Mumbai: Indian stock markets recovered from early losses on Monday but could not hold on to gains and finally closed slightly lower. Weak signals from global markets made investors cautious throughout the day. Both key indices moved in a narrow range as traders avoided taking big positions.

Sensex and Nifty Close Marginally Down

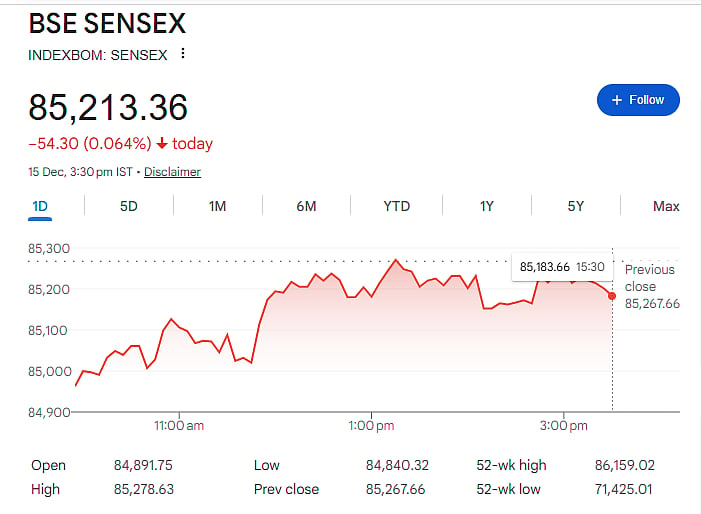

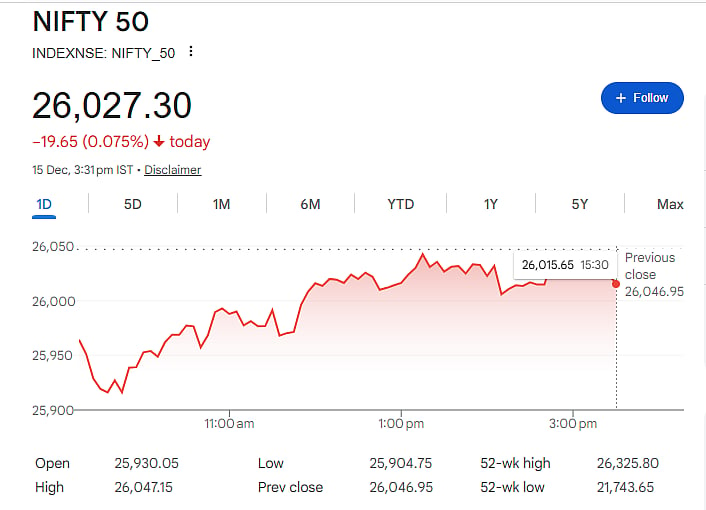

At the end of the trading session, the Sensex closed at 85,213.36, falling by 54.30 points or 0.06 per cent. The Nifty also ended in the red, settling at 26,027.30, down 19.65 points or 0.08 per cent. Early in the day, markets were under pressure but managed to recover some losses as the session progressed.

Heavyweight Stocks Face Selling Pressure

Several major stocks weighed on the Sensex. Shares of Mahindra & Mahindra, Maruti Suzuki, Bajaj Finserv, Titan, HDFC Bank, Bharti Airtel, Bajaj Finance, Power Grid and NTPC ended lower. Weak buying interest in these large stocks limited any strong recovery in the indices.

Limited Support From Select Stocks

Only a few stocks managed to close higher. Hindustan Unilever, Trent, HCL Technologies, Infosys and Asian Paints provided some support to the market. However, their gains were not enough to offset losses in heavyweight stocks.

Midcap and Smallcap Performance Mixed

The broader market showed mixed trends. The Nifty Midcap index slipped by 0.12 per cent, showing mild weakness. In contrast, the Nifty Smallcap index performed better and rose 0.21 per cent, indicating selective buying in smaller stocks.

Sector-wise Movement

Auto stocks faced the most pressure, with the Nifty Auto index falling 0.91 per cent. The pharma sector also ended lower, as the Nifty Pharma index declined 0.4 per cent. On the positive side, media and FMCG stocks saw buying interest. The Nifty Media index jumped 1.79 per cent, while the Nifty FMCG index gained 0.69 per cent.

Outlook Remains Cautious

Market experts said investors remained cautious due to continued foreign fund outflows and a weak rupee. They added that future market movement will depend more on company earnings and key global data, including US inflation and jobs numbers, which will influence interest rate expectations for 2026.