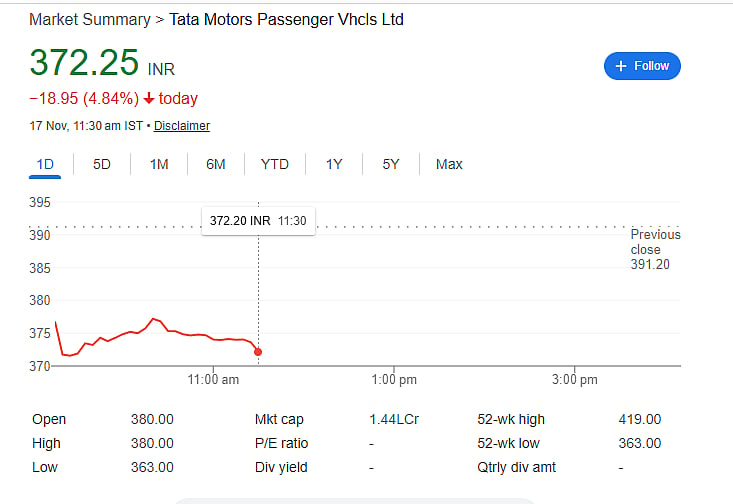

Mumbai: Tata Motors Passenger Vehicles (TMPV) plunged almost 6 percent on Monday after reporting a softer-than-expected Q2 FY26. The decline reflected steep deterioration in Jaguar Land Rover’s (JLR) performance, which overshadowed TMPV’s domestic gains.

The stock opened weak at Rs 369, down from Rs 391.2, marking the company’s first results since its demerger into a standalone entity. With global demand for premium cars already softening, JLR’s setbacks intensified market concerns about the recovery timeline.

JLR’s Struggles Weigh Down Group Performance

The quarter proved harsher than anticipated, as JLR slashed its full-year EBIT margin guidance to a mere 0–2 percent, compared to the earlier 5–7 percent forecast. The luxury automaker reported a pre-tax loss of £485 million before exceptional items, while revenue dipped 24.3 percent year-on-year to £24.9 billion. A major cyber incident in September disrupted production, dragging margins into negative territory and prompting warnings of a free cash outflow between £2.2–£2.5 billion.

Without a one-time commercial vehicles demerger gain, TMPV would have posted a Rs 6,370 crore loss versus last year’s Rs 3,056 crore profit. In its standalone form, TMPV logged a Rs 237 crore adjusted loss, despite a 6 percent revenue rise to Rs 12,751 crore. EBITDA fell sharply to Rs 303 crore, pushing margins down to 2.4 percent.

Brokerages Respond With Caution, Mixed Forecasts

JM Financials flagged JLR’s margin of –8.6 percent as a major concern, citing the cyberattack, tariff-related costs, unfavourable forex, and higher warranty expenses. It noted strong domestic EV traction but maintained a Reduce rating with a Rs 365 target price.

Jefferies predicted Q3 would also feel the impact of the cyberattack, expecting normalisation only by Q4. It highlighted structural challenges—competition, China tax changes, EV transition pressures, and ageing models—leading to an Underperform call with a Rs 300 target.

CLSA took a more positive view, acknowledging severe JLR margin damage but emphasising India PV margin strength and potential tailwinds from GST cuts. It retained an Outperform rating with a Rs 450 target.

Goldman Sachs stayed Neutral with a Rs 365 TP, noting that JLR’s disruption was far worse than anticipated and estimating a 30,000-unit production hit in Q3.