Indian equity bourses clocked fresh high during this week led by the strong gains in heavyweight IT and banking stocks.

Benchmark index Sensex took positive cues from strong rally in Wall Street bourses and surged nearly 1.8 percent during the week as gains in selective stocks like Reliance Industries, Infosys, HDFC twins and ICICI Bank largely attributed to the rally on the bourses this week.

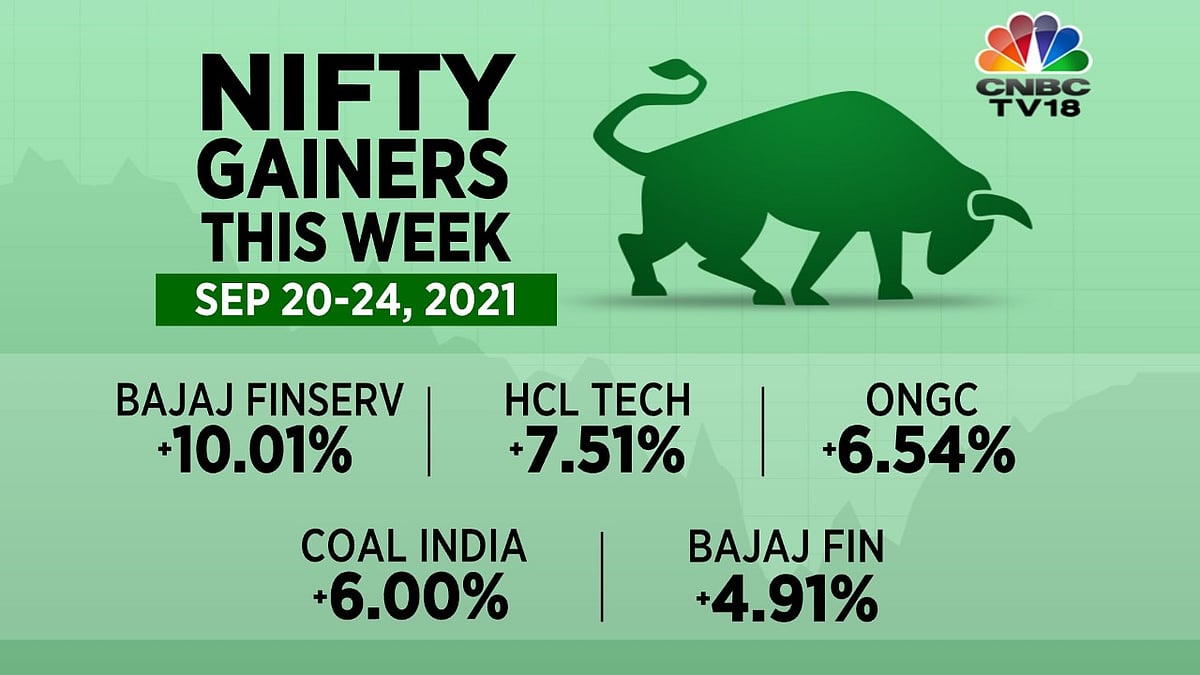

Nifty Gainers |

US Fed kept interest rate unchanged and indicated that tapering could start soon. However, global sentiments improved after US Fed indicated to hike interest rate in 2022 and not anytime soon.

However, it signaled that interest rate hike could be at faster pace than expected. Further, US Fed slashed GDP growth forecast for current year and expects higher inflation in current year.

On the other hand, debt laden Evergrande’s capability to repay huge loan dented global market sentiments to some extent and left market in limbo. Metal stocks too tumbled during the week due to fear of lower demand from world’s largest metal consumer as China’s largest real estate firm ‘Evergrande’ faces crisis. Going ahead, investors will closely keep a close eye on development related to Evergrande debt repayment.

Meanwhile, domestic investors cheered on possible crisis of Evergrande that may help India to attract fund outflows from China. Sector-wise, IT index outperformed during the week and rose nearly 3.5% on expectations of improved future prospects.

Further, Accenture’s robust quarterly result and guidance gave a boost to Indian IT stocks on last session during the week. While investors will also take cues from upcoming economic data and covid-19 situation.

On charts, Nifty set a new milestone at 17947.45 on the Friday trading session closing at 17,853.20 while Bank Nifty closed at 37,830.30. Overall, Nifty rallied more than 600 points while Banknifty saw a volatile move of more than 1500 points during the week.

On the sectoral front, the Nifty Realty and Media took the lead by gaining around 21.5 percent and 12.29 percentrespectively while PSU banks lost 4.49 percent along with the Pharma sector which negated with minor losses of 0.54 percent.

Nifty Losers | CNBC TV18

Technically, the benchmark index settled above the 20 and 50 days Moving Averages indicating a further uptrend. Both benchmark indices gave a closing above the convergence line as well as bullish clouds of the Ichimoku Clouds indicator, which indicates a further bullish view. Also, the Parabolic SAR has formed below the candles, which indicates a further northward journey.

At present, the Nifty has its crucial support of 17,250 while resistance lies at 18,000 and 18,200 levels while the Banknifty has the support of 37,000 and resistance of 38,200 levels.

Going ahead, investors will keep a close eye on development related to Evergrande debt repayment. COVID-19 related situation will also stay in focus.

Key domestic economic data like manufacturing PMI, auto sales, GST data, FOREX reserves are scheduled next week. Investors will also monitor global data like US crude oil stock inventory, US jobless claims and manufacturing PMI data of US and China.

Weekly gainers and losers

• Bajaj Twins (Bajaj Finserv and Bajaj Finance) gained 10 percent/~5 percent in one week on the back of positive business outlook.

• Recent deal announced by the HCL Tech boosted sentiments and was among the top gainer in Nifty 50 index this week.

• ONGC stock surged on the back of rising crude oil prices

• Coal India surged on improved business outlook. A report on coal price hike further lifted stock price this week.

• Metal stocks tumbled during the week due to fear of lower demand leading to Tata Steel and JSW Steel being among the top losers this week.

(Ankit Pareek is Research Analyst, Choice Broking)