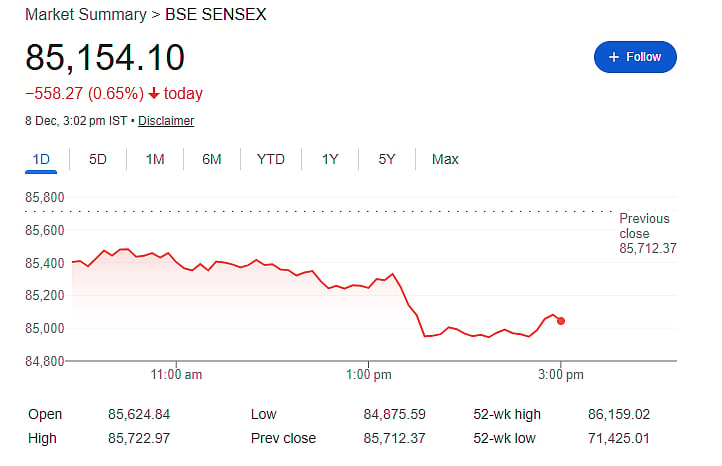

Mumbai: Indian equities began the week on a weak note, with no single negative news driving the fall. After a strong close on Friday following the RBI rate cut, the market lost all gains. The Nifty 50 slipped below its 20-day moving average, with 46 of 50 stocks showing losses.

Midcap and Smallcap Indices Hit Hard

The broader market saw steeper declines. On the midcap index, 96 of 100 stocks traded in the red, while 97 of 100 smallcap stocks fell. The midcap index has dropped over 1,200 points recently and is down 1,800 points from its November 17 peak of 61,180.

Investor Wealth Wiped Out

The ongoing market slide has erased Rs 7.5 lakh crore of investor wealth. Market sentiment remains fragile as traders look for fresh cues from global markets.

Global and Domestic Factors

This week, all eyes are on the US Federal Reserve’s policy announcement, which could impact Indian equities. Domestically, a surge of IPOs is adding to pressure. Five IPOs opened for subscription this week, pushing the total number past 100 and total fundraising near Rs 1.8 lakh crore. The upcoming ICICI Prudential AMC IPO, worth Rs 10,622 crore, is set to open Friday and is the fourth-largest of the year.

Investor Takeaway

Experts suggest caution, as the market reacts to global and domestic factors. High IPO activity, macro uncertainties, and liquidity pressures may continue to influence volatility. Investors are advised to focus on quality stocks and long-term strategies.

Disclaimer: Investors are advised that stock market investments are subject to market risks. Past performance is not indicative of future results. Please consult a financial advisor before making investment decisions.