Mumbai: Tata Capital, a leading non-banking financial company from the Tata Group, had a tepid start in the stock market on Monday. The shares listed at Rs 330, just 1.22 percent above the IPO issue price of Rs 326 on both the BSE and NSE. The stock closed day one at Rs 331.10 on NSE and Rs 330.40 on BSE, giving investors only a small premium.

Shares Decline After First Day of Trade

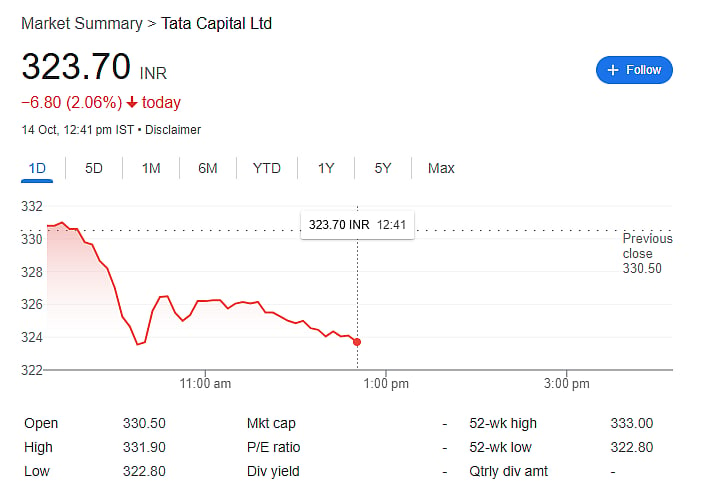

Despite a steady debut, Tata Capital shares slipped over 2 percent on Tuesday, the day after listing. Investors who expected a strong post-listing rally were disappointed, as market sentiment remained subdued. This decline came even though the IPO was fully subscribed.

Biggest IPO of 2025, But Limited Buzz

Tata Capital’s Rs 15,512 crore IPO is India’s largest public offering in 2025 so far. The price band for the IPO was set between Rs 310 and Rs 326 per share. The offer was subscribed 1.95 times by the end of the bidding period, indicating fair interest but not overwhelming demand.

Day One Trading and Market Cap

On listing day (October 13), Tata Capital shares touched a high of Rs 333 and a low of Rs 326.15 on the BSE. On the NSE, the highest price recorded was Rs 333 during intraday trade. By the end of the day, the company’s market capitalisation stood at Rs 1.4 lakh crore.

In terms of trading activity, nearly 100 lakh shares changed hands on BSE, while over 1,176 lakh shares were traded on NSE — showing healthy volumes despite the lack of major price movement.